Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

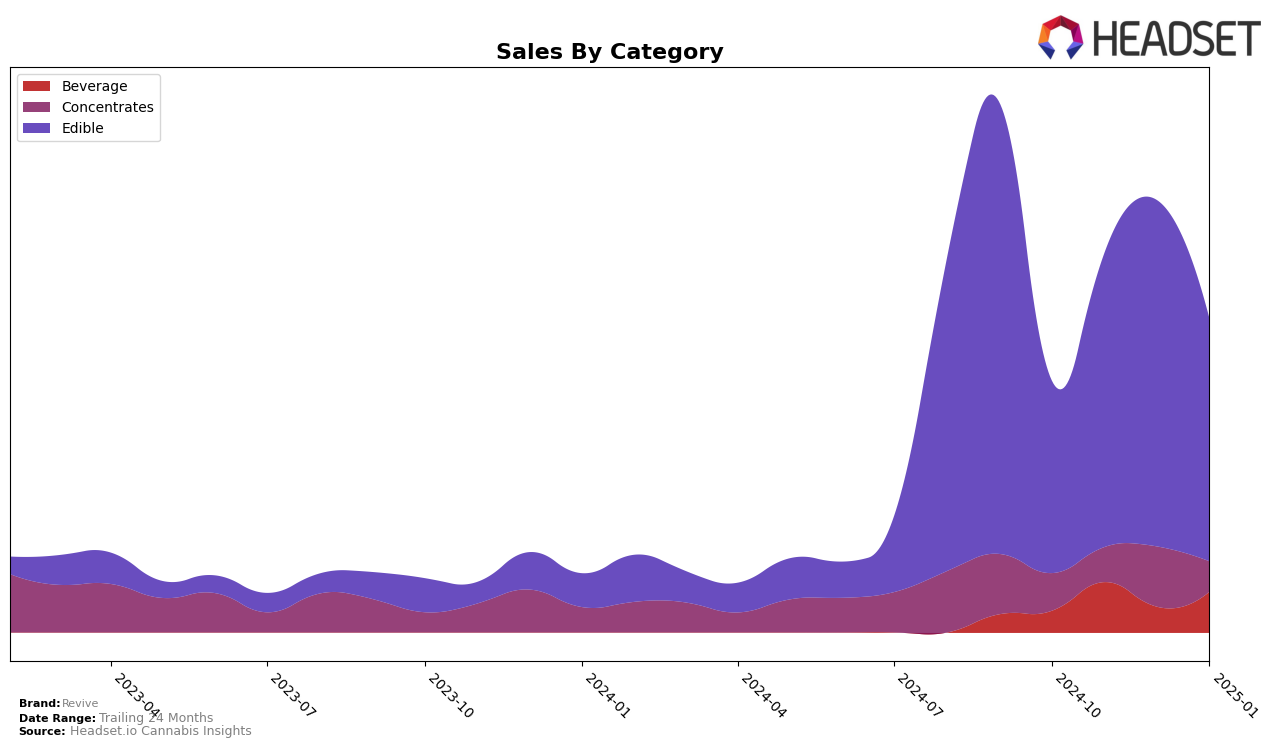

Revive has shown a notable performance in the Ohio market, particularly within the Beverage and Edible categories. In the Beverage category, Revive managed to secure the 6th position in both November 2024 and January 2025, despite not ranking in the top 30 in October or December. This consistency in November and January suggests a strong brand presence and potential consumer loyalty in the Beverage category, even amidst fluctuating rankings. However, the absence from the top 30 in two months could indicate challenges in maintaining a consistent market position or possibly seasonal variations affecting sales.

In the Edible category, Revive has demonstrated a steady upward trend in Ohio, improving from a 33rd rank in October 2024 to a 28th rank by January 2025. This upward movement highlights an increasing consumer preference or effective market strategies that have helped Revive climb the ranks. The sales figures show a peak in December, followed by a slight decline in January, which may reflect typical holiday season buying patterns. The ability to remain within the top 30 across these months is a positive indicator of Revive's growing foothold in the edible market.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ohio, Revive has demonstrated notable resilience and growth. From October 2024 to January 2025, Revive improved its rank from 33rd to 28th, indicating a positive trend in market presence. This upward movement is particularly significant when compared to competitors such as Moxie, which fluctuated between ranks 34 and 30, and Chew & Chill (C & C), which maintained a relatively stable position around the 32nd rank. Despite J-Bad experiencing a dip in December 2024, it managed to close January 2025 at 27th, just ahead of Revive. Meanwhile, Eden's Trees consistently outperformed Revive, holding ranks in the low 20s, although it saw a decline to 25th in January 2025. Revive's sales trajectory, with a significant peak in December 2024, suggests a strong consumer response and potential for further growth, positioning it as a formidable contender in the Ohio edibles market.

Notable Products

In January 2025, the CBC/THC 3:1 Citrus Blossom Gummies 11-Pack (330mg CBC, 110mg THC) emerged as the top-performing product for Revive, reclaiming its number one rank with notable sales of 882 units. Summer Melon Gummies 11-Pack (550mg), which held the top spot in the previous two months, slipped to second place, showing a significant drop in sales compared to December. THC Rich Dark Chocolate (100mg) made a notable entry into the rankings at third place, indicating a rise in popularity. The Blue Razzberry Fruit Drink (100mg THC, 6.7oz) debuted in the rankings at fourth place, while Cookies & Cream Chocolate 10-Pack (100mg) fell to fifth, continuing its downward trend from October 2024. Overall, the Edible category dominated the top ranks, with the Beverage category starting to gain traction.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.