Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

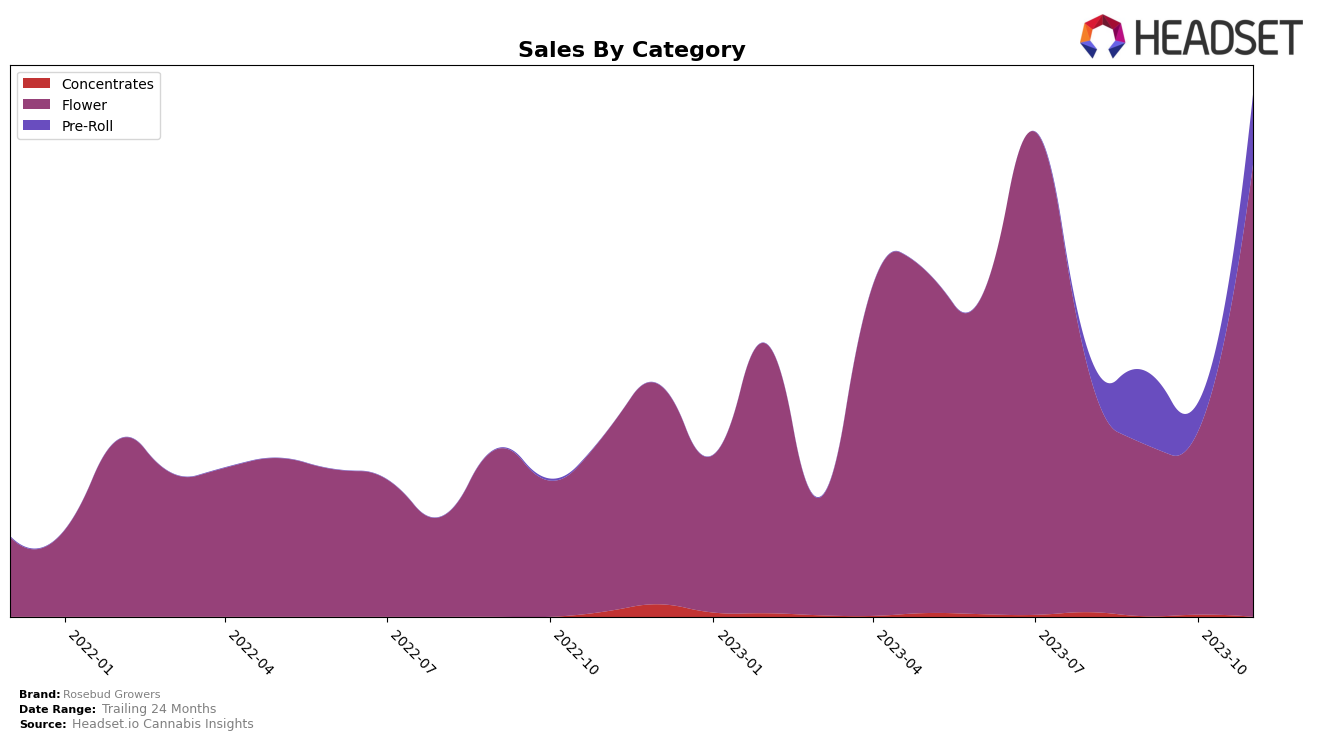

In the Flower category, Rosebud Growers has shown a commendable progression in its ranking within the Oregon market. The brand, which was not among the top 20 brands in August 2023, has steadily climbed the ranks, moving from 37th place in August to 13th place in November. This significant leap in rankings suggests an increase in popularity and customer preference for their Flower products. Interestingly, this upward trend in ranking is mirrored by a notable increase in sales, providing a positive outlook for the brand's performance in this category.

As for the Pre-Roll category, Rosebud Growers' performance in Oregon has been somewhat inconsistent. The brand started in a low position in August 2023, ranking 82nd, but made a substantial jump to the 40th position in September. However, the following months saw a decline and then a slight recovery, ending at the 43rd position in November 2023. Despite the fluctuating rankings, it's important to note that the brand has remained within the top 50, indicating a level of resilience in the competitive Pre-Roll market. The sales trend in this category also shows a similar pattern of instability, which may be a point of focus for the brand moving forward.

Competitive Landscape

In the Flower category within the Oregon state, Rosebud Growers has shown a significant improvement in its market position, moving from a rank of 37 in August 2023 to 13 in November 2023. This upward trend in rank indicates a positive growth trajectory for the brand, outperforming competitors such as Oregrown and Meraki Gardens, who have also improved their ranks but not as dramatically. However, Rosebud Growers still trails behind brands like Lucky Lion and Deep Creek Gardens, who consistently maintained their positions in the top 20 throughout the period. The missing rank for Rosebud Growers in September indicates that they were not in the top 20 brands for that month, but their impressive recovery in November shows resilience and potential for future growth.

Notable Products

In November 2023, the top-performing product from Rosebud Growers was 'Lumpy Space Princess (Bulk)', which was also the top-seller in the Flower category. With an impressive sales figure of 16,915 units, it jumped from the second position in October to first in November. The second highest-grossing product was 'Purple Payton (Bulk)', also from the Flower category, which moved up from the fourth position in October. 'Gumbo (Bulk)' made a new entry into the top three, while 'Cream Brulee (Bulk)' dropped from third to fourth place. Interestingly, 'Grimaze (Bulk)', which was the top-selling product in October, fell to the fifth position in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.