Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

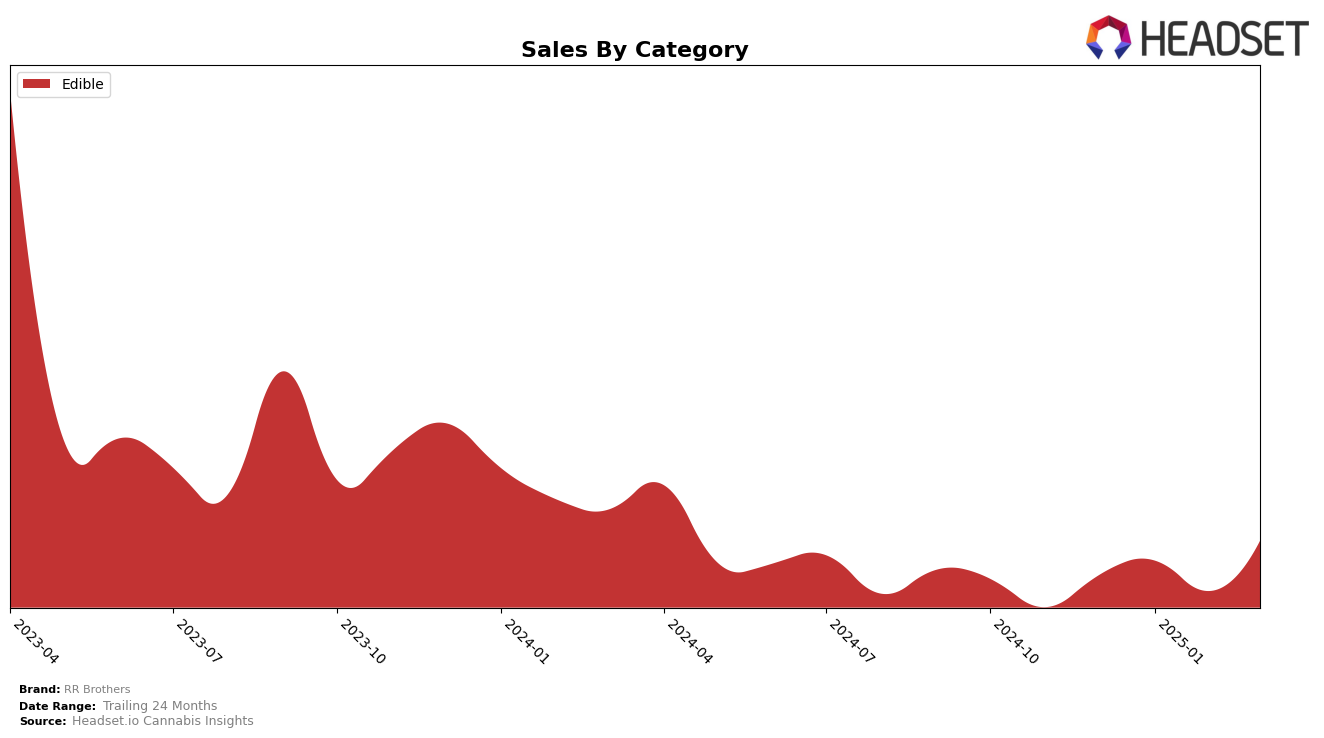

RR Brothers has shown a commendable performance in the Edible category in Arizona. Over the months from December 2024 to March 2025, the brand has maintained its presence within the top 30 rankings, fluctuating slightly but consistently improving its standing. Starting at the 25th position in December, RR Brothers moved up to 24th in January, slipped to 27th in February, and then regained the 24th position in March. This indicates a dynamic yet resilient market presence, with the brand effectively navigating the competitive landscape in Arizona's Edible sector.

Examining the sales trends, there is a noteworthy increase in March 2025, which saw the highest sales figures for RR Brothers during this period. The brand's ability to bounce back to the 24th rank in March after a dip in February is indicative of strategic adjustments that could have been implemented to boost their market performance. Notably, RR Brothers did not drop out of the top 30 rankings at any point, highlighting their sustained relevance in the market. However, a deeper dive into their strategies and category-specific performance in other states or provinces could provide further insights into their overall market strategy and adaptability.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, RR Brothers has experienced some fluctuations in its rankings over the past few months, which may have implications for its sales trajectory. While RR Brothers saw a dip in February 2025, dropping to 27th place, it managed to recover to 24th place by March 2025. This recovery is notable when compared to competitors such as Mellow Vibes (formerly Head Trip), which consistently hovered around the mid-20s in rank, and Chew & Chill (C & C), which made a significant leap from 31st to 25th place in March 2025. Meanwhile, Grow Sciences maintained a relatively stable position, slightly ahead of RR Brothers, and BITS consistently outperformed RR Brothers, holding a top 20 position until March 2025 when it fell to 22nd. These dynamics suggest that while RR Brothers is making strides to improve its market position, it faces stiff competition from brands that are either stabilizing or improving their ranks, which could impact RR Brothers' future sales growth in the Arizona edible market.

Notable Products

In March 2025, the top-performing product from RR Brothers was Hybrid Cherry Gummies (100mg) in the Edible category, maintaining its number one rank from February with sales reaching 789 units. The CBD/THC/CBN/CBG 1:1:1:1 Peach Mango Gummies (100mg CBD, 100mg THC, 100mg CBN, 100mg CBG) closely followed, rising to the second position with a notable sales figure of 730 units, up from third place in February. Indica Grape Gummies (100mg) improved its standing to third place, moving up from a consistent fourth place in previous months. Sativa Mango Gummies 10-Pack (100mg) re-entered the rankings at fourth place after being absent in January and February. Lastly, THC/CBN 2:1 Blueberry Grape Gummies (100mg THC, 50mg CBN) secured the fifth position, returning to the list after also being unranked in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.