Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

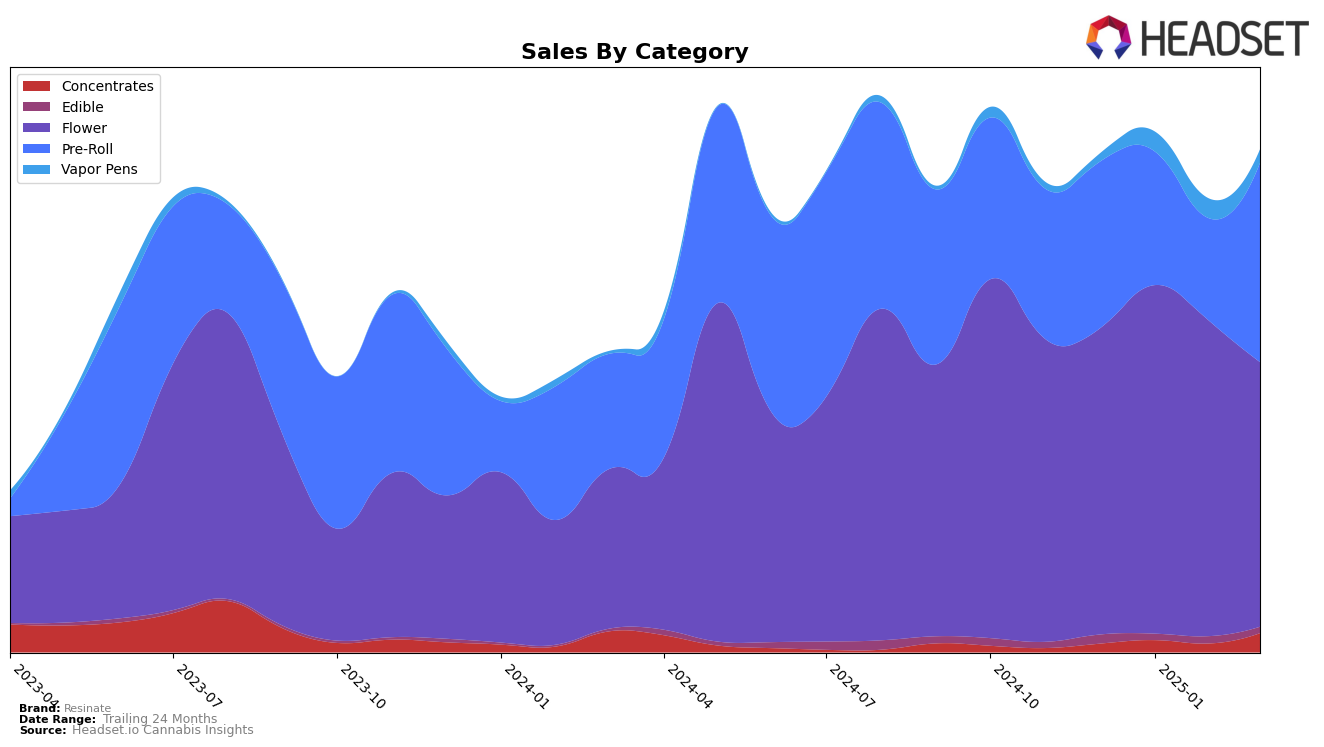

Resinate's performance in Massachusetts showcases a varied trajectory across different product categories. In the Concentrates category, Resinate made a notable entry into the top 30 in March 2025, indicating a significant upward movement after being absent from the rankings in December 2024 and February 2025. Meanwhile, their presence in the Flower category remained relatively stable, with rankings fluctuating between 21st and 30th place from December 2024 to March 2025. This consistency suggests a solid foothold in the Flower market, although a decline in sales from February to March 2025 might warrant attention.

In the Pre-Roll category, Resinate displayed a remarkable recovery by March 2025, climbing to the 22nd position after dropping to 38th in February. This rebound was accompanied by a substantial increase in sales, which could be indicative of successful marketing or product strategy adjustments. However, the Vapor Pens category presents a contrasting story, where Resinate's rankings remained outside the top 30, peaking at 80th in February 2025 before declining to 98th in March. This suggests potential challenges in gaining traction within this segment, pointing towards areas for strategic improvement. Overall, while Resinate shows strengths in certain categories, there are clear opportunities for growth and optimization in others.

Competitive Landscape

In the Massachusetts Flower category, Resinate experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 27 in December, Resinate improved to rank 21 by February, only to drop out of the top 20 by March. This volatility in rank is mirrored by its sales performance, which peaked in January 2025 before declining significantly by March. In comparison, Root & Bloom consistently maintained a higher rank, peaking at 20 in February, indicating stronger market stability. Meanwhile, Bountiful Farms showed resilience by recovering from a rank of 36 in January to 28 by March, suggesting a potential threat to Resinate's market share. Additionally, The Botanist made a significant leap from outside the top 50 to rank 31 in March, highlighting a competitive landscape that could further challenge Resinate's position. These dynamics suggest that while Resinate has potential for growth, it faces stiff competition from brands like Root & Bloom and emerging contenders like The Botanist.

Notable Products

In March 2025, Blue Dream Pre-Roll (1g) emerged as the top-performing product for Resinate, climbing from third place in February to secure the number one spot with impressive sales of 4610 units. Skunk #1 Pre-Roll (1g) made a strong debut at the second position, while Gelato (3.5g) slipped from first in February to third place. Socrates Sour Pre-Roll (1g) ranked fourth, maintaining a presence in the top five, and Mountaintop Mint Pre-Roll (1g) rounded out the top five, dropping from its previous first-place position in December 2024. This month marked significant shifts in rankings, particularly for Blue Dream Pre-Roll, which showcased a remarkable increase in popularity and sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.