Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

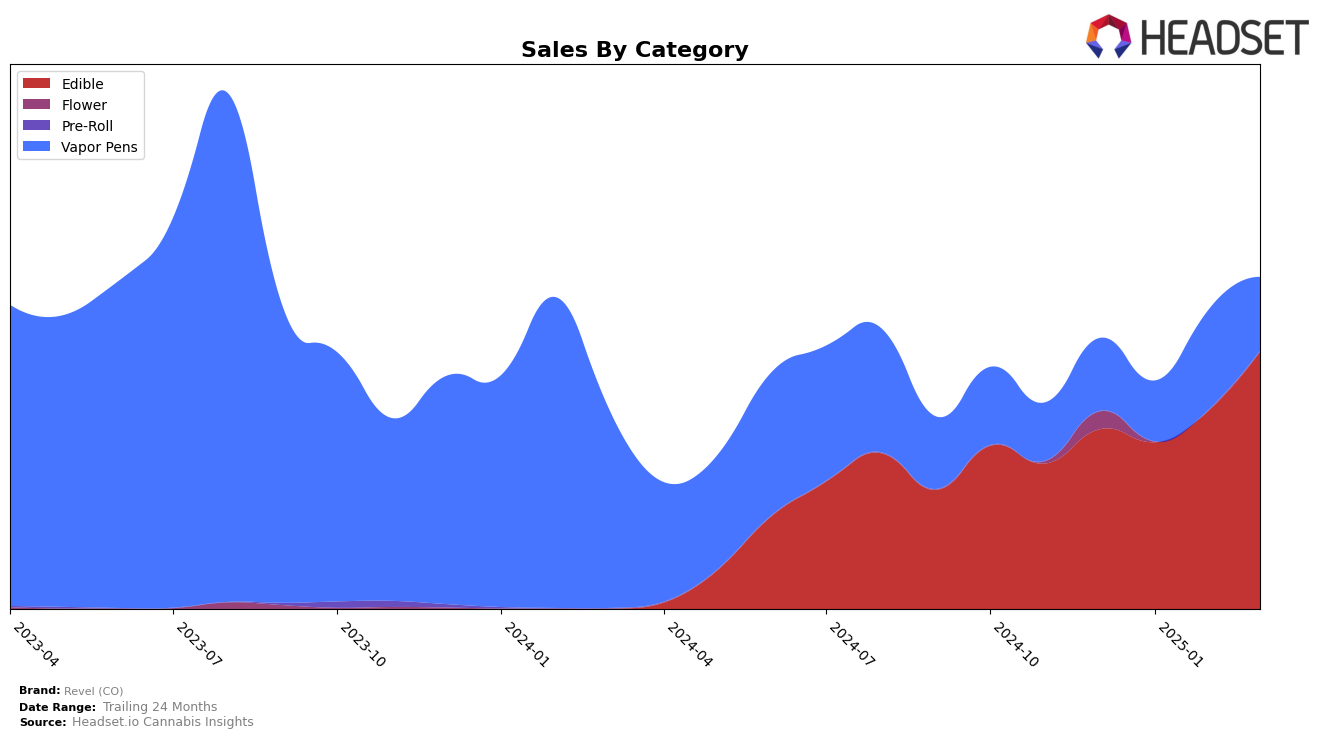

Revel (CO) has shown a consistent presence in the Colorado market, particularly in the Edible category. The brand maintained a stable rank of 9th place from December 2024 through February 2025, before moving up to 8th place in March 2025. This upward movement in March suggests a positive trend for the brand within the Edibles segment. The sales figures for March 2025 reflect a significant increase, indicating a strong performance that could be attributed to successful marketing strategies or new product launches. In contrast, Revel (CO) did not make it into the top 30 brands in the Vapor Pens category, highlighting a challenge or opportunity for improvement in this area.

In the Vapor Pens category, Revel (CO) has experienced fluctuating rankings, with positions ranging from 45th to 53rd between December 2024 and March 2025, ultimately landing at 49th place in March. This inconsistency suggests that while the brand has a presence, it faces stiff competition or potential issues in gaining a stronger foothold. The sales figures in this category show a peak in February 2025, which could indicate a temporary boost due to promotions or seasonal demand. However, the inability to break into the top 30 brands in this category in Colorado suggests that Revel (CO) may need to reassess its strategy or product offerings to enhance its market position.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Revel (CO) has demonstrated a noteworthy upward trajectory, particularly in the first quarter of 2025. Starting from a consistent 9th place ranking from December 2024 through February 2025, Revel (CO) climbed to 8th place in March 2025, indicating a positive shift in market positioning. This improvement is underscored by a significant increase in sales, with March 2025 figures showing a robust growth compared to the previous months. In contrast, competitors such as Incredibles experienced a slight decline in rank, moving from 8th to 9th place, while Tastebudz maintained a steady 6th position despite a downward trend in sales over the same period. Meanwhile, Joyibles held a consistent 7th place, but Revel (CO)'s strategic advancements suggest a potential to challenge this position if the current momentum continues. These dynamics highlight Revel (CO)'s growing influence in the market, driven by its ability to capture increased consumer interest and sales.

Notable Products

In March 2025, the top-performing product for Revel (CO) was the THC/CBG 2:1 Uplifted Mango Tangerine Gummies 10-Pack, which climbed back to the number one position with impressive sales of 8,516 units. The THC/CBD/CBC 1:1:1 Relaxed Peach Lemonade Gummies 20-Pack, despite a slight drop to second place, maintained strong sales figures. The CBD/CBN/THC 1:1:1 Sleepy Strawberry Gummy 20-Pack held steady in third, showing consistent demand. Energetic Lemon Lime Gummy remained fourth, while Focus Grape Gummy continued in fifth place, indicating stable consumer preferences. Compared to the previous months, the rankings show a dynamic shift, particularly with the top two products exchanging positions from February to March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.