Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

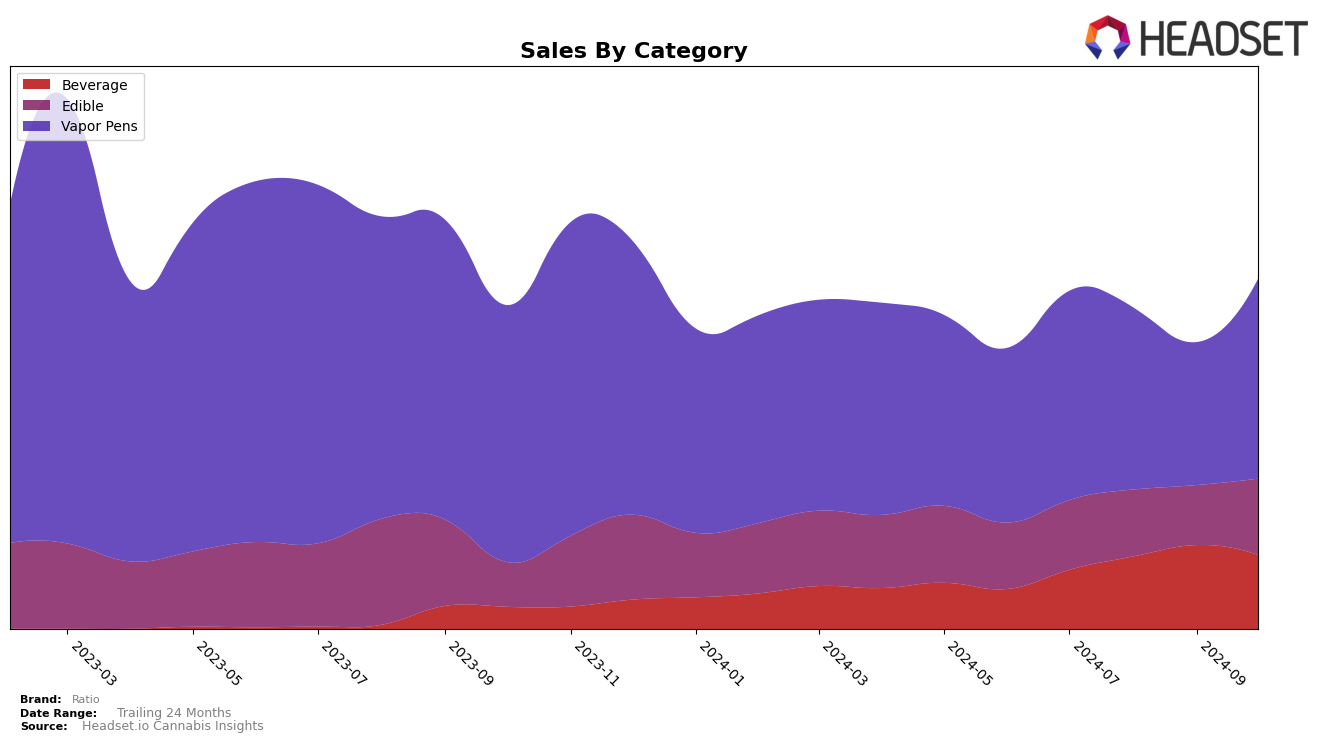

Ratio's performance in the Missouri market has shown some notable shifts across different categories. In the Edible category, Ratio has been steadily climbing the ranks from 37th position in July to 32nd by October, indicating a positive upward trend in consumer preference. This improvement in ranking is further supported by a recovery in sales volume in October after a dip in the preceding months. On the other hand, the Vapor Pens category in Missouri presents a slightly different picture, where Ratio has not managed to break into the top 30, peaking at 39th in July and fluctuating around the 40th mark in subsequent months. This suggests a more challenging competitive landscape or a need for strategic adjustments in this category.

In Washington, Ratio has maintained a consistent presence in the Beverage category, holding steady at the 10th position from July through October. This consistency indicates a solid brand loyalty or effective market penetration strategy in Washington's Beverage segment. While the stability in ranking is commendable, the actual sales figures reveal a slight dip in October after a peak in September, hinting at potential seasonal trends or market dynamics that could be explored further. The ability to maintain a top 10 position over several months signifies a strong foothold in the Washington Beverage market, contrasting with the challenges faced in other categories and states.

Competitive Landscape

In the Missouri vapor pens category, Ratio has experienced a fluctuating rank over the past few months, moving from 39th in July 2024 to 40th in October 2024. Despite these fluctuations, Ratio's sales have shown resilience, with a notable increase from September to October. This suggests a positive reception of their products, even amidst stiff competition. Notably, Flower by Edie Parker has consistently improved its rank, reaching 41st in October from 58th in July, indicating a growing market presence. Meanwhile, Flora Farms experienced a rank drop, missing the top 20 in August, but rebounded to 38th by October. Smokey River Cannabis also saw a decline from 28th in September to 37th in October, despite having strong sales earlier. CAMP Cannabis experienced a similar trend, with a rank drop to 44th in October. These dynamics highlight the competitive landscape Ratio is navigating, where maintaining or improving rank amidst such volatility is crucial for sustaining sales growth.

Notable Products

In October 2024, Ratio's top-performing product was the Orange Breeze Shot (100mg, 2oz) in the Beverage category, which ascended to the number one spot with sales reaching 3151 units. The Island Punch Shot (100mg THC, 2oz) followed closely, ranking second after experiencing a slight drop from its previous top position in July and August. The Strawberry Burst Shot (100mg, 2oz), although leading in September, slipped to third place in October. In the Vapor Pens category, the CBD/THC 1:20 Active Distillate Disposable (0.5g) re-entered the rankings at fourth position, showcasing a resurgence in popularity since July. The CBD/THC 1:5 Focus Distillate Disposable (0.5g) maintained its position at fifth, consistent with its performance in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.