Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

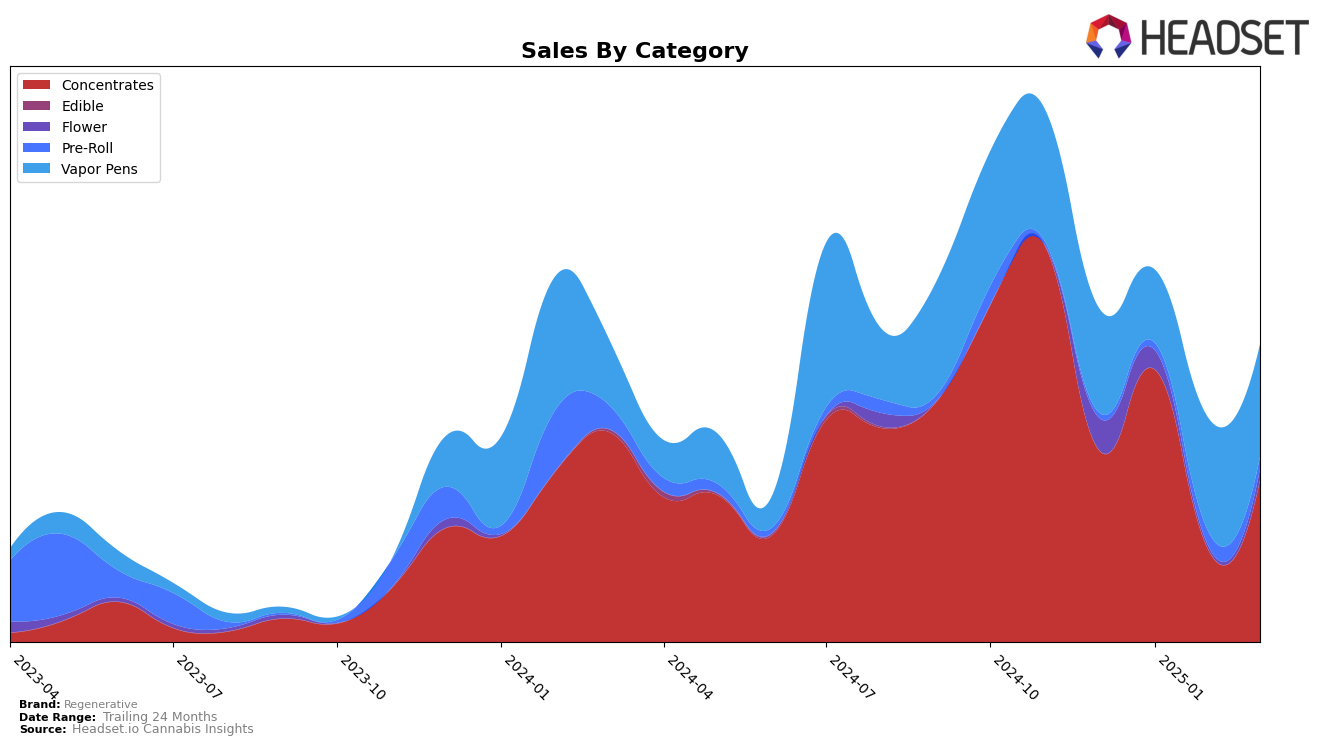

Regenerative's performance in the Massachusetts market shows varied results across different product categories. In the Concentrates category, the brand experienced significant fluctuations in rankings, starting at 21st in December 2024, climbing to 13th in January 2025, and then dropping to 30th in February before recovering to 21st by March. This volatility indicates potential challenges in maintaining a consistent market position, possibly due to competitive pressures or shifting consumer preferences. The sales figures also reflect this inconsistency, with a notable peak in January followed by a dip in February and a partial recovery in March. Such movements suggest that while Regenerative has the capability to reach higher ranks, sustaining that position remains a challenge.

In contrast, Regenerative's Vapor Pens category in Massachusetts presents a different picture. The brand did not make it into the top 30 rankings, with positions ranging from 81st to 73rd over the observed months. Despite not breaking into the top tier, there is a slight upward trend from January to February, which could indicate a potential for growth if the brand can capitalize on this momentum. The sales numbers in this category are relatively stable, with no dramatic spikes or drops, suggesting a steady, albeit modest, consumer base. This steadiness might provide a foundation upon which Regenerative can build to improve its rankings and market presence in the future.

Competitive Landscape

In the Massachusetts concentrates category, Regenerative has experienced notable fluctuations in its market position over recent months, impacting its competitive stance. Starting in December 2024, Regenerative was ranked 21st, but it saw a significant improvement in January 2025, climbing to 13th place. This rise was accompanied by a substantial increase in sales, outperforming brands like Theory Wellness, which improved from 29th to 21st, and Superflux, which fell from 16th to 24th. However, by February 2025, Regenerative's rank dropped to 30th, indicating it fell out of the top 20, while Treeworks maintained a stable position around 13th. In March 2025, Regenerative rebounded to 21st place, showcasing its resilience and potential for recovery. Despite these fluctuations, Regenerative's ability to climb back into the top 20 suggests a competitive edge that could be leveraged for future growth, especially when compared to brands like Dab Fx, which consistently ranked within the top 24. These insights highlight the dynamic nature of the market and the importance of strategic positioning for Regenerative to maintain and improve its market share.

Notable Products

In March 2025, the top-performing product for Regenerative was Lemon Headz OG Live Resin Cartridge (1g) in the Vapor Pens category, which climbed from third place in January to secure the first position with sales of 446 units. Blueberry Muffin Live Resin Cartridge (1g), also in the Vapor Pens category, rose from third place in February to second place in March, showing a consistent upward trend. Cherry Gar-See-Ya Live Badder (1g) made a notable entry into the Concentrates category at third place, marking its debut in the rankings. Whiplash Pre-Roll (1g) slipped from second place in February to fourth place in March, indicating a slight decline in its popularity. Sticky Rice x Grandi Candy Live Sugar (1g) secured the fifth position in the Concentrates category, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.