Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

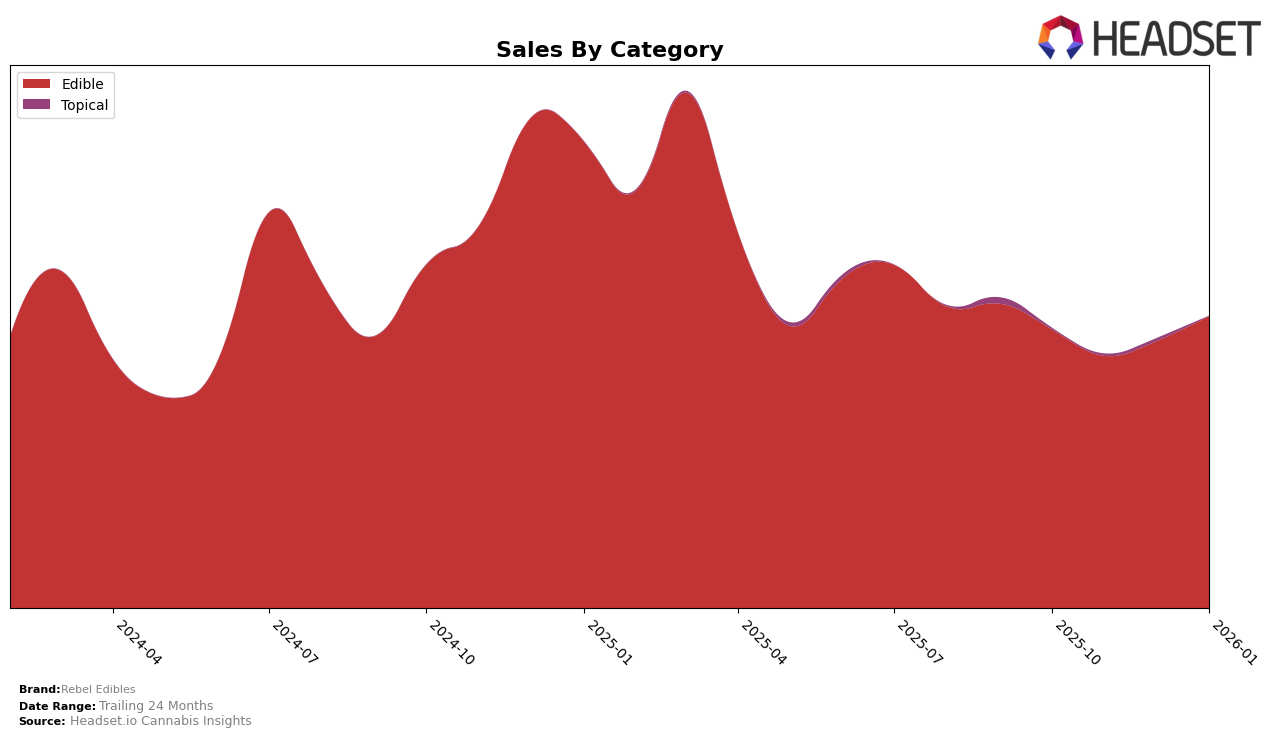

Rebel Edibles has shown a consistent presence in the Colorado edibles market over the past few months. Beginning in October 2025, the brand held the 16th position and maintained this ranking into November. Although there was a slight dip to 17th place in December, Rebel Edibles bounced back to 14th in January 2026, indicating a positive trend and a strong recovery. This movement suggests a resilience and potential growth in their market share, despite the competitive nature of the edibles category. The stability in their ranking, coupled with a noticeable uptick in sales from December to January, highlights Rebel Edibles as a brand to watch in the Colorado market.

While Rebel Edibles maintains a presence in Colorado, the absence of rankings in other states or provinces suggests that the brand might not yet have a significant footprint outside this region. This could be viewed as a limitation or an opportunity for expansion, depending on the brand's strategic goals. The focus on Colorado could imply a strategic decision to consolidate their market position before exploring new territories. As they continue to perform well in the edibles category, it will be interesting to see if they leverage this success to penetrate other markets or diversify their product offerings.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Rebel Edibles has shown a notable fluctuation in its ranking over the past few months. While it was ranked 16th in October and November 2025, it experienced a slight dip to 17th in December before climbing to 14th in January 2026. This upward movement in January indicates a positive trend in sales performance, contrasting with the consistent rankings of competitors like Smokiez Edibles, which maintained a steady 12th position throughout the same period. Meanwhile, Cheeba Chews and Coda Signature have seen more volatility, with Cheeba Chews dropping from 12th to 15th and Coda Signature falling out of the top 15 in January. The consistent presence of DOSD Edibles in the top 13, however, underscores the competitive pressure Rebel Edibles faces as it strives to improve its market position and sales figures.

Notable Products

In January 2026, Rebel Edibles' top-performing product was the Indica Blue Raspberry Pebbles Gummies 10-Pack (100mg), maintaining its first-place rank consistently since October 2025 with sales reaching 3949 units. The Sativa Strawberry Orange Pebble Bites Gummies 10-Pack (100mg) held steady in second place, showing slight growth in sales from previous months. The Hybrid Strawberry, Green Apple, Blue Raspberry, and Mango Coated Gummies 10-Pack (100mg) continued to rank third, with a modest sales increase to 959 units. The Hybrid Pebbles Gummy Nerds 10-Pack (100mg) remained in fourth place, while the CBD/CBN/THC 1:1:2 Sweet Dreams Honey Lavender Caramels 20-Pack (50mg CBD, 50mg CBN, 100mg THC) maintained its fifth-place position, demonstrating a notable sales increase since its introduction in December 2025. Overall, the product rankings for Rebel Edibles have remained stable, with slight sales variations across their top products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.