Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

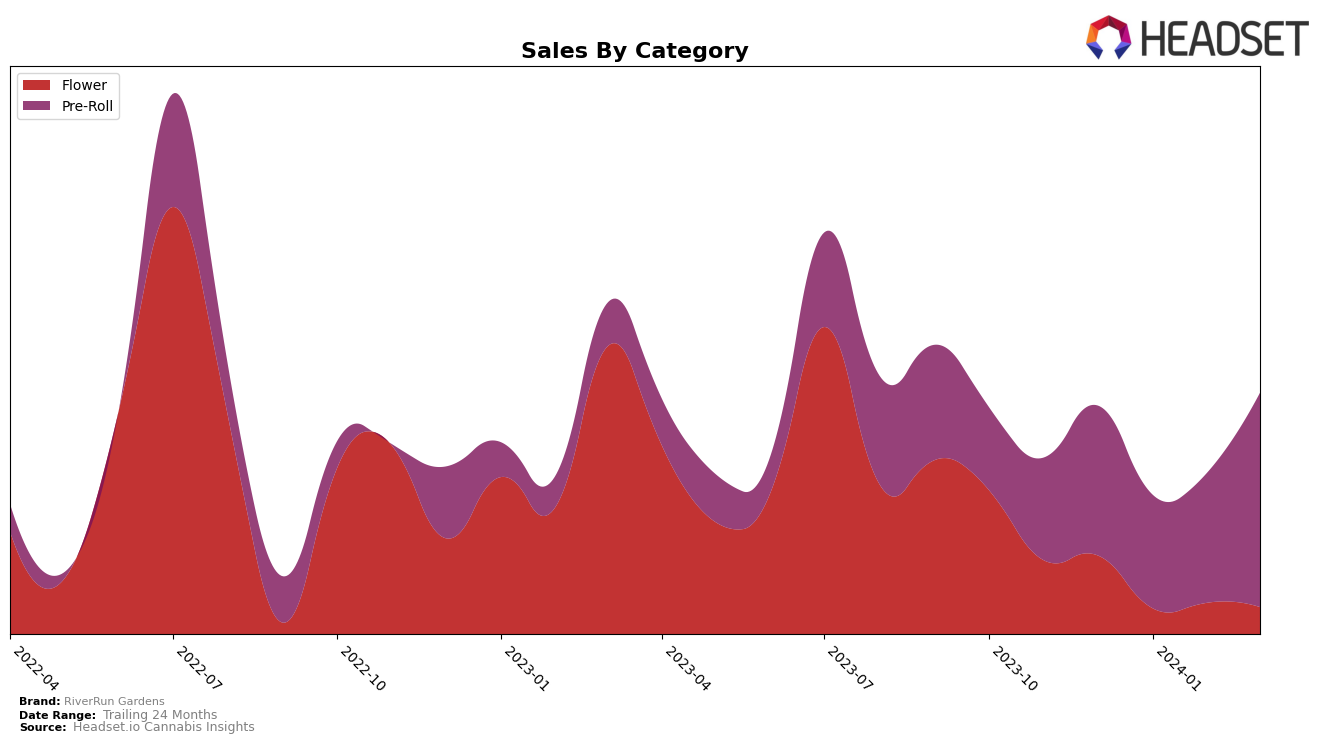

In the competitive cannabis market of Massachusetts, RiverRun Gardens has shown a fluctuating but noteworthy performance across different categories. Specifically, in the Flower category, the brand experienced a decline in rankings from December 2023 to March 2024, moving from the 84th to the 96th position. This downward trend, despite a slight improvement in February 2024, indicates a struggle to maintain or improve its market position against competitors. The sales figures, which peaked at $68,389 in December 2023 before dropping significantly in the following months, mirror this trend, suggesting challenges in sustaining consumer interest or distribution effectiveness in this category.

Conversely, RiverRun Gardens' performance in the Pre-Roll category within the same state paints a more optimistic picture. The brand notably improved its ranking, advancing from the 45th position in December 2023 to the 30th by March 2024. This positive trajectory is further underscored by a significant increase in sales, jumping from $113,960 in December 2023 to an impressive $155,196 by March 2024. Such a marked improvement not only highlights RiverRun Gardens' growing popularity and consumer acceptance in the Pre-Roll category but also suggests effective marketing, product quality, or distribution strategies that have positively impacted its market share and consumer preference in Massachusetts.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Massachusetts, RiverRun Gardens has shown a notable improvement in its market position, moving from not being in the top 20 in December 2023 to ranking 30th by March 2024. This upward trajectory in rank is underscored by a significant increase in sales from February to March 2024, suggesting a growing consumer interest or effective strategic adjustments. Competitors such as Garden Remedies and Valorem have experienced fluctuations in their rankings, with Garden Remedies dropping from 17th to 29th and Valorem seeing a significant rank improvement from 46th to 28th in the same period. Meanwhile, Local Roots has maintained a stable position, slightly improving to rank 31st by March 2024. This dynamic movement among competitors, especially the significant rank improvement of RiverRun Gardens, highlights the competitive nature of the Pre-Roll market in Massachusetts and suggests that RiverRun Gardens is gaining momentum, potentially affecting its market share and competitive standing.

Notable Products

In March 2024, RiverRun Gardens saw Pint Sized Pre-Roll (1g) as its top-selling product, achieving remarkable sales of 940 units. Following closely, Lobster Pot Pre-Roll (1g) and Durban Fruit Pre-Roll (1g) took the second and third spots, with the latter showing a notable improvement from its fifth position in December 2023. The fourth and fifth ranks were held by LA Kush Cake Pre-Roll (0.5g) and Durban Fruit Pre-Roll (0.5g), respectively, indicating a strong consumer preference for pre-rolled products. This month's data reveal a significant shift in consumer preferences, with Durban Fruit Pre-Roll (1g) demonstrating a notable rise in popularity. Overall, the rankings underscore a dominant trend towards pre-rolled cannabis products within RiverRun Gardens' offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.