Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

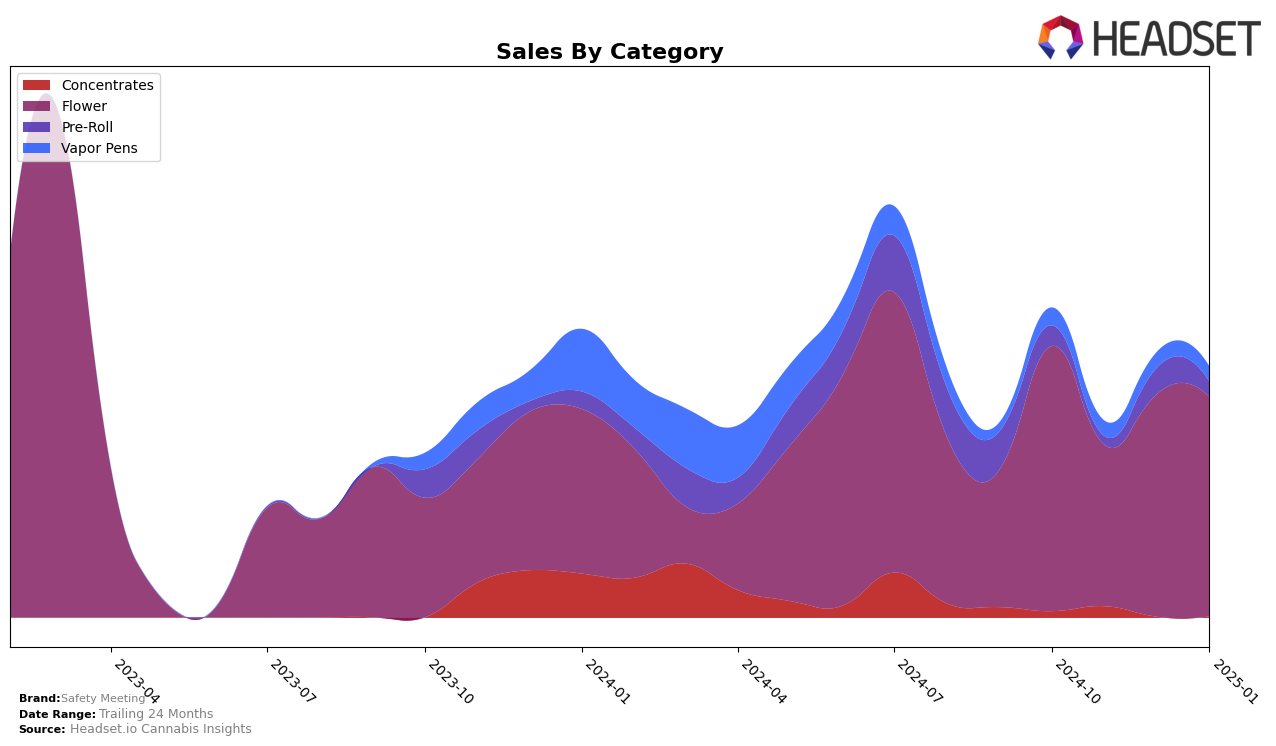

Safety Meeting has shown varied performance across different categories and states. In the state of Illinois, the brand's presence in the Concentrates category was not strong enough to secure a spot in the top 30 rankings from October 2024 to January 2025, indicating a potential area for growth. However, Safety Meeting has maintained a consistent position in the Pre-Roll category, ranking 48th in both December 2024 and January 2025, after not being in the top 30 in November 2024. This consistency suggests a stable demand for their Pre-Roll products in Illinois. Meanwhile, in the Vapor Pens category, the brand experienced slight fluctuations, moving from 67th in October 2024 to 69th in January 2025, hinting at a relatively stable yet competitive market position.

In Nevada, Safety Meeting has demonstrated a strong presence in the Flower category. The brand ranked 24th in October 2024, dropped to 38th in November, but quickly rebounded to 30th in December and further improved to 25th in January 2025. This upward trend in the Flower category suggests a positive reception and growing market share in Nevada. The sales figures for the Flower category also reflect this trend, with sales increasing from $146,548 in November to $202,747 in January, showcasing a significant recovery and growth. This performance highlights Safety Meeting's strength and potential in the Flower category within the Nevada market.

Competitive Landscape

In the competitive landscape of the flower category in Nevada, Safety Meeting has experienced notable fluctuations in its rank over the past few months, reflecting a dynamic market environment. In October 2024, Safety Meeting was ranked 24th, but it dropped to 38th in November, before climbing back to 30th in December and 25th in January 2025. This indicates a resilient recovery in rank despite the competitive pressures. Comparatively, Summa Cannabis maintained a stronger position, ranking consistently higher than Safety Meeting until January 2025, when it fell out of the top 20. Meanwhile, Super Good showed a significant rise in December, reaching the 14th position, which suggests a potential threat to Safety Meeting's market share. On the other hand, Mojave and Bohemian Bros have been less consistent, with ranks fluctuating significantly, indicating potential volatility in their market strategies. Overall, Safety Meeting's ability to rebound in rank suggests a competitive resilience, but the brand must strategize to maintain and improve its position against competitors like Super Good, which have shown the capability to outperform in sales and rank.

Notable Products

In January 2025, Safety Meeting's top-performing product was Chem D (3.5g) in the Flower category, which rose to the number one spot with sales of $507. THC Bomb (14g) maintained its position at number two in the Flower category, despite a decrease in sales from the previous month. Wedding Cake (14g), also in the Flower category, debuted at the third position, highlighting its growing popularity. Bio-Jesus (14g) experienced a decline, dropping to fourth place from its previous second position in October 2024. The White Wedding RBX #2 Pre-Roll 5-Pack (2.5g) fell to fifth place, having been the top-ranked pre-roll in November 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.