Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

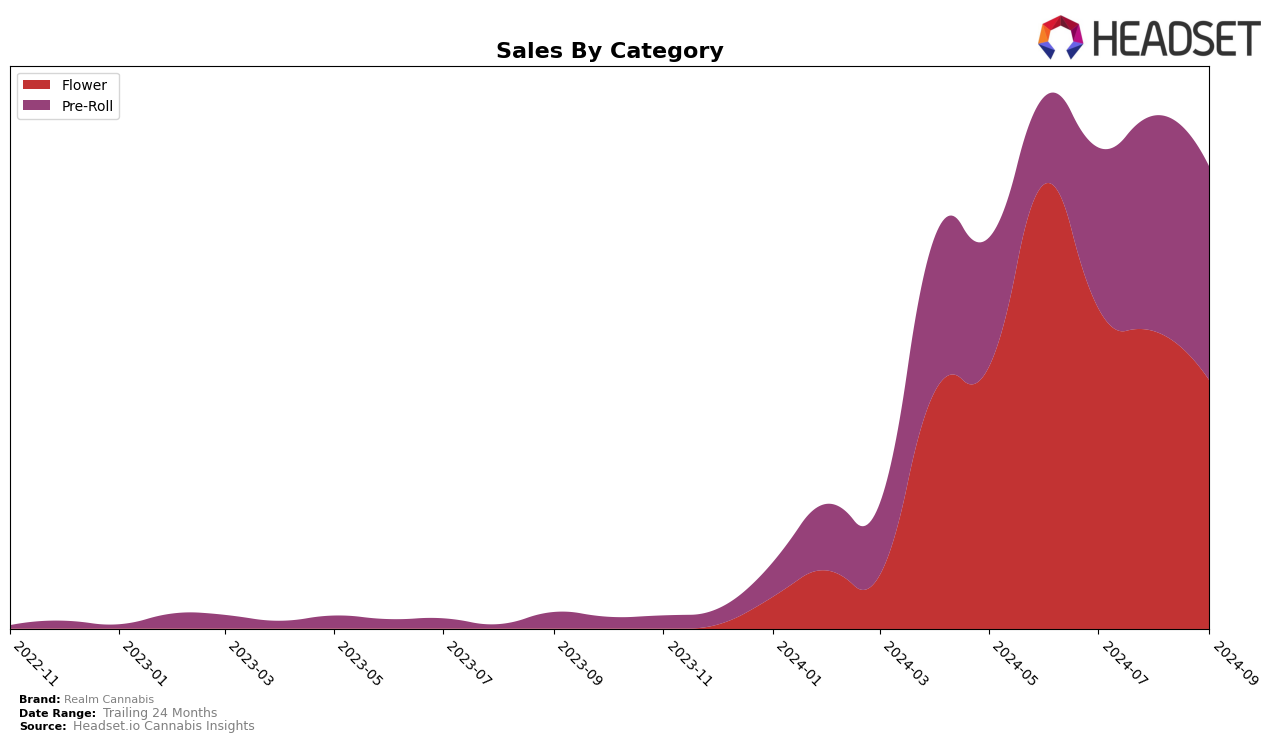

Realm Cannabis has shown varied performance across different product categories and states, with notable movements in rankings that reflect both challenges and opportunities. In the Massachusetts market, the brand's presence in the Flower category has seen a decline over the months, dropping from a rank of 29 in June 2024 to 47 by September. This downward trend in rankings suggests a significant decrease in their market share or competitive positioning within this category, as their sales have also decreased from $435,148 in June to $242,770 in September. In contrast, the Pre-Roll category presents a more optimistic picture for Realm Cannabis, with a climb from 66th place in June to 28th by September, indicating a strengthening position in this segment. This improvement in ranking, despite not being in the top 30 initially, highlights a strategic focus or consumer preference shift towards their Pre-Roll products.

Examining the overall trends, it is evident that Realm Cannabis is navigating a complex market landscape with mixed results across different categories. The decline in the Flower category could be a cause for concern, as it suggests potential issues such as increased competition or changing consumer preferences that the brand needs to address. On the other hand, the positive trajectory in the Pre-Roll category in Massachusetts signals an area of growth and opportunity that the brand can capitalize on. By focusing on the strengths and addressing the challenges in these categories, Realm Cannabis can potentially enhance its market presence and drive future growth. The varied performance across these categories underscores the importance of strategic adaptation in response to evolving market dynamics.

Competitive Landscape

In the competitive landscape of the Massachusetts flower category, Realm Cannabis has experienced notable fluctuations in rank and sales over recent months. Starting from a strong position in June 2024 with a rank of 29, Realm Cannabis saw a decline to 47 by September 2024. This downward trend in rank is accompanied by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, brands such as Ocean Breeze and Khalifa Kush have shown more stable or improving ranks, with Ocean Breeze peaking at rank 27 in August before a slight decline, and Khalifa Kush improving to rank 45 by September. Additionally, Cookies maintained a relatively stable rank around the mid-40s, suggesting consistent performance. These dynamics highlight the competitive pressures Realm Cannabis faces, emphasizing the need for strategic adjustments to regain its earlier market position and counteract the upward momentum of its competitors.

Notable Products

In September 2024, Delicata Grapes Pre-Roll (1g) maintained its top position as the leading product for Realm Cannabis, achieving sales of 9,663 units. Grape Pancakes Pre-Roll (1g) emerged as a strong contender, securing the second rank. Big Brother Pre-Roll (1g) climbed to the third position, showcasing a notable increase from its previous absence in August rankings. GovernMint Oasis (3.5g) held the fourth spot, slightly dropping from its second place in August. Spritzer Pre-Roll (1g) rounded out the top five, having slipped from its third position in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.