Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

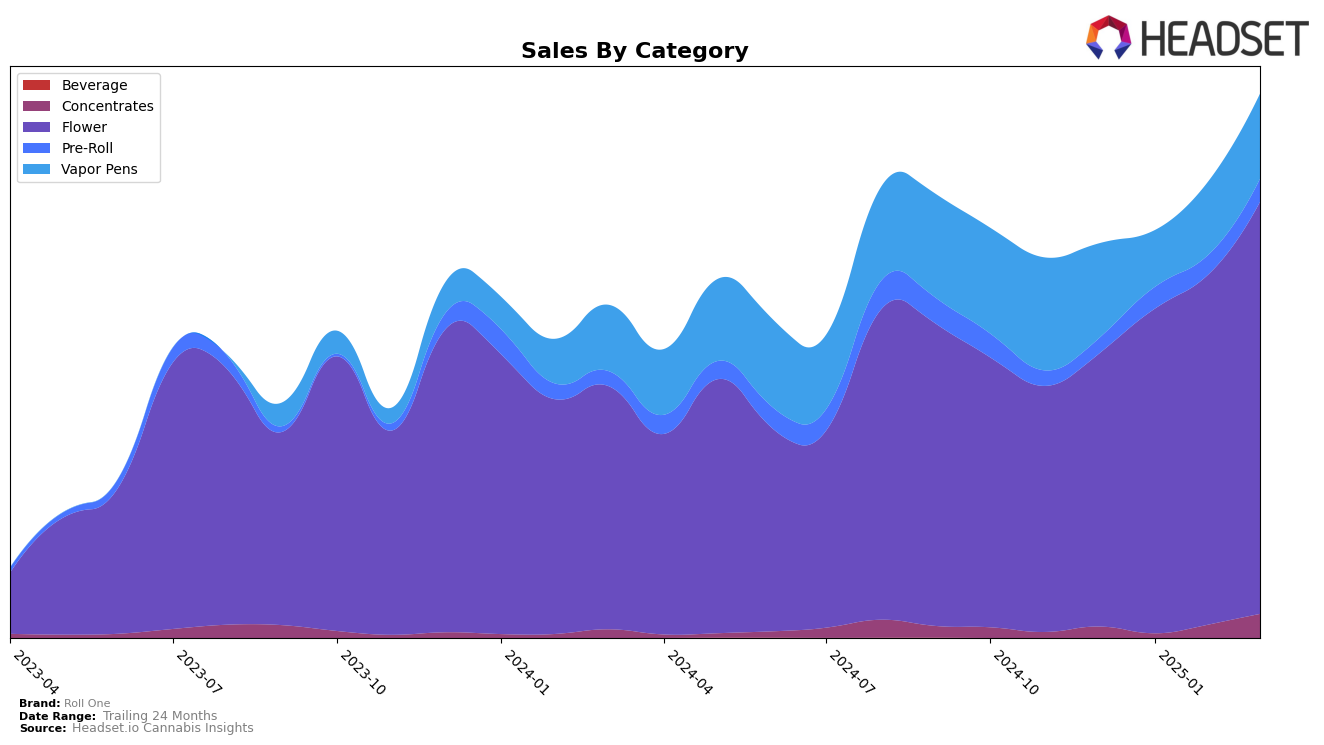

Roll One's performance across various categories and states reveals both promising trends and areas where there is potential for growth. In Arizona, the brand made a notable entry into the top 30 for Concentrates by March 2025, suggesting a positive trajectory in this category. However, their presence in the Flower category was inconsistent, as they were not ranked in the top 30 for January and February 2025, despite securing the 39th spot by March 2025. This fluctuation indicates potential volatility or a competitive market landscape in Arizona's Flower category.

In contrast, Maryland illustrates a more consistent and upward trend for Roll One. The brand has shown steady improvement in the Flower category, moving from the 15th position in December 2024 to a solid 10th place by March 2025. This consistent climb suggests strong market acceptance and growth potential in Maryland's Flower segment. Additionally, Roll One's performance in the Pre-Roll and Vapor Pens categories remained relatively stable, maintaining a presence within the top 30, which indicates a solid foothold in these segments. This stability, coupled with the upward trend in the Flower category, positions Roll One as a noteworthy player in Maryland's cannabis market.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Roll One has shown a promising upward trajectory in its rankings from December 2024 to March 2025. Starting at 15th place, Roll One improved its position to 10th by March 2025, reflecting a strategic gain in market share. This upward movement contrasts with brands like Modern Flower, which experienced a decline from 7th to 12th place over the same period, indicating potential challenges in maintaining their market position. Meanwhile, Curio Wellness and Grassroots have maintained relatively stable positions within the top 10, suggesting strong brand loyalty or effective marketing strategies. Roll One's consistent sales growth, culminating in a significant increase by March 2025, highlights its potential to continue climbing the ranks and capturing a larger share of the Maryland flower market.

Notable Products

In March 2025, Roll One's top-performing product was Lights Out (3.5g) in the Flower category, maintaining its number one rank for the third consecutive month with sales reaching 12,435 units. Chem Hound (3.5g) held steady at the second position, showing a slight increase in sales from February. Legendary GMO (3.5g) made a notable debut in the rankings at third place, suggesting growing popularity. San Fernando Valley OG (3.5g) dropped to fourth place, continuing its decline from the previous months. Pungent Smile (3.5g) rounded out the top five, slipping one spot from February's ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.