Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

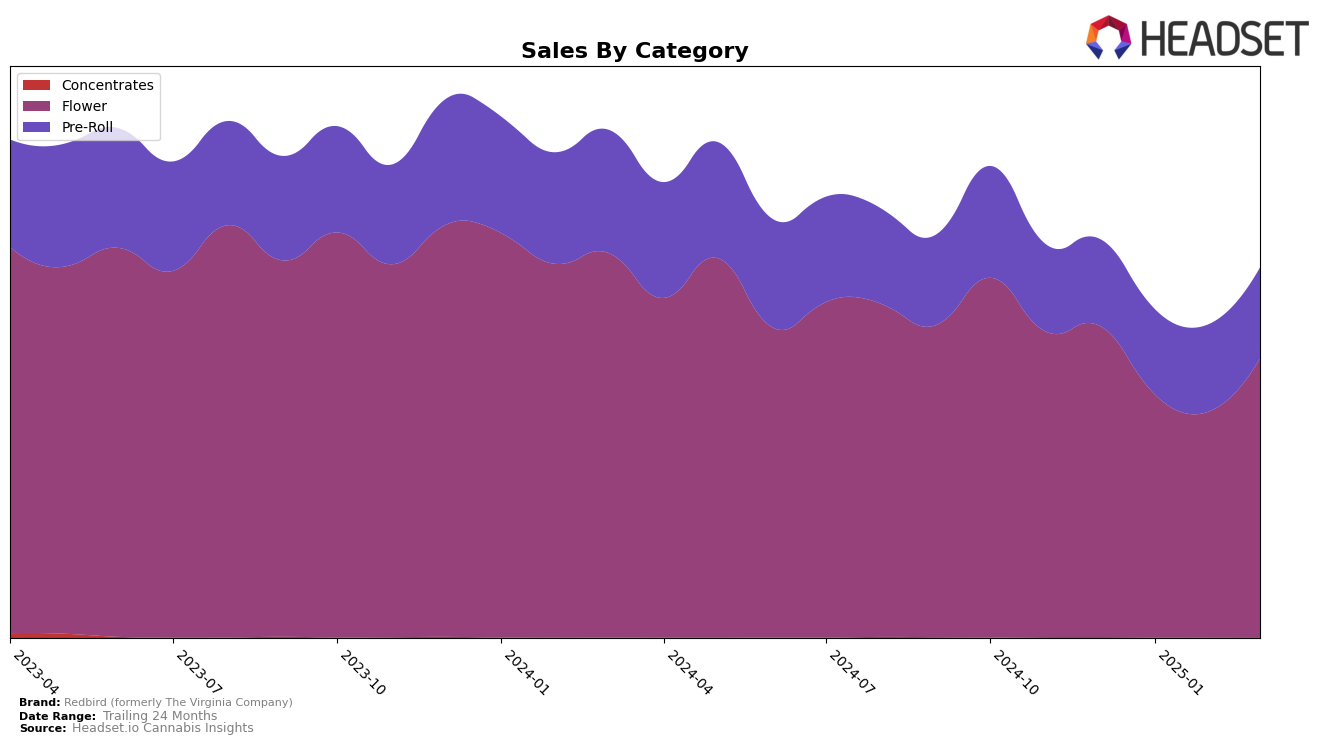

In the state of Washington, Redbird (formerly The Virginia Company) has demonstrated notable performance in the Flower category. The brand's ranking improved from 8th place in February 2025 to an impressive 4th place by March 2025. This upward movement suggests a growing consumer preference for their Flower products, despite a dip in sales earlier in the year. Such a rebound indicates effective strategies in place to capture market share, particularly as the brand was not in the top 30 for some months in other categories across different states.

Conversely, in the Pre-Roll category, Redbird has maintained a relatively stable position, hovering around the 20th rank in Washington throughout the first quarter of 2025. While this consistency suggests a steady demand for their Pre-Roll offerings, the brand's absence from the top 30 in other states indicates potential areas for growth and expansion. The slight increase in sales from January to March 2025, however, does highlight a positive trend that could be leveraged for better rankings in the future. This performance across categories and states shows both strengths and opportunities for Redbird as it continues to navigate the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Redbird (formerly The Virginia Company) has shown a notable upward trajectory in its ranking, moving from 8th place in February 2025 to 4th place by March 2025. This improvement is significant as it indicates a recovery from a downward trend observed earlier, where Redbird slipped from 6th in December 2024 to 8th in February 2025. In comparison, Artizen Cannabis maintained a relatively stable position, fluctuating slightly but remaining in the top 5, while WA Grower experienced a decline from 3rd in February to 6th in March. Lifted Cannabis Co also saw a slight drop from 3rd to 5th over the same period. Meanwhile, Legends consistently held the 2nd position, showcasing robust performance. Redbird's recent climb in rank suggests a positive shift in consumer preference or strategic adjustments that have enhanced its market presence, positioning it closer to its competitors in terms of market influence.

Notable Products

In March 2025, Redbird (formerly The Virginia Company) saw Kush Cream Cake (3.5g) maintain its top position in the Flower category with sales reaching 2100 units, showcasing a consistent performance since December 2024. Raspberry Dosido (3.5g) climbed to the second position, improving from its third place in February 2025, highlighting its growing popularity. Ice Cream Cake (3.5g) secured the third rank, marking a steady rise from fifth place the previous month. White Wedding (3.5g) debuted at fourth place, indicating a strong entry into the market. Tropicanna Garlic (3.5g) rounded out the top five, showing a promising start as it entered the rankings for the first time in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.