Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

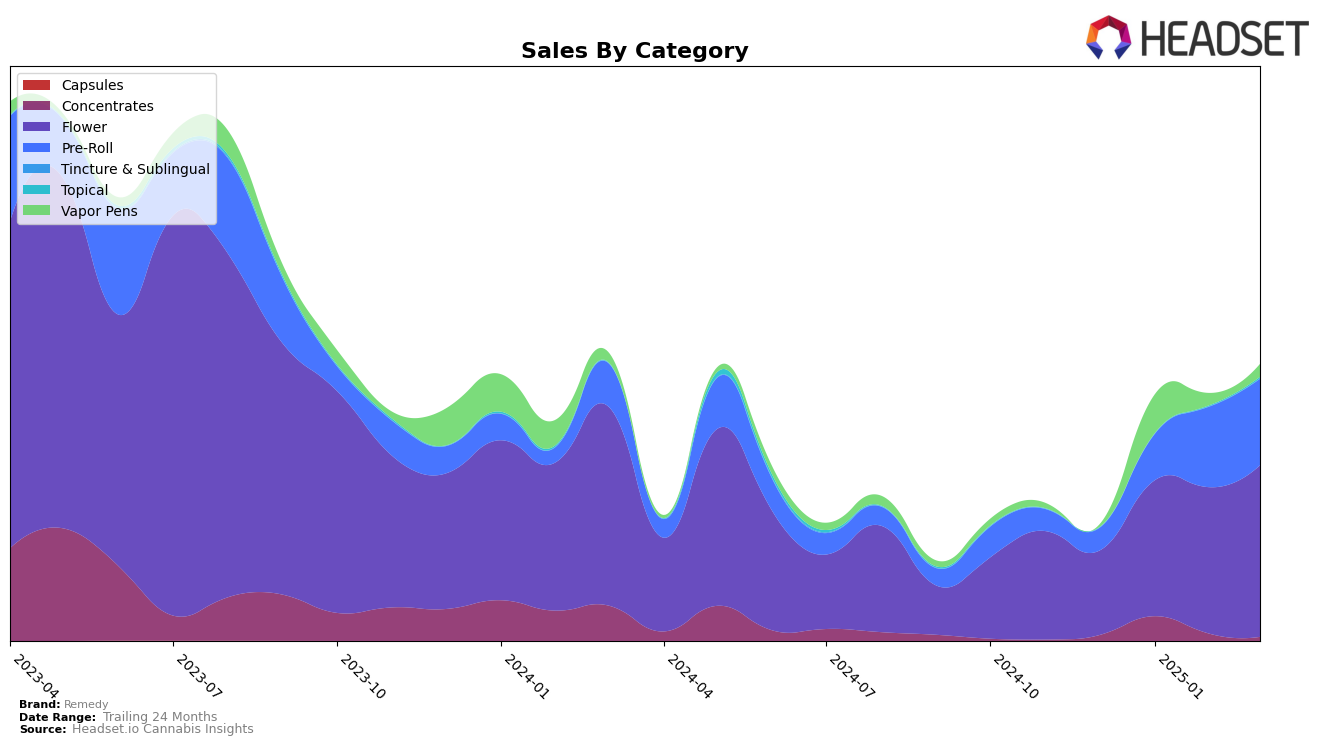

In the state of Nevada, Remedy has shown varied performance across different cannabis categories. Notably, the brand has made a significant impact in the Pre-Roll category, climbing from a ranking of 47 in December 2024 to 18 by March 2025, indicating a strong upward trend. Conversely, in the Concentrates category, Remedy did not appear in the top 30, which suggests potential areas for improvement or a strategic focus elsewhere. In the Flower category, Remedy has shown steady progress, improving its ranking from 51 in December 2024 to 34 in March 2025. This consistent upward trajectory in Flower could suggest a growing consumer preference or successful marketing strategies in this segment.

While Remedy's performance in the Flower and Pre-Roll categories in Nevada is noteworthy, its presence in the Vapor Pens category has been less stable. Starting at rank 37 in January 2025, Remedy's position fluctuated, dropping to 53 in February before slightly recovering to 51 in March. This volatility could indicate challenges in maintaining a competitive edge or fluctuating consumer preferences. The absence of Remedy in the top 30 for Concentrates throughout the observed months highlights a potential gap in this category. These mixed results across categories suggest that while Remedy is gaining traction in certain areas, there are opportunities for strategic adjustments to enhance its market presence further.

Competitive Landscape

In the Nevada flower category, Remedy has shown a notable upward trend in rank from December 2024 to March 2025, moving from 51st to 34th position. This improvement is significant when compared to competitors such as Greenway Medical, which saw a decline from 23rd to 33rd, and GB Sciences, which also experienced a drop from 24th to 36th. Remedy's sales have been on a steady increase, contrasting with the declining sales of competitors like Greenway Medical and GB Sciences. This positive trajectory in both rank and sales suggests that Remedy is gaining a stronger foothold in the market, potentially due to strategic marketing efforts or product offerings that resonate well with consumers. Meanwhile, BLVD has shown a similar upward trend, moving from 41st to 30th, indicating a competitive landscape where brands are vying for improved market positions.

Notable Products

In March 2025, the top-performing product from Remedy was Las Vegas Kush Cake Pre-Roll (1g), which climbed to the number one spot with a significant sales figure of 2613 units. This product showed a remarkable rise from its second-place ranking in February 2025. Following closely, Las Vegas Kush Cake (3.5g) maintained a strong performance, securing the second rank, up from fourth in February. Bio-Jesus (3.5g), which held the top rank for three consecutive months, slipped to third place. Meanwhile, new entries Bio-Jesus Pre-Roll (1g) and Chem Dawg Pre-Roll (1g) debuted at fourth and fifth positions, respectively, indicating a growing popularity in the pre-roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.