Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

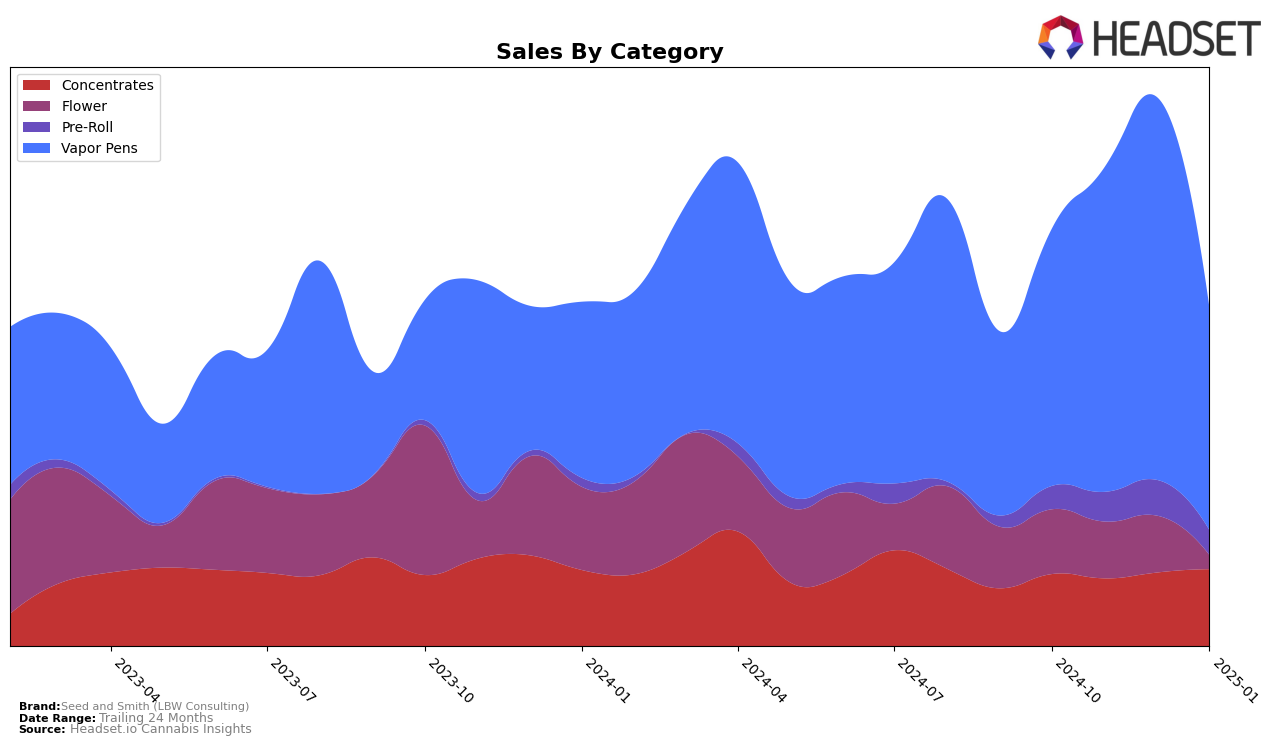

Seed and Smith (LBW Consulting) has shown varied performance across different categories in Colorado. In the Concentrates category, the brand has consistently maintained a strong presence, improving its ranking from 20th in October 2024 to 17th by January 2025. This upward movement is indicative of a steady growth trend, supported by an increase in sales from $111,542 in October to $119,107 in January. Conversely, in the Flower category, Seed and Smith experienced a significant drop, falling out of the top 50 by January 2025, which might raise concerns regarding their competitive positioning in this segment.

The Pre-Roll category presents a mixed picture for Seed and Smith in Colorado. Initially, the brand improved its ranking from 53rd in October to 36th in December 2024, but then slightly declined to 40th in January 2025. Despite this fluctuation, the sales figures suggest a positive trend overall. In contrast, the Vapor Pens category saw Seed and Smith achieve impressive gains, reaching as high as 11th place in December, before slipping to 20th in January. This suggests that while the brand has made significant strides, maintaining its position requires strategic efforts to sustain momentum.

Competitive Landscape

In the competitive landscape of vapor pens in Colorado, Seed and Smith (LBW Consulting) has shown a dynamic shift in rankings over recent months, reflecting both opportunities and challenges in the market. Notably, Seed and Smith climbed from a rank of 22 in October 2024 to an impressive 11 by December 2024, before dropping to 20 in January 2025. This fluctuation suggests a volatile market presence, possibly influenced by seasonal demand or competitive pressures. In contrast, Olio and The Colorado Cannabis Co. maintained relatively stable positions, with Olio peaking at rank 11 in November 2024 and The Colorado Cannabis Co. reaching rank 12 in the same month. These competitors consistently outperformed Seed and Smith in sales, indicating a potential gap in market penetration or brand loyalty. Meanwhile, Juicy and Haze (CO) struggled to maintain top-tier rankings, often falling below the top 20, which could present an opportunity for Seed and Smith to capture additional market share if they can stabilize their ranking trajectory.

Notable Products

In January 2025, the top-performing product for Seed and Smith (LBW Consulting) was the OG Banana Live Resin Cartridge (1g) in the Vapor Pens category, which climbed to the number one rank with sales of $758. The Gasonade Live Resin Cartridge (1g) followed closely in second place, showing a notable rise from its previous fourth position in November 2024. Citrus Bliss Live Resin Cartridge (1g) secured the third spot, improving from its fifth-place ranking in December 2024. Dance Star Terp Live Resin Cartridge (1g) debuted at fourth place, while Cake Crashers Live Resin (1g) entered the ranks at fifth. This month saw a reshuffling of rankings, with several products making significant advances compared to prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.