Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

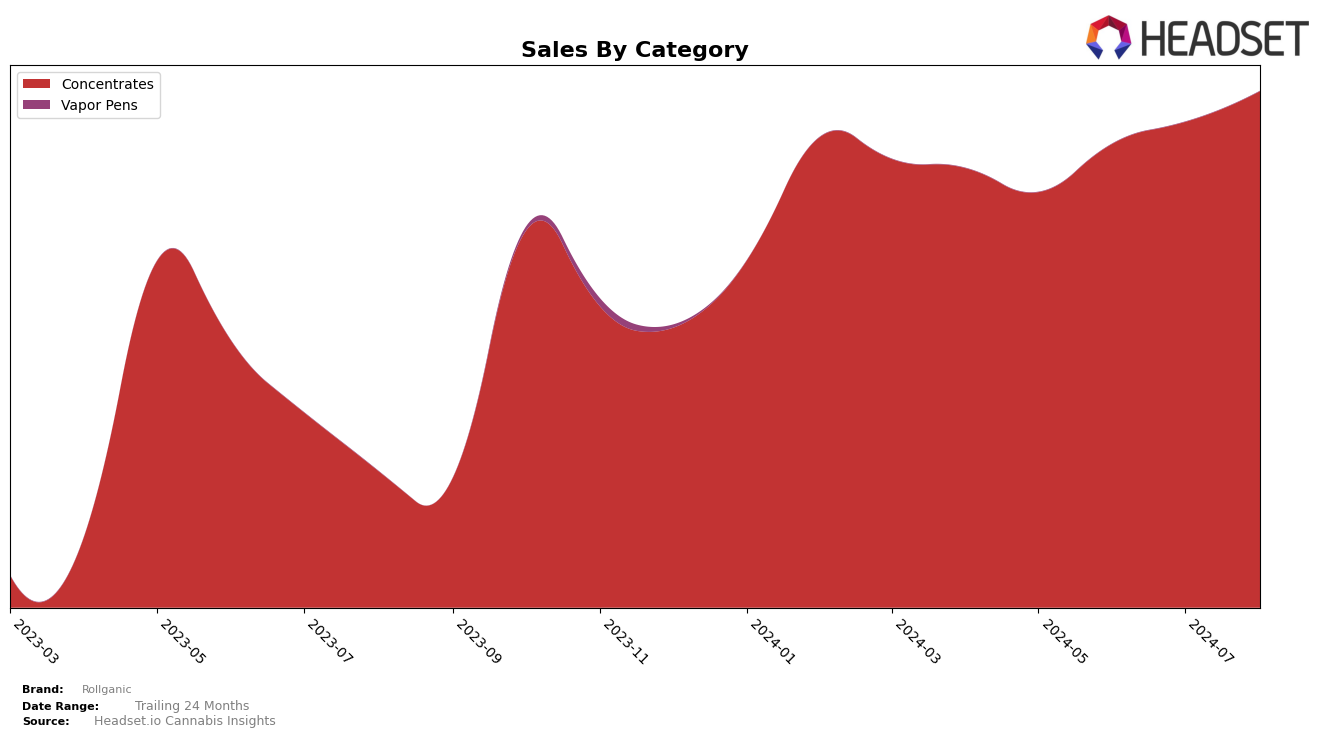

Rollganic has shown a notable upward trajectory in the Concentrates category within Michigan. Starting from a rank of 42 in May 2024, the brand has steadily climbed to position 28 by August 2024. This consistent improvement indicates a growing consumer preference and increased market penetration. The brand's rise into the top 30 by August is a positive indicator of its strengthening presence in the Michigan market, reflecting both effective marketing strategies and possibly product quality enhancements that resonate with consumers.

However, it is important to note that Rollganic's absence from the top 30 brands in the Concentrates category before August 2024 suggests that there was a period of struggle or lower visibility. The absence of rankings in the top 30 during those earlier months highlights the competitive nature of the market and the challenges Rollganic faced. Despite this, the brand's recent upward movement is promising and suggests that it is overcoming previous hurdles to establish a more solid footing in the market. This trend is worth monitoring to see if Rollganic can maintain its momentum and continue to rise in the rankings.

Competitive Landscape

In the Michigan concentrates market, Rollganic has shown a steady improvement in rank from May to August 2024, moving from 42nd to 28th place. This upward trend is indicative of growing consumer preference and effective marketing strategies. However, Rollganic faces stiff competition from brands like Monster Xtracts, which has also seen a significant rise in rank from 46th to 27th over the same period, and Dabs & Doses, which consistently outperformed Rollganic, ranking 26th in August. Notably, Dabhouse Records made a remarkable leap from 96th in May to 29th in August, suggesting a rapidly increasing market share that could pose a threat to Rollganic's growth. Meanwhile, Society C experienced a decline in rank, dropping to 30th in August, which could provide Rollganic with an opportunity to capture some of its market share. Overall, Rollganic's consistent upward trajectory in rank and sales positions it well, but continued vigilance and strategic marketing will be essential to maintain and improve its standing amidst dynamic competition.

Notable Products

For August 2024, Rollganic's top-performing product is The Spice Live Hash Rosin (1g) in the Concentrates category, maintaining its number one rank from previous months with an impressive sales figure of 4911. Snow G Live Hash Rosin (1g) debuted at the second rank. Watermelon Zkittlez Live Hash Rosin (1g) climbed to the third position, improving from its fifth rank in July. Snow G Live Resin (1g) entered the rankings at the fourth spot. Bay Burger Live Resin (1g) dropped from fourth in July to fifth in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.