Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

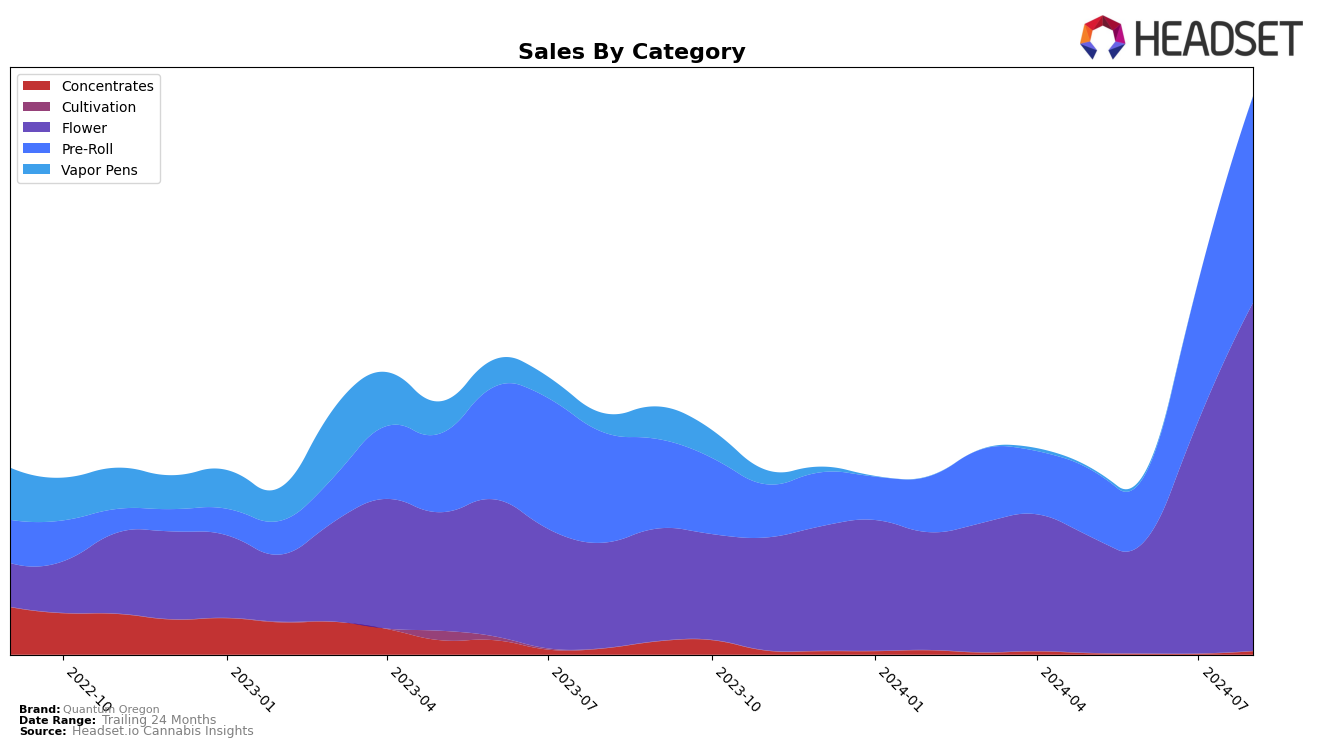

Quantum Oregon has shown significant improvement in the Flower category within Oregon over the past few months. Starting from a rank of 91 in May 2024, the brand has made impressive strides, moving up to rank 27 by August 2024. This upward trend is indicative of growing consumer preference and market penetration. The substantial leap from rank 40 in July to rank 27 in August further underscores this positive momentum. However, the initial ranking outside the top 30 in May and June suggests that the brand had to overcome some initial market challenges.

In the Pre-Roll category, Quantum Oregon has also demonstrated notable progress in Oregon. The brand's ranking improved from 48 in May 2024 to 22 in August 2024, showing a consistent upward trajectory. This steady climb indicates a strengthening brand presence and increasing consumer acceptance. Despite a slight dip in June where the brand ranked 53, the subsequent recovery and rise to 31 in July and further to 22 in August highlight a resilient market strategy. The absence of top 30 rankings in May and June for both categories suggests areas for potential improvement and strategic focus.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Quantum Oregon has shown a remarkable upward trajectory in recent months. Starting from a rank of 91 in May 2024, Quantum Oregon has climbed to 27 by August 2024. This significant improvement in rank indicates a strong increase in market presence and consumer preference. Comparatively, Oregrown has also seen a positive trend, moving from 68 to 26 over the same period, while Herbal Dynamics has maintained a relatively stable position, hovering around the mid-20s. Summary Farms experienced a notable fluctuation, dropping to 87 in July before rebounding to 28 in August. Similarly, Bon Fire Farms has shown a steady rise, reaching 29 in August. The consistent upward trend of Quantum Oregon, especially in the context of its competitors' performance, suggests a growing market share and increasing consumer loyalty, making it a brand to watch in the Oregon flower market.

Notable Products

In August 2024, the top-performing product for Quantum Oregon was White Truffle Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its number one rank from July with sales of $3,600. Cream Pie (Bulk) in the Flower category secured the second position. Glizzy Stick - White Truffle Infused Blunt (1.7g) rose to the third rank from its previous fourth position in June, showing significant improvement. Affogato (Bulk) in the Flower category held steady at the fourth position, consistent with its ranking in July. Hazmat OG Pre-Roll 2-Pack (1g) entered the top five for the first time, securing the fifth rank.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.