Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

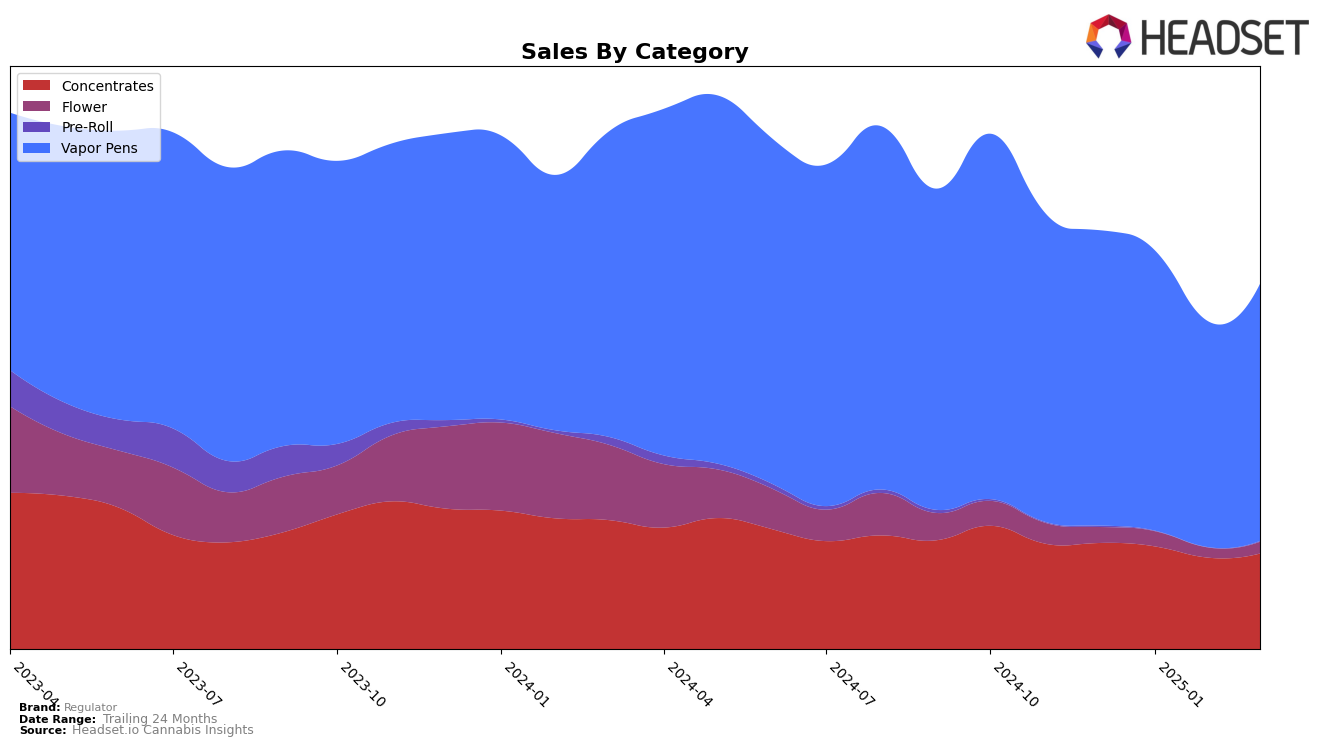

In the state of Washington, Regulator has shown a consistent performance in the Concentrates category, maintaining a steady 4th place ranking from December 2024 through March 2025. This stability suggests a strong foothold in the market, although it is worth noting that sales have experienced a slight decline over this period. In the Vapor Pens category, Regulator has demonstrated some fluctuations, moving from 12th place in December 2024 to 10th in January 2025, then back to 12th in February, before improving to 11th in March. This indicates a competitive environment where Regulator is making efforts to climb the ranks, though it remains outside the top 10 for most of this period.

While Regulator has managed to maintain a prominent position in Concentrates, their performance in the Vapor Pens category highlights the challenges they face in achieving higher rankings. The fact that they are not in the top 30 in other categories or states suggests there may be opportunities for growth or areas where the brand is not as competitive. The sales trends in Washington, especially in the Concentrates category, may provide insights into consumer preferences and the brand's strategies to maintain its market share. For those interested in a deeper dive into Regulator's performance in other states or categories, further analysis would be required to uncover additional insights.

Competitive Landscape

In the competitive landscape of vapor pens in Washington, Regulator has shown a dynamic performance from December 2024 to March 2025. Starting at rank 12 in December, Regulator improved to rank 10 in January, only to slip back to 12 in February and then slightly recover to 11 in March. This fluctuation in rank highlights the competitive pressure from brands like Ooowee, which also experienced a rank drop in January but managed to climb back to its December position by March. Meanwhile, Dabstract maintained a stable position in the top 10 throughout the period, indicating a strong market presence that Regulator is competing against. Despite these challenges, Regulator's sales trajectory shows a recovery in March after a dip in February, suggesting potential for regaining higher ranks if this upward trend continues. This competitive environment underscores the importance for Regulator to leverage strategic marketing and product differentiation to enhance its market position against established competitors in Washington's vapor pen category.

Notable Products

In March 2025, the top-performing product for Regulator was Hindu Kush Wax (1g) in the Concentrates category, reclaiming the number one position after a brief drop to fourth place in February. Purple Punch Distillate Cartridge (1g) in the Vapor Pens category secured the second spot, showing a slight decline from its first-place ranking in February, with sales reaching 2302 units. Tangie Sugar Wax (1g) made a notable entry at third place, marking its debut in the rankings. Pineapple Super Silver Haze Distillate Cartridge (1g) and Jack Herer Distillate Cartridge (1g) entered the rankings in March at fourth and fifth positions, respectively, indicating a growing interest in the Vapor Pens category. Overall, the Concentrates and Vapor Pens categories demonstrated strong sales performance for Regulator in March 2025.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.