Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

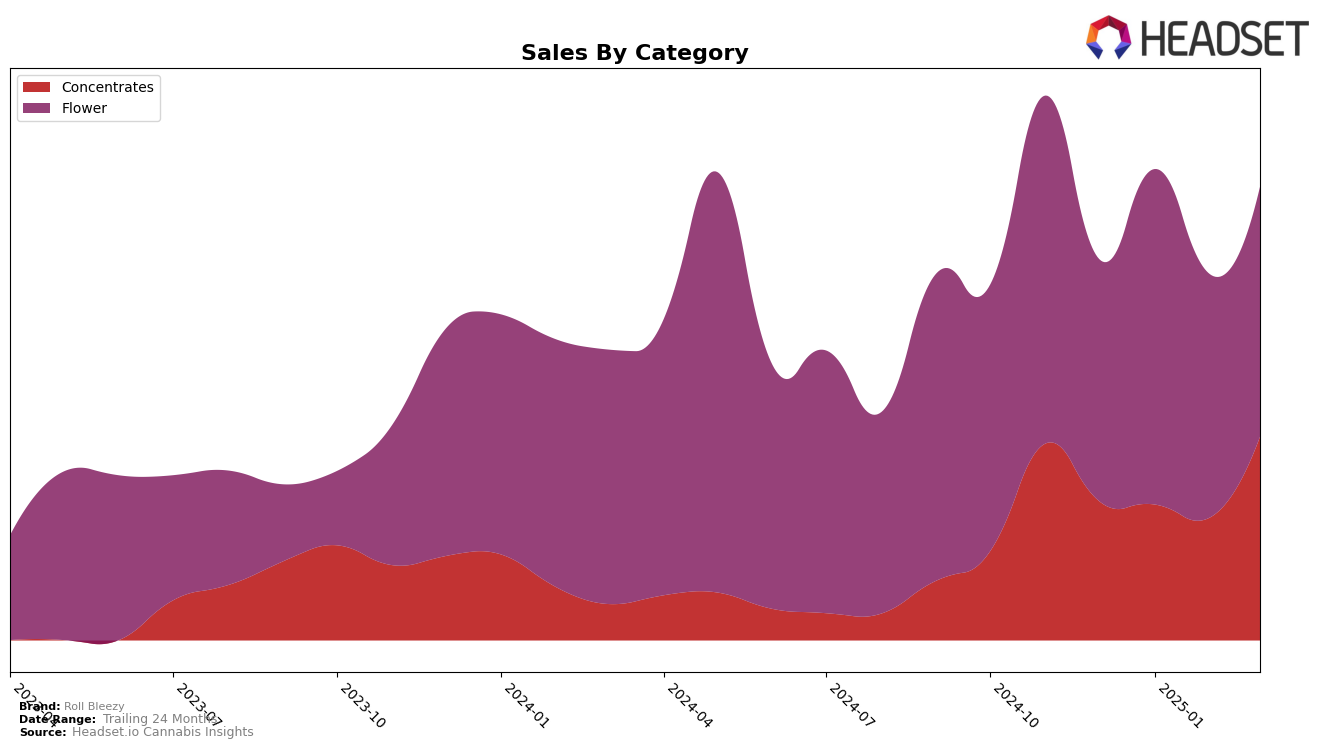

Roll Bleezy has demonstrated notable performance shifts in the California market, particularly within the Concentrates category. The brand has consistently held a position within the top 20, with a commendable rise from 17th in December 2024 to 12th by March 2025. This upward trajectory indicates a strengthening presence and possibly increased consumer preference or strategic distribution enhancements. However, it's worth noting that while they maintained their rank in February 2025, there was a slight dip in sales, suggesting a competitive landscape or potential seasonal factors impacting consumer purchasing behavior.

In contrast, Roll Bleezy's performance in the Flower category in California shows more volatility. Starting at 76th place in December 2024, the brand saw a significant jump to 57th in January 2025, only to fluctuate between 68th and 73rd in the following months. This inconsistency in rankings might reflect challenges in maintaining a steady market share or shifts in consumer preferences. Despite these fluctuations, the brand's sales figures reveal a robust increase in January 2025, hinting at successful promotional efforts or product launches that captured consumer interest during that period.

Competitive Landscape

In the competitive landscape of the California flower category, Roll Bleezy has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 76th in December 2024, Roll Bleezy made a significant leap to 57th in January 2025, indicating a strong surge in sales performance. However, the brand's rank slipped to 68th in February and further to 73rd in March. This volatility suggests a competitive pressure from brands like Gold Flora, which saw a rise to 48th in February before dropping to 79th in March, and Old Pal, which entered the top ranks in February at 89th and improved to 74th in March. Meanwhile, 710 Labs and Seed Junky Genetics maintained relatively stable positions, indicating consistent sales that could be a benchmark for Roll Bleezy's strategic planning. These dynamics highlight the importance for Roll Bleezy to capitalize on its peak performance periods and address the factors contributing to its rank declines to sustain growth in the competitive California flower market.

Notable Products

In March 2025, the top-performing product from Roll Bleezy was Peanut Butter Breath Sauce (1g) in the Concentrates category, achieving the number one rank with sales of 7638 units. Sour D Watermelon Z Sauce (1g), also in the Concentrates category, climbed to the second position, a notable rise from its third-place rank in February. Blue Razzmatazz Sauce (1g) secured the third spot, having moved up from fifth position in February. Honey Banana Sauce (1g) entered the rankings at fourth place, while Lanimal Sherb (3.5g) debuted in fifth place in the Flower category. The data indicates a strong performance for Concentrates, with notable upward shifts in rankings for these products compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.