Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

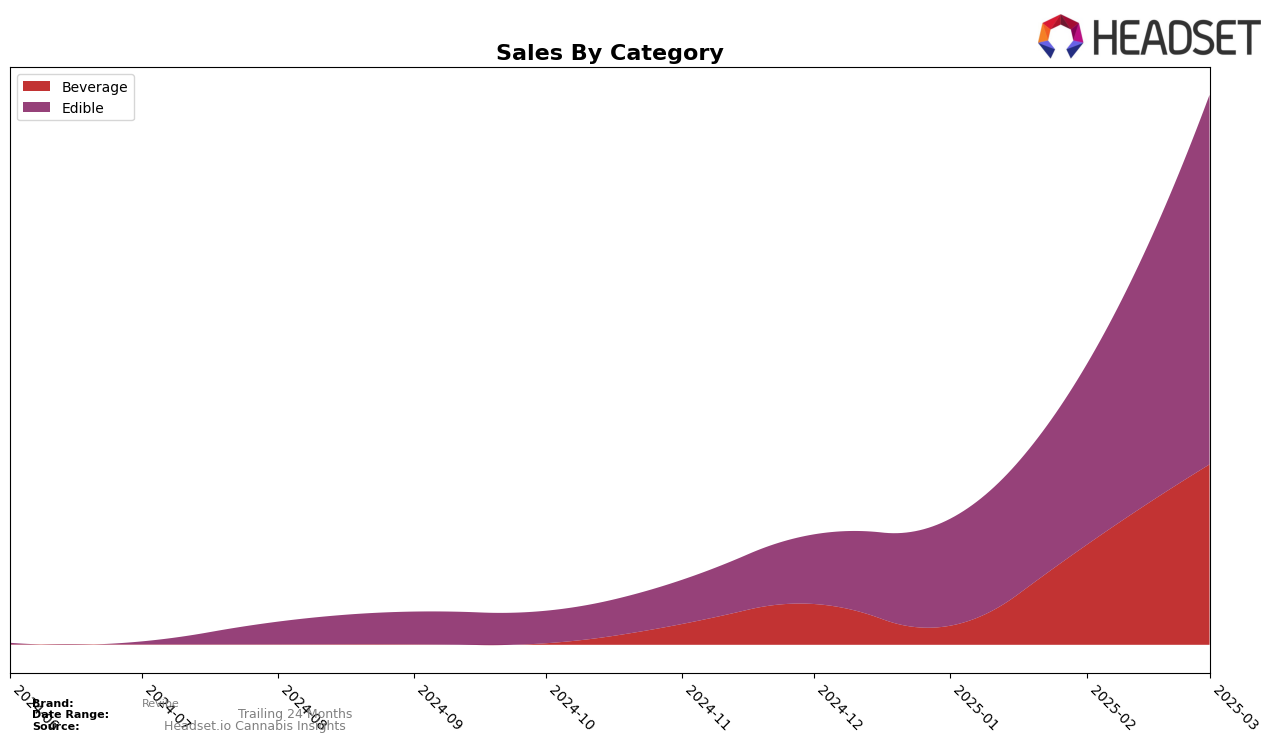

Revibe has demonstrated a notable performance in the Ohio market, particularly in the Beverage category. In December 2024, Revibe ranked 7th, but unfortunately, it fell out of the top 30 in January 2025, indicating a temporary decline. However, the brand made a strong comeback by securing the 4th position in both February and March 2025. This recovery is significant as it suggests a positive reception of Revibe's products in the Ohio beverage sector, reflecting a strong upward trend in sales, which exceeded $65,000 by March 2025.

In the Edible category, Revibe's performance in Ohio also shows a promising trajectory. Starting from a 48th position in December 2024, the brand improved its ranking significantly to 19th by March 2025. This consistent upward movement in rankings highlights Revibe's growing popularity and acceptance among consumers in the edibles market. The sales figures, which more than doubled from December to March, underline this trend. However, the brand's absence from the top 30 in January in the Beverage category serves as a reminder of the competitive nature of the market.

Competitive Landscape

In the competitive landscape of the edible category in Ohio, Revibe has demonstrated a remarkable upward trajectory in both rank and sales over the past few months. Starting from a rank of 48 in December 2024, Revibe climbed to 19 by March 2025, showcasing a significant improvement in market presence. This ascent is particularly noteworthy when compared to competitors such as Kiva Chocolate, which slipped out of the top 20 by March 2025, and The Botanist, which fluctuated but managed to re-enter the top 20. Meanwhile, Lost Farm and Main Street Health maintained relatively stable positions, though Lost Farm experienced a notable sales increase in March. Revibe's rapid rise in rank and sales suggests a growing consumer preference and effective market strategies, positioning it as a formidable contender in the Ohio edible market.

Notable Products

In March 2025, Revibe's top-performing product was the Tropical Mango Drink (100mg THC, 8oz, 237ml), which climbed to the top position from fifth place in February, with sales reaching 1884 units. The Watermelon Drink (100mg THC, 8oz, 237ml) followed closely, maintaining a strong presence by securing the second spot, up from fourth in February. The CBN/THC 3:1 Blueberry Lemonade Gummies 10-Pack (300mg CBN, 100mg THC) saw a slight drop to third place after leading in February. Sour Blue Razzberry Gummies 10-Pack (500mg) debuted in the rankings at fourth position. The 500mg Summer Melon Gummies 10-Pack remained consistent in fifth place, mirroring its January placement.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.