Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

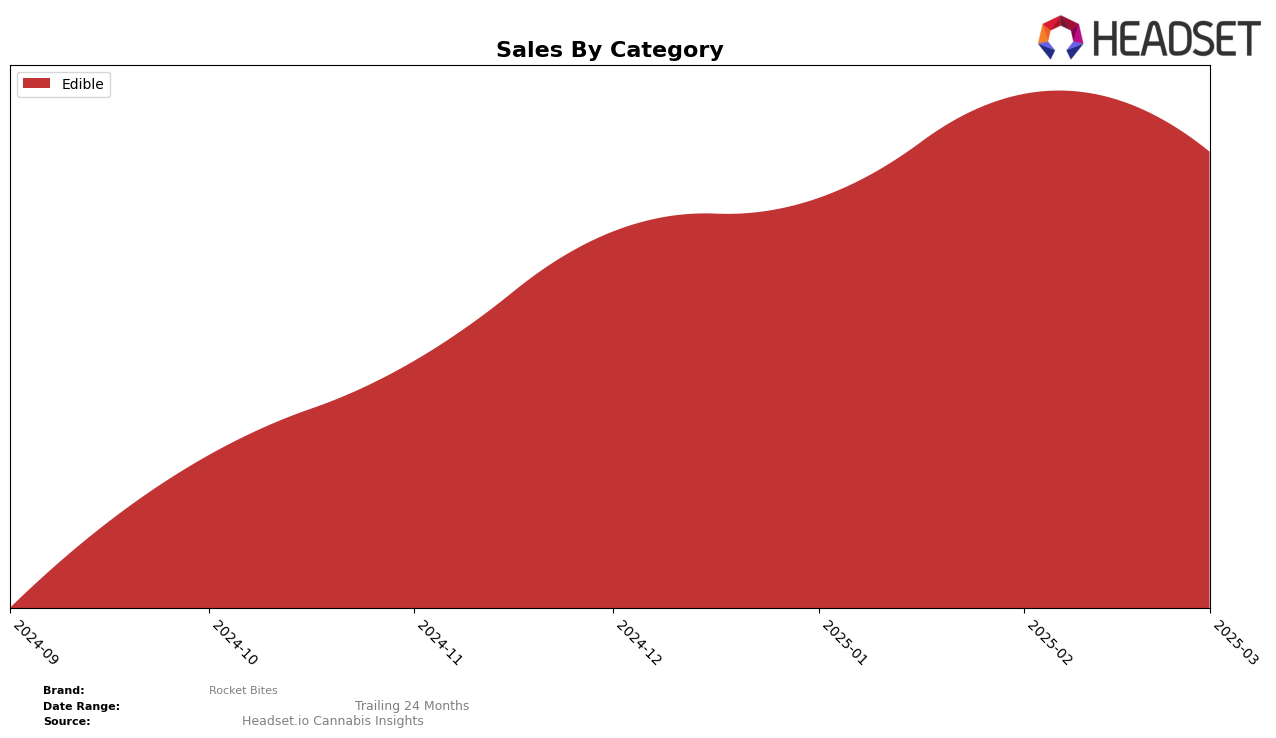

Rocket Bites has demonstrated notable performance in the Edible category within Michigan. Over the past few months, the brand has shown a positive trend, climbing from the 16th position in December 2024 to reach the 9th spot by February 2025. This upward movement indicates a growing consumer preference and market penetration for Rocket Bites in this category. However, a slight dip was observed in March 2025, where the brand ranked 12th. Despite this fluctuation, the overall trend remains positive, reflecting the brand's resilience and ability to capture market share in the competitive Edible sector.

In terms of sales, Rocket Bites experienced a consistent increase from December 2024 to February 2025, with sales peaking in February. This growth trajectory is indicative of successful market strategies and possibly an expanding product lineup that resonates well with consumers. Although there was a decrease in sales in March 2025, the brand managed to maintain its presence in the top 15, which is a promising sign. It's worth noting that Rocket Bites' absence from the top 30 in other states or provinces might suggest areas for potential growth and expansion in the future.

Competitive Landscape

In the competitive landscape of the Michigan edible cannabis market, Rocket Bites has demonstrated notable fluctuations in its rank over the first quarter of 2025. Starting from a rank of 16 in December 2024, Rocket Bites improved significantly to reach the 9th position by February 2025, before slipping to 12th in March 2025. This upward trajectory in February coincided with a peak in sales, suggesting a successful marketing or product strategy during that period. In contrast, competitors like Detroit Edibles / Detroit Fudge Company maintained a more stable presence, consistently ranking between 7th and 10th, while Dixie Elixirs showed a steady improvement, climbing from 13th to 11th. Meanwhile, NOBO and Banned Cannabis Edible Co. experienced a decline in their rankings, indicating potential challenges in maintaining market share. These dynamics highlight Rocket Bites' potential for growth amidst a competitive environment, although sustaining its momentum will be crucial to securing a top position in the coming months.

Notable Products

In March 2025, Cotton Candy Clouds Gummies 10-Pack (200mg) maintained its position as the top-selling product for Rocket Bites, achieving a sales figure of 39,154. Strawberry Supernova Gummies 10-Pack (200mg) consistently held the second rank from January to March 2025. Fruity Flash Gummies 10-Pack (200mg) showed a notable improvement, climbing to third place from its fourth position in February. Atomic Cherry Gummies 10-Pack (200mg) returned to the rankings in March, securing the fourth spot after being absent in January. Blazing Starfruit Gummies 10-Pack (200mg) experienced a slight decline, dropping from third in January to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.