Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

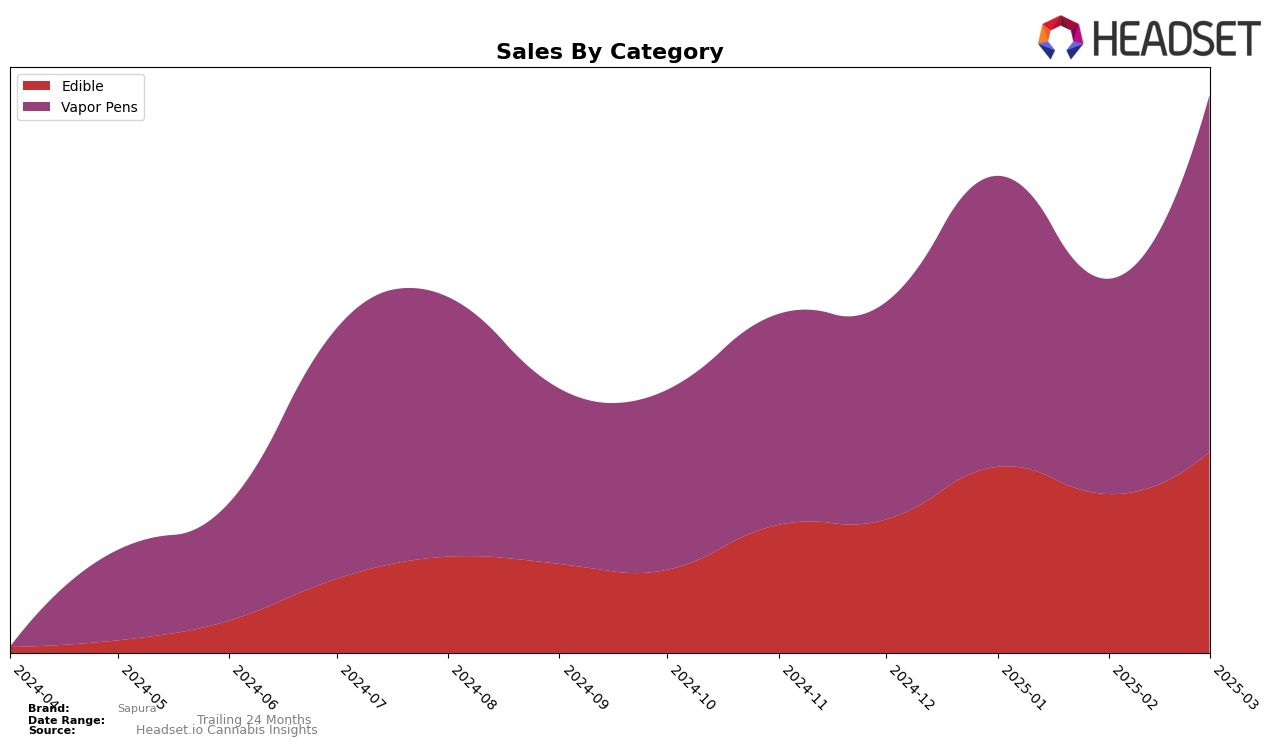

In the state of Massachusetts, Sapura has shown notable performance in the Edible category, maintaining a consistent presence within the top 30 brands. Starting in December 2024 at rank 30, Sapura improved its position to 23 by March 2025. This upward trend suggests a growing consumer preference for their products, which is further supported by a steady increase in sales figures over these months. The ability to sustain their rank in a competitive market like Massachusetts indicates a strong market presence and potentially effective marketing strategies.

However, in the Vapor Pens category, Sapura's journey has been more dynamic. Initially outside the top 30 in December 2024, they climbed to rank 27 by March 2025. This indicates a significant recovery and potential growth in consumer interest or product availability. Despite not being in the top 30 at the beginning of the observed period, the brand's ability to make such strides highlights a promising trajectory. This kind of movement can hint at strategic adjustments or new product introductions that resonate well with consumers in Massachusetts. For those interested in the detailed trends and data, further exploration into Sapura's market strategies and product offerings could provide deeper insights.

Competitive Landscape

In the Massachusetts vapor pens category, Sapura has demonstrated a dynamic shift in its competitive standing from December 2024 to March 2025. Initially ranked at 41st, Sapura made a significant leap to 33rd in January 2025, although it briefly dropped to 39th in February before climbing to 27th in March. This upward trend in rank is mirrored by a substantial increase in sales, particularly notable in March 2025. In comparison, Nectar also showed a positive trajectory, moving from 33rd to 25th over the same period, indicating a competitive push within the market. Meanwhile, Galactic maintained a relatively stable position, although it experienced a slight decline from 22nd to 26th. Brands like DRiP (MA) and Treeworks remained outside the top 20, suggesting that while they are competitors, they have not posed a significant threat to Sapura's recent gains. This competitive landscape highlights Sapura's potential for continued growth and its strategic positioning to capitalize on market opportunities in Massachusetts.

Notable Products

In March 2025, the top-performing product for Sapura was Wild Watermelon Gummies 20-Pack (100mg), which secured the number one rank with sales of 2193 units. Poppin Pineapple RSO Gummies 20-Pack (100mg) followed closely in second place, showing a significant rise from its previous rank of third in December 2024. Tropical Paradise Punch Gummies 20-Pack (100mg) debuted in the rankings at third place, indicating strong market entry. Outrageous Orange Gummies 20-Pack (100mg) dropped to fourth position after holding the top rank in January and February 2025. Strawberry Banana Dreamin' Gummies 20-Pack (100mg) remained stable at fifth place, consistent with its position in February 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.