Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

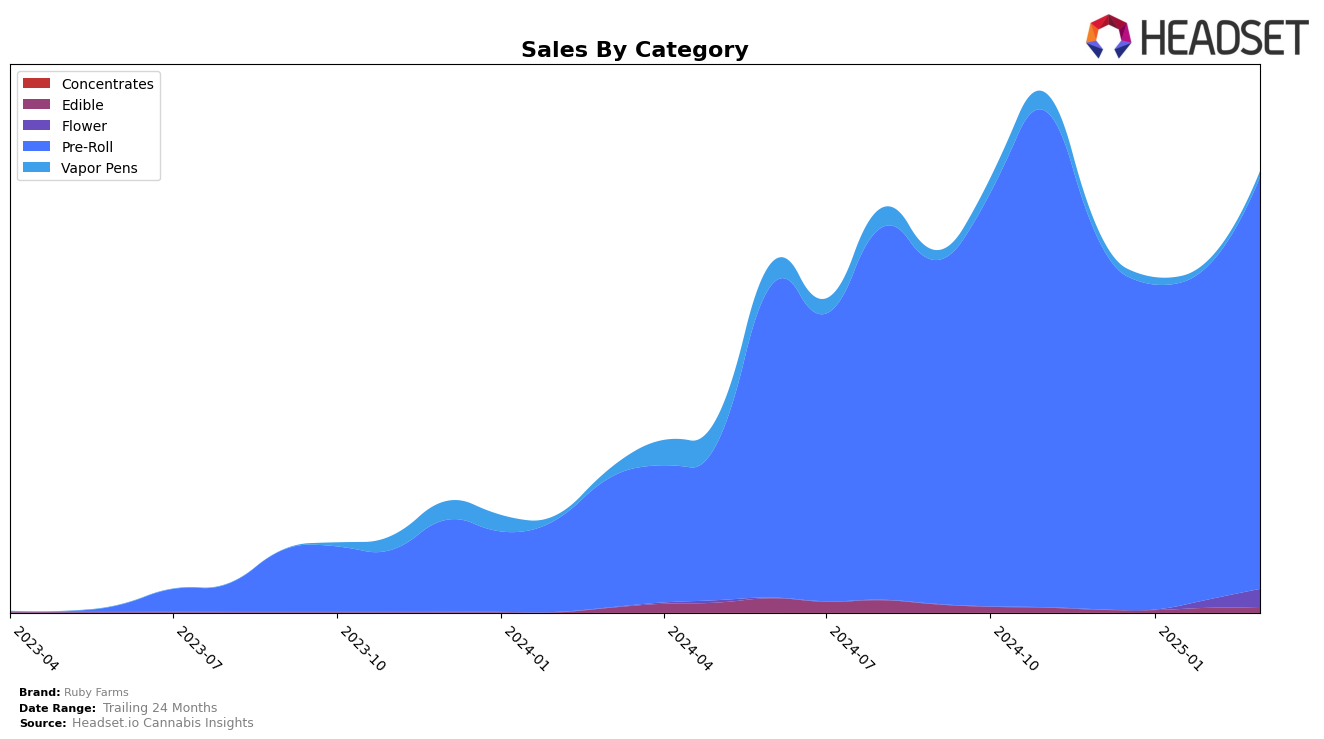

In the state of New York, Ruby Farms has demonstrated a varied performance across different cannabis categories. Notably, they have maintained a stronghold in the Pre-Roll category, consistently ranking first from December 2024 through March 2025. This indicates a robust consumer preference and brand loyalty in this category. In contrast, their presence in the Flower category saw a significant improvement, moving from outside the top 30 in December 2024 to ranking 58th by March 2025. This upward trend could suggest a growing market acceptance and an effective strategy in expanding their Flower offerings.

Ruby Farms' performance in the Vapor Pens category in New York was less prominent, with a rank of 55 in December 2024 and no subsequent top 30 rankings in the following months. This absence from the top 30 could be seen as a challenge for the brand, indicating potential areas for growth or reevaluation of their product strategy in this segment. The steady increase in sales for their Pre-Roll products, however, highlights a strong market position and suggests that focusing on this category might continue to yield positive results for Ruby Farms.

Competitive Landscape

In the competitive landscape of the New York pre-roll category, Ruby Farms has consistently maintained its position as the leading brand from December 2024 through March 2025, holding the number one rank each month. This stability in rank is a testament to its strong market presence and consumer preference. In contrast, Dank. By Definition has consistently held the second position, yet its sales figures are notably lower than Ruby Farms, indicating a significant gap in market share. Similarly, Florist Farms remains in third place, with sales figures that are less than half of Ruby Farms' sales, further highlighting Ruby Farms' dominance in this category. The consistent ranking and sales performance of Ruby Farms suggest a robust brand loyalty and effective market strategies, setting a high bar for competitors in the New York pre-roll market.

Notable Products

In March 2025, Ruby Farms' top-performing product was the Classics - White Widow Pre-Roll 7-Pack (3.5g) in the Pre-Roll category, maintaining its first-place ranking consistently from December 2024 through March 2025, with sales reaching 7344 units. The Doobies - Sour Diesel Pre-Roll 7-Pack (3.5g) held the second position, showing a steady rise from fourth place in January 2025. Doobies - Blue Dream Pre-Roll 7-Pack (3.5g) improved its ranking to third place, up from fifth in February 2025, indicating a resurgence in popularity. The Doobies - Sour Tangie Pre-Roll 7-Pack (3.5g) held its fourth position from February to March, showing stable performance. Meanwhile, Granddaddy Purple Pre-Roll 7-Pack (3.5g) slipped from third place in February to fifth in March, reflecting a decline in sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.