Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

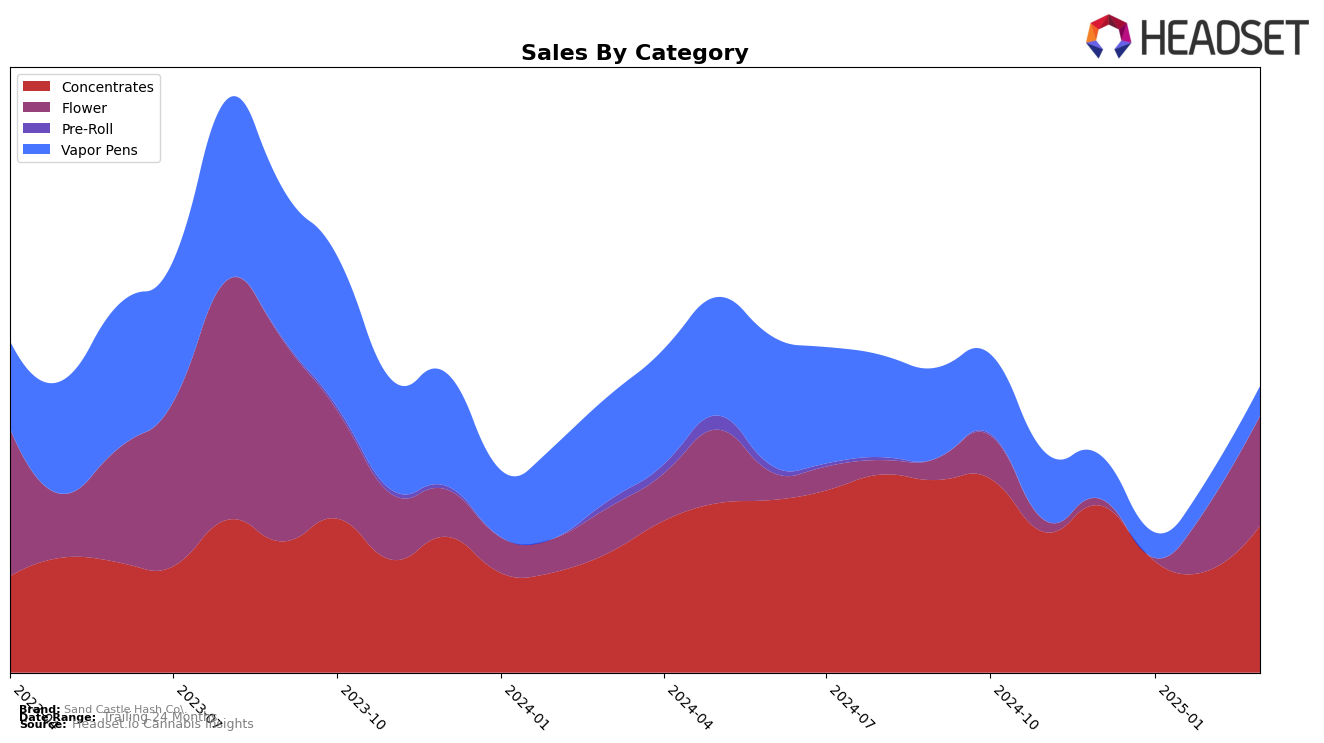

Sand Castle Hash Co. experienced notable fluctuations in its performance across different product categories and states. In the Oregon market, the brand's presence in the Concentrates category has been relatively stable, with a slight improvement in ranking from 29th in December 2024 to 28th by March 2025. This movement indicates a positive trend for the brand, as it managed to climb back into the top 30 after slipping out of it temporarily in January and February 2025. The sales figures also reflect this recovery, showing a rebound in March 2025 after a dip in the earlier months. Such performance suggests that Sand Castle Hash Co. is managing to maintain its foothold in the competitive landscape of Oregon's Concentrates market.

However, the brand faces challenges in the Vapor Pens category within Oregon. Here, Sand Castle Hash Co. has not managed to secure a position within the top 30 brands from December 2024 through March 2025. This absence from the top ranks highlights a significant area for improvement, as the brand's sales in this category have seen only modest growth. Despite a slight increase in sales from January to March 2025, the brand's overall ranking remains outside the competitive echelon, indicating potential areas for strategic focus to enhance market presence and brand visibility in the Vapor Pens segment.

Competitive Landscape

In the Oregon concentrates market, Sand Castle Hash Co. has experienced a fluctuating rank over the past few months, with a notable improvement from 33rd in February 2025 to 28th in March 2025. This upward movement suggests a positive trend in sales performance, contrasting with competitors like Concrete Jungle, which fell from 16th to 26th during the same period, indicating a significant decline in sales. Meanwhile, Kaprikorn has shown a steady presence, maintaining a position near the top 30, which could pose a competitive challenge if their upward trend continues. Additionally, Afterglow and Calyx Crafts have shown improvements, moving from outside the top 30 into the 29th and 30th positions, respectively, in March 2025. These shifts highlight a dynamic market where Sand Castle Hash Co. must continue to innovate and capture consumer interest to maintain and improve its standing.

Notable Products

In March 2025, Sand Castle Hash Co.'s top-performing product was Jealousy Temple Ball Hash (1g) in the Concentrates category, maintaining its number one rank from February with impressive sales of 1157 units. Modified Grape (Bulk) from the Flower category made a strong entry, securing the second position with a notable rise in sales. Rainbow Sherbet Temple Ball Hash (1g) dropped to third place from its previous second-place ranking in February, although it still showed a significant sales increase to 796 units. Super Boof (Bulk) entered the rankings at fourth place in the Flower category, demonstrating a promising performance. Headband Haze Temple Ball Hash (1g) appeared for the first time in the top five, rounding out the list at fifth place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.