Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

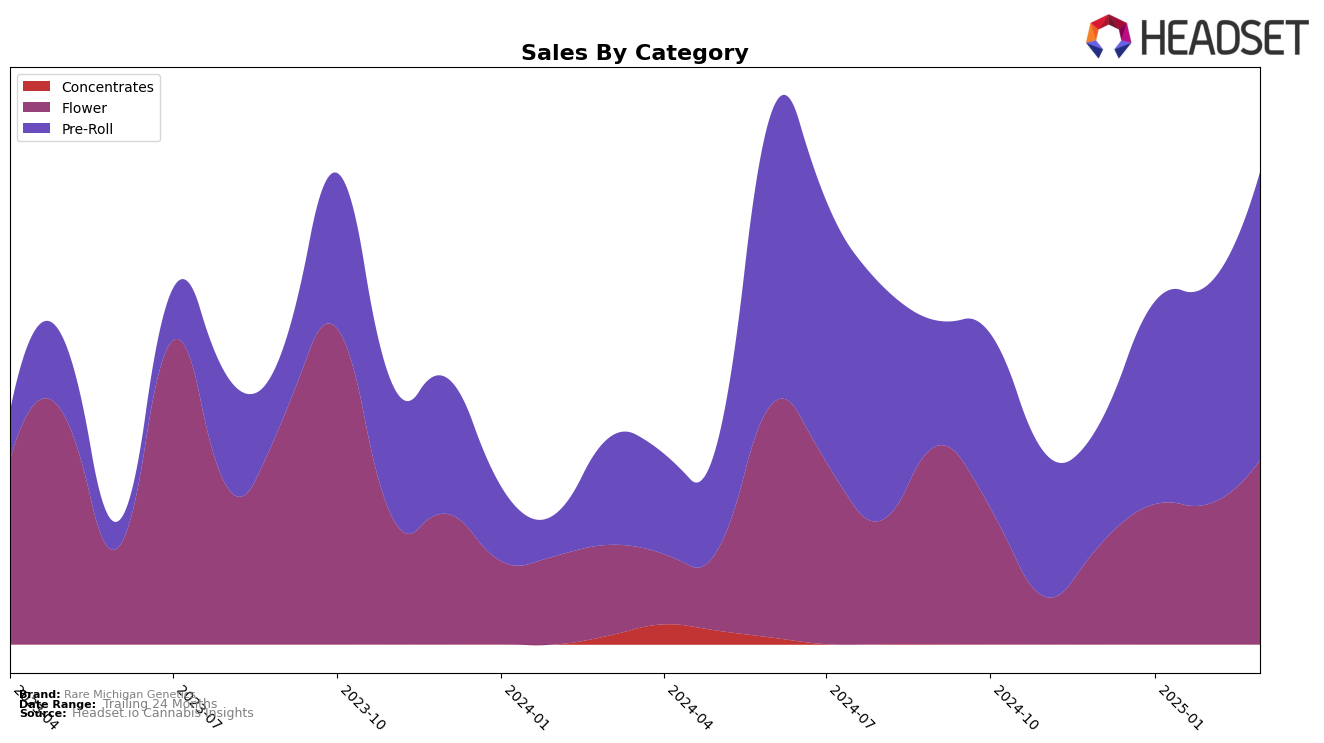

Rare Michigan Genetics has shown varied performance across different product categories and states, with notable trends emerging in the first quarter of 2025. In the Michigan market, the brand's Flower category struggled to secure a spot in the top 30 rankings from December 2024 through March 2025. This absence from the top rankings indicates potential challenges in competing with other brands in this category. However, a positive sign is the upward trend in sales, with a significant increase from January to March 2025, suggesting that despite not being a top-ranked brand, there is growing consumer interest and sales momentum in this category.

Conversely, Rare Michigan Genetics has excelled in the Pre-Roll category within Michigan, demonstrating a consistent upward trajectory in rankings. Starting from the 35th position in December 2024, the brand rapidly climbed to the 13th position by March 2025. This impressive ascent indicates effective market penetration and consumer preference for their Pre-Roll products. The substantial sales growth from December 2024 to March 2025 further underscores the brand's strengthening presence in this category. The contrasting performance across categories highlights Rare Michigan Genetics' strategic positioning and potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of Michigan's Pre-Roll category, Rare Michigan Genetics has demonstrated a remarkable upward trajectory in brand ranking and sales performance. Starting from a rank of 35 in December 2024, Rare Michigan Genetics climbed to 13 by March 2025, showcasing a consistent improvement over the months. This upward movement is particularly notable when compared to competitors like Seed Junky Genetics, which started at rank 22 and only reached 15 by March 2025, and Galactic, which fluctuated slightly and ended at rank 14. Meanwhile, Muha Meds and Rollz maintained stronger positions, with Rollz achieving a rank of 11 by March 2025. Despite these competitors, Rare Michigan Genetics' sales have shown a robust increase, indicating a growing consumer preference and market presence, which could potentially lead to further rank improvements if the trend continues.

Notable Products

In March 2025, Rare Michigan Genetics saw Titty Sprinkles Pre-Roll (1g) rise to the top spot in the Pre-Roll category, with notable sales reaching 9,158 units. Party Girl Pre-Roll (1g) followed closely in second place, although it experienced a decline from its top position in February. Daiquiri Deck Pre-Roll (1g) maintained its third-place ranking from the previous month, showing consistent performance. Dank Juice Pre-Roll (1g) entered the top five for the first time, securing the fourth position. Floozie Pre-Roll (1g) dropped to fifth place, continuing its downward trend from earlier months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.