Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

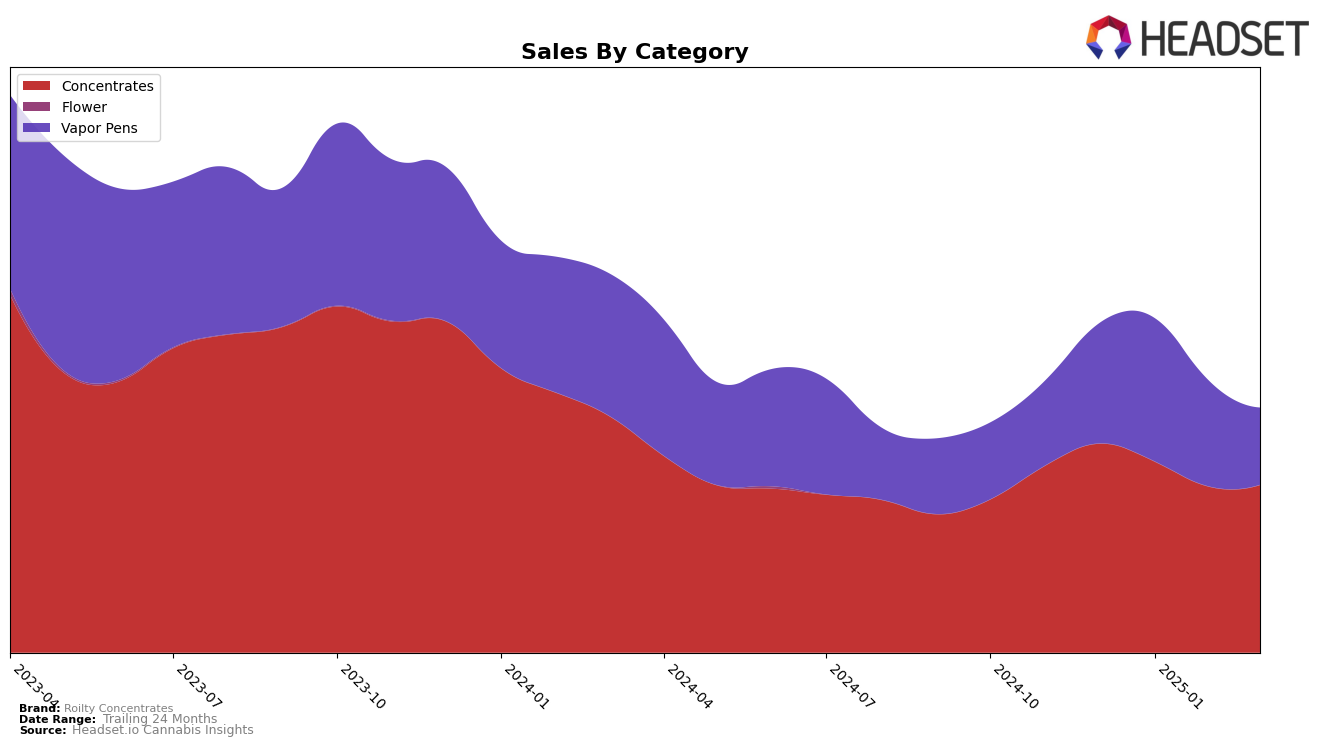

Roilty Concentrates has demonstrated varied performance across different provinces and product categories. In Alberta, the brand has been a strong contender in the Concentrates category, consistently maintaining a top 10 position, although it slipped slightly from 3rd in January 2025 to 6th by March 2025. This suggests a competitive landscape but also highlights Roilty's resilience in maintaining a solid presence. In contrast, their performance in the Vapor Pens category in Alberta has seen more fluctuation, with a notable drop from 27th in January to 44th in March, falling out of the top 30 in the latest month. This indicates challenges in maintaining market share in this category.

In Ontario, Roilty Concentrates has shown stability in the Concentrates category, holding steady around the 8th to 9th rank, demonstrating consistent consumer interest and market presence. However, in the Vapor Pens category, Roilty has struggled to break into the top 50, with rankings hovering in the mid-60s, suggesting a need for strategic adjustments to improve their standing. Meanwhile, in Saskatchewan, Roilty Concentrates has dominated the Concentrates category, maintaining the top position for several months, which underscores their strong brand loyalty and market penetration in this province. Yet, their performance in Vapor Pens, while initially promising, has seen a decline, dropping from 12th to 17th by March, indicating potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of the concentrates category in Alberta, Roilty Concentrates has experienced notable fluctuations in its market position from December 2024 to March 2025. Starting at rank 5 in December 2024, Roilty Concentrates climbed to rank 3 in January 2025, showcasing a significant improvement in its competitive standing. However, by March 2025, the brand had slipped to rank 6, indicating increased competition and potential challenges in maintaining its market share. During this period, Vortex Cannabis Inc. consistently held a strong position, maintaining a rank of 4 or 5, while Astro Lab showed resilience by reclaiming its rank 4 position in March 2025 after a slight dip. Meanwhile, Western Cannabis demonstrated a positive trajectory, improving from rank 11 in December 2024 to rank 8 by March 2025, suggesting a growing presence in the market. These dynamics highlight the competitive pressures Roilty Concentrates faces and the importance of strategic initiatives to sustain and enhance its ranking in the Alberta concentrates market.

Notable Products

In March 2025, the top-performing product from Roilty Concentrates was Henry the Grape Ape Distillate Cartridge (1g) in the Vapor Pens category, maintaining its leading position from February with sales of 1663 units. White Knight Sugar Wax (1g) climbed to second place in the Concentrates category, showing a notable increase from its third position in February. Pink Princess Sugar Wax (1g) saw a resurgence, securing the third rank after being unranked in February. Queen Bee Kush Shatter (1g) debuted impressively in fourth place within the Concentrates category. Aristocratic Apple Distillate Cartridge (1g) experienced a drop, falling to fifth place from its previous fourth rank in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.