Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

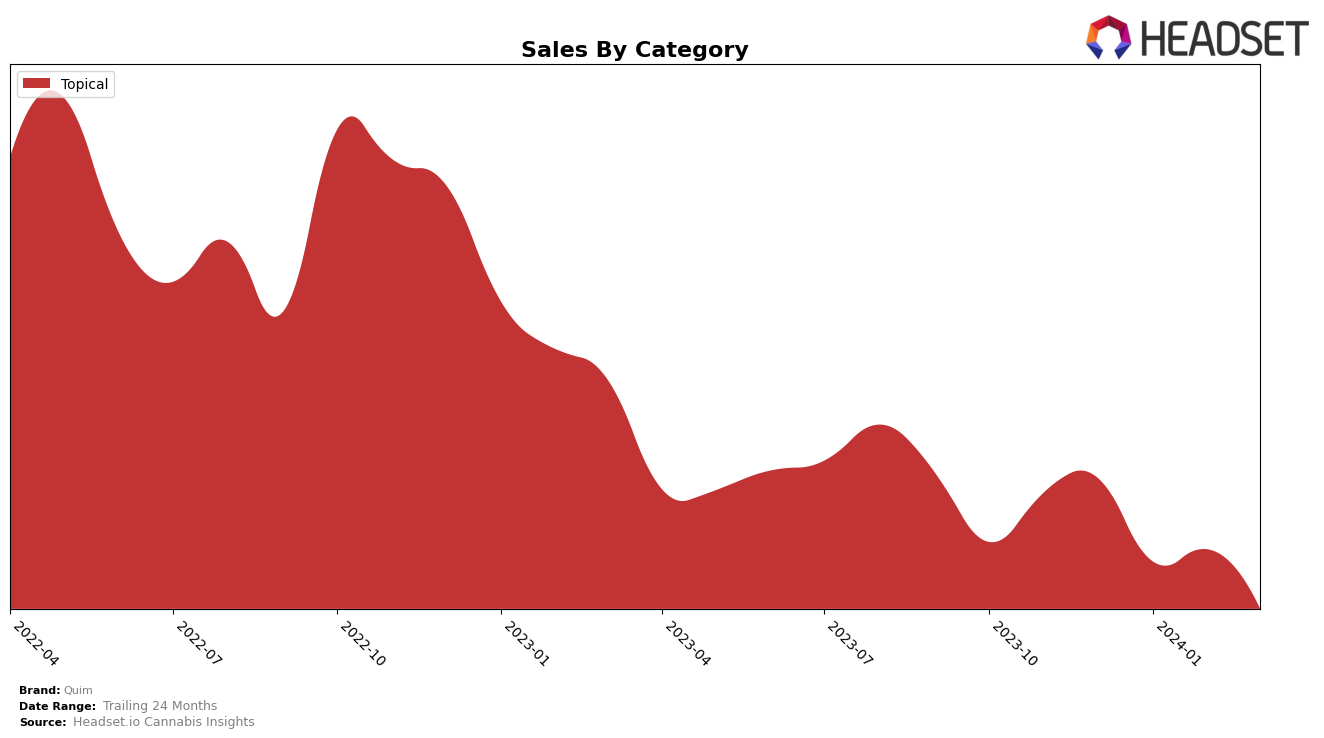

In California, the Quim brand, known for its focus on cannabis-infused topicals, has shown a notable trajectory in the market, albeit with some challenges. Starting in December 2023, Quim ranked 15th in the topicals category but saw a slight decline over the following months, slipping to 19th by March 2024. This movement indicates a competitive struggle within the category, despite maintaining a presence in the top 20. The sales figures reflect this journey, with a peak in December 2023 at $17,784, followed by a significant drop in March 2024 to $4,088. This decline in sales and rank suggests Quim faced challenges in maintaining its market share amidst stiff competition, an important consideration for stakeholders tracking performance across the cannabis industry.

The fluctuations in Quim's performance within the California market highlight the volatile nature of the cannabis industry, where brand positioning can change rapidly. The initial strong performance in December, with Quim securing a spot in the top 15, underscores the brand's potential and consumer interest. However, the subsequent decline in both rank and sales underscores the importance of adapting strategies to sustain and enhance market presence. For industry analysts and enthusiasts, these movements offer insights into consumer preferences and the competitive landscape in California's cannabis market. While the specifics behind the decline are not detailed here, factors such as marketing efforts, product quality, and distribution channels could play significant roles in these trends. Quim's journey through the ranks serves as a case study in the challenges brands may face in maintaining visibility and appeal in a crowded and dynamic market.

Competitive Landscape

In the competitive landscape of the topical cannabis market in California, Quim has experienced a slight decline in its ranking from December 2023 to March 2024, moving from 15th to 19th position. This shift indicates a challenging period for Quim, as its sales have also seen a significant decrease during these months. Competing brands such as Cannariginals Emu 420 have maintained a stable position at 18th rank, slightly outperforming Quim in terms of rank stability and sales in March 2024. Meanwhile, Opi-Not has shown remarkable improvement, moving up from 23rd to 17th, overtaking Quim in both rank and sales by March 2024. Other competitors like Mother Humboldt's and Jade Nectar have had fluctuating rankings but displayed a trend towards improvement or stability, which contrasts with Quim's declining trajectory. This competitive analysis underscores the importance of strategic adjustments for Quim to regain its footing in the evolving topical cannabis market in California.

Notable Products

In March 2024, Quim's top-performing product was Night Moves Intimate Oil (70mg THC, 10ml) within the Topical category, regaining its top position with 87 sales. Following closely, Night Moves Intimate Oil (350mg THC, 50ml) also in the Topical category, secured the second rank, a position it swapped with the leading product from the previous month. Notably, the sales figures reveal a competitive edge for the 70mg variant, underscoring its consistent consumer preference. This shift in rankings from February to March indicates a dynamic consumer interest within Quim's product line. The data suggests a fluctuating but strong market presence for Quim's topicals, particularly the Night Moves Intimate Oil variants, in the cannabis market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.