Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

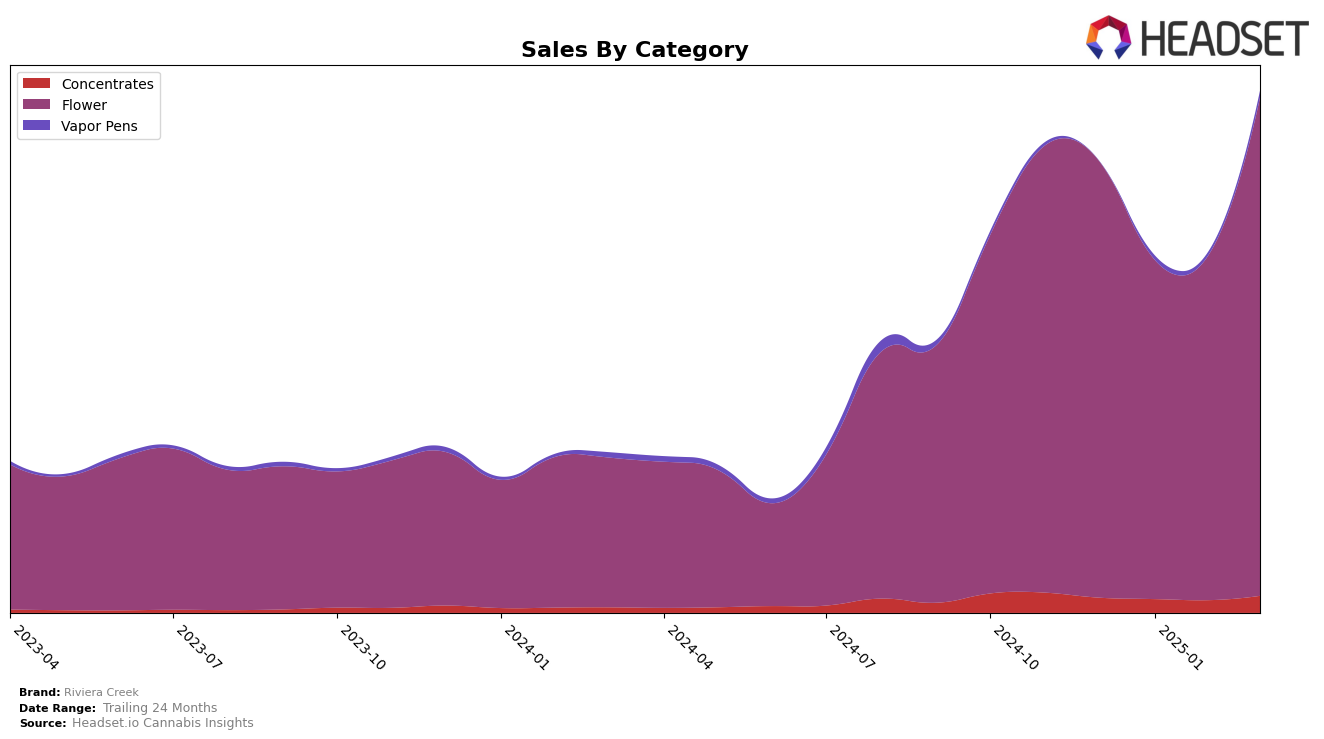

Riviera Creek has demonstrated notable performance in the Ohio market, particularly in the Flower category. Throughout the observed months, the brand maintained a strong presence, consistently ranking within the top two positions. While there was a slight drop from the first to the second position in January, the brand quickly stabilized, maintaining its second-place ranking through February and March. This consistency highlights Riviera Creek's strong foothold in the Flower category, supported by a significant upward trend in sales from February to March.

In the Concentrates category, Riviera Creek's performance in Ohio has been slightly more variable. The brand started and ended the observed period in the third position, despite a dip to fifth place in January and February. This fluctuation suggests a competitive landscape in the Concentrates market, with Riviera Creek managing to reclaim its initial standing by March. Despite the temporary dip in rankings, the brand's sales in March indicate a positive trajectory, suggesting potential for future growth and stability within the category. Notably, Riviera Creek's absence from the top 30 in other states or provinces might indicate areas for potential expansion or increased marketing efforts.

Competitive Landscape

In the competitive landscape of the Ohio flower category, Riviera Creek has experienced notable shifts in its market position over recent months. Initially holding the top rank in December 2024, Riviera Creek was overtaken by Rythm in January 2025, which has since maintained its leading position. Despite this shift, Riviera Creek has consistently held the second rank from January to March 2025, indicating a strong market presence. While Klutch Cannabis and Buckeye Relief have remained stable at third and fourth ranks respectively, Riviera Creek's sales saw a significant rebound in March 2025, suggesting a positive trend that could potentially challenge Rythm's dominance. This dynamic highlights the competitive tension in Ohio's flower market, where Riviera Creek remains a formidable contender despite recent ranking changes.

Notable Products

In March 2025, Stambaugh GC (2.83g) maintained its position as the top-performing product for Riviera Creek, despite a decrease in sales to 14,658. GMO Cookies (2.83g) climbed back to the second spot after slipping to third in February. Riviera Creek Moon Rocks (1g) dropped to third place but showed consistent sales growth over the months. Moon Rocks Rosin (1g) improved its rank to fourth from fifth in the previous two months. Notably, A Riv Stick Infused Blend (1g) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.