Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

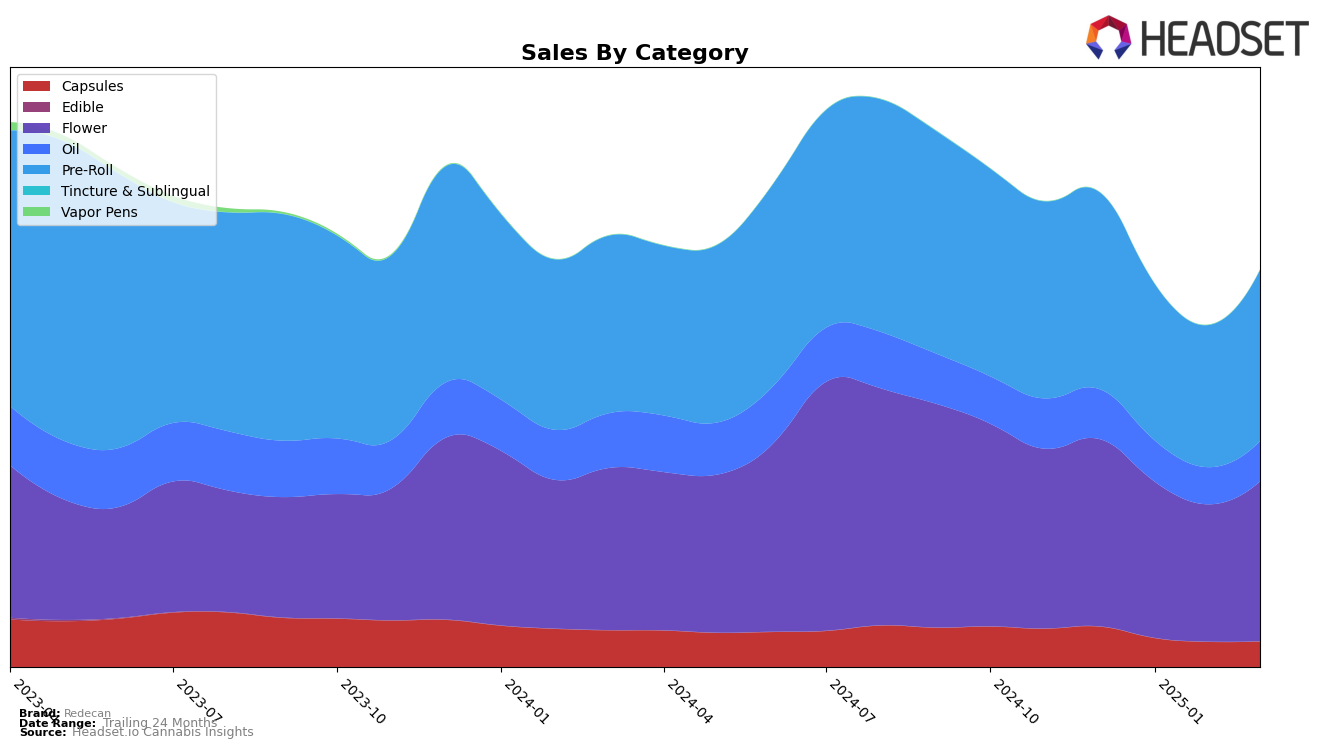

Redecan has demonstrated a varied performance across different categories and regions. In Alberta, the brand has maintained a steady presence in the Flower category, fluctuating between the 6th and 9th positions from December 2024 to March 2025. However, their sales in this category have shown a downward trend before recovering in March. In the Pre-Roll category, Redecan has consistently ranked within the top 6, with a notable increase in sales from February to March 2025. Meanwhile, in British Columbia, the brand has struggled to break into the top 20 in the Flower category, with rankings hovering around the mid-20s, indicating a more challenging market environment.

In Ontario, Redecan has shown strong performance, especially in the Capsules and Oil categories, where they have maintained top positions. The brand’s dominance in the Oil category is particularly noteworthy, consistently holding the number one spot. However, the Flower and Pre-Roll categories have seen a slight decline in rankings, suggesting increased competition or shifting consumer preferences. In Saskatchewan, Redecan's presence in the Flower category was noteworthy at the beginning of the year but dropped out of the top 30 by March, indicating potential challenges in maintaining market share. The Pre-Roll category also saw Redecan drop out of the rankings after December, highlighting areas for potential improvement.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Redecan has experienced a slight decline in rank from December 2024 to March 2025, moving from 6th to 8th place. This shift can be attributed to the dynamic movements of competitors such as The Original Fraser Valley Weed Co., which improved its position from 9th in December 2024 to 7th in March 2025, and SUPER TOAST, which climbed from 10th to 6th place over the same period. Despite Redecan's consistent presence in the top 10, its sales figures have shown a downward trend, contrasting with the upward trajectory of competitors like SUPER TOAST, which saw a notable increase in sales by March 2025. Meanwhile, Big Bag O' Buds and Pepe have maintained their positions outside the top 8, suggesting a less direct impact on Redecan's rank but highlighting the competitive pressures within the market. This analysis underscores the importance for Redecan to strategize effectively to regain its higher ranking and counteract the sales decline.

Notable Products

In March 2025, the top-performing product for Redecan was Redees - Cold Creek Kush Pre-Roll 10-Pack (4g), maintaining its first-place rank for four consecutive months with sales reaching 37,234 units. Following closely, Redees- Hemp'd Animal Runtz Pre-Roll 10-Pack (4g) consistently held the second position, showing a slight increase in sales compared to February. Animal Rntz (3.5g) remained steady at third place, although its sales figures slightly decreased over the months. THC 30 Reign Drops Oil (30ml) retained its fourth-place ranking, showing a recovery in sales from the previous month. Redees - Wappa Pre-Roll 10-Pack (4g) consistently ranked fifth, with a noticeable improvement in sales compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.