Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

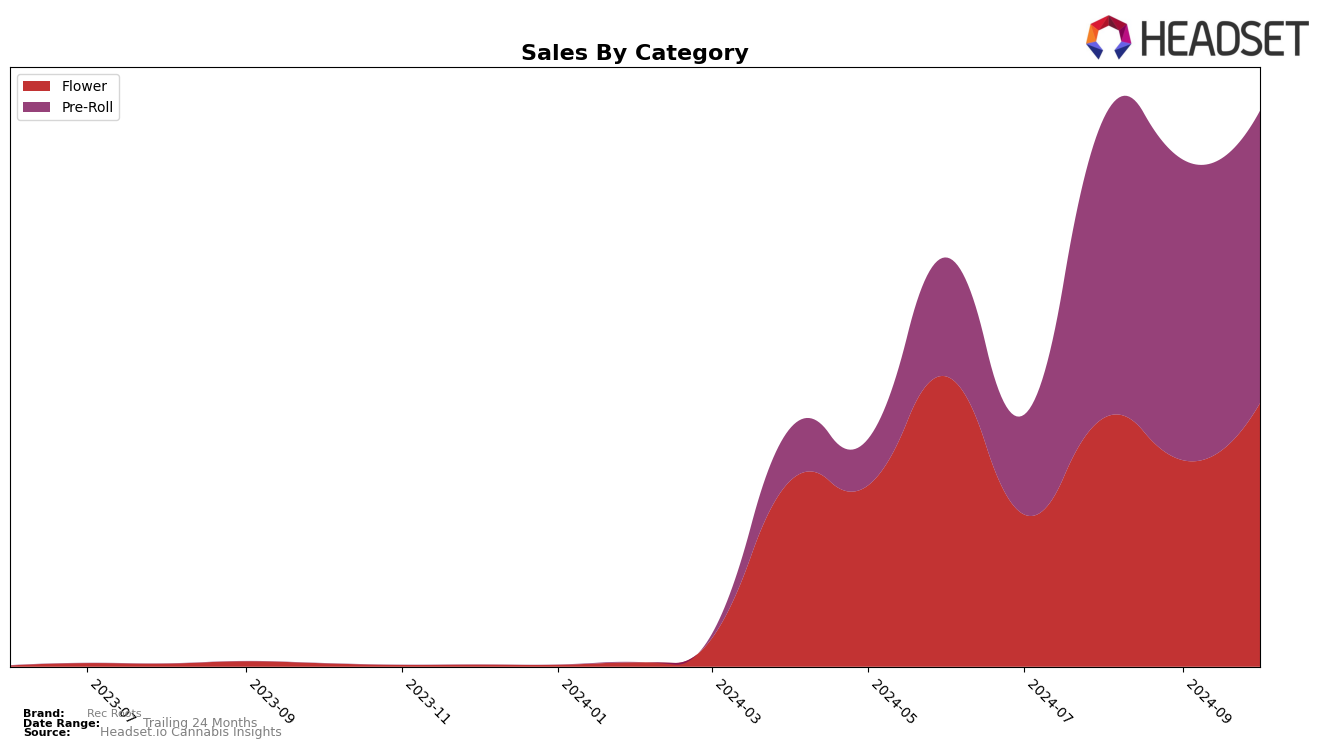

Rec Roots has demonstrated notable performance across different categories and states, with particular emphasis on its growth in the New York market. In the Flower category, the brand has shown an upward trend, climbing from a rank of 50 in July 2024 to 39 by October 2024. This improvement suggests a strengthening presence in the market, as evidenced by the increase in sales from $84,176 in July to $145,952 in October. However, the brand's absence from the top 30 in July and August indicates there is still room for growth and competition remains intense.

In the Pre-Roll category, Rec Roots has experienced more dynamic movements within the rankings in New York. Starting at rank 51 in July, the brand made a significant leap to position 31 in August and maintained its presence in the top 30 in subsequent months. This upward trajectory is supported by a consistent increase in sales, peaking in September. Despite a slight drop to rank 30 in October, the brand's ability to remain within the top 30 highlights its resilience and potential for sustained growth in the Pre-Roll sector. The fluctuations in ranking underscore the competitive nature of the market and suggest areas where Rec Roots could focus its efforts to further solidify its standing.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in New York, Rec Roots has shown a dynamic shift in its market positioning from July to October 2024. Initially ranked at 51st in July, Rec Roots made a significant leap to 31st in August, maintaining a stable position in September at 26th, before slightly dropping to 30th in October. This upward trajectory, particularly from July to September, indicates a positive reception and increased sales momentum. However, the slight decline in October suggests a need for strategic adjustments to maintain competitiveness. Notably, Flamer consistently outperformed Rec Roots, maintaining a rank within the top 30 throughout the period, while Luci also showed fluctuations but remained competitive. The presence of House of Sacci, which peaked at 20th in September, further underscores the competitive pressure in the market. These insights highlight the importance for Rec Roots to capitalize on its growth momentum and address the competitive challenges posed by these brands to sustain and improve its market position in New York's Pre-Roll segment.

Notable Products

In October 2024, the top-performing product for Rec Roots was Sour Jefe Pre-Roll (1g), maintaining its first-place ranking for the fourth consecutive month with sales reaching 4577 units. Mimosa x Orange Punch Pre-Roll (1g) climbed to second place from its previous fifth position in August, showcasing a significant rise in popularity. GG4 Pre-Roll (1g) held steady at third place, with sales increasing to 3136 units from September. Pink Runtz (3.5g) entered the top five, securing the fourth position with 2451 units sold, marking a return to the rankings after a previous absence. Unicorn Microdots Pre-Roll (1g) made its debut in the rankings at fifth place, indicating strong initial sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.