Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

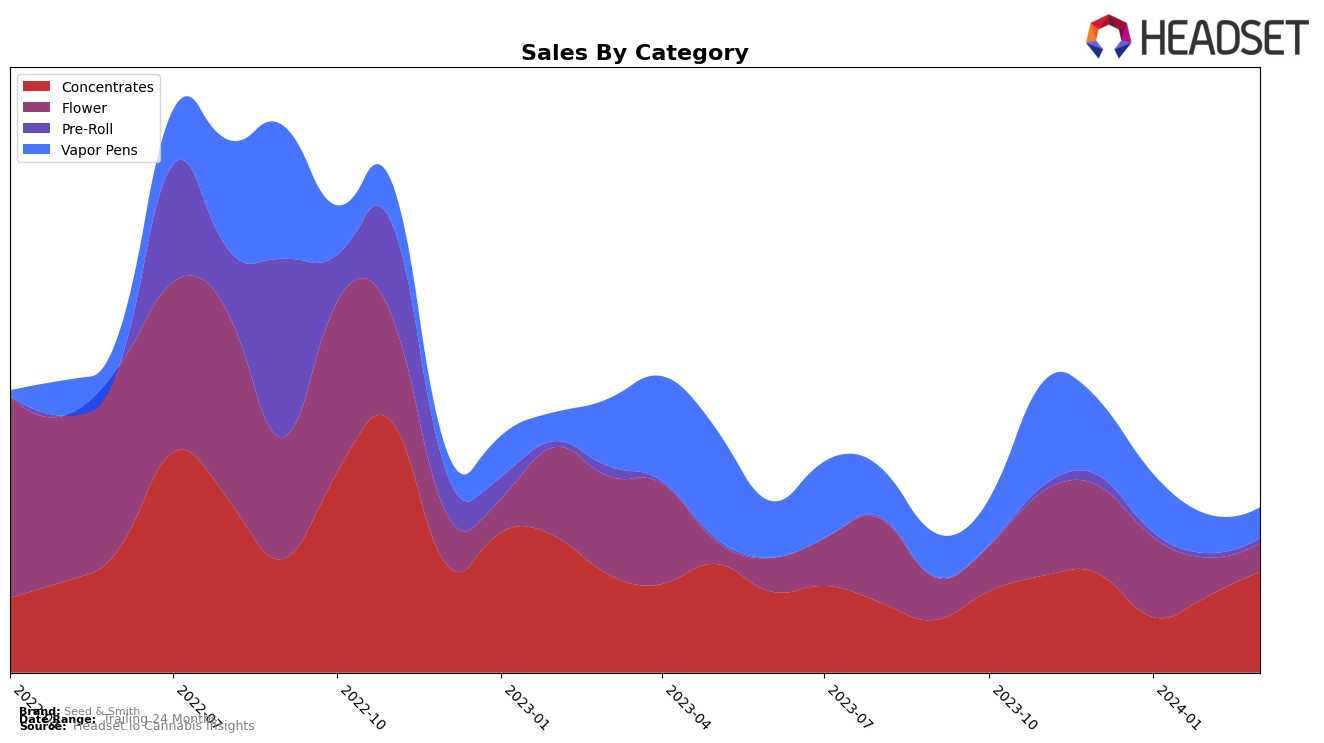

In the competitive cannabis market of Colorado, Seed & Smith has shown varied performance across different product categories. Notably, in the Concentrates category, the brand has demonstrated a promising upward trajectory, moving from a rank of 31 in December 2023 to 29 by March 2024, despite a dip in January. This recovery is highlighted by an increase in sales from $71,192 in December 2023 to $73,042 in March 2024, indicating a regained favor among consumers. However, the brand's performance in the Flower and Pre-Roll categories tells a different story. For Flower, Seed & Smith ranked outside the top 30 brands from December 2023 through March 2024, with a significant drop in sales from $63,527 to $20,732 in the same period. Similarly, in the Pre-Roll category, the brand consistently ranked below the top 30, indicating a need for strategic adjustments to improve its market standing in these segments.

While Seed & Smith has faced challenges in certain categories, its performance in the Vapor Pens category also deserves attention. Despite a slight downward trend in rankings from 61 in December 2023 to 71 in March 2024, the consistent presence in the rankings indicates a steady demand for their Vapor Pens. This is important as it suggests that while Seed & Smith may be struggling in the highly competitive Flower and Pre-Roll markets, there is a loyal customer base for their Vapor Pens in Colorado. The decrease in sales from $55,152 in December 2023 to $22,405 in March 2024, however, suggests that while the brand has maintained its rank, it may be losing market share or facing increased competition. Overall, Seed & Smith's performance across categories in Colorado shows a mixed but insightful picture of the brand's current market dynamics and potential areas for growth and improvement.

Competitive Landscape

In the competitive landscape of the concentrates category in Colorado, Seed & Smith has shown a notable fluctuation in its market position, initially not ranking within the top 20 brands in December 2023, then dropping further in January 2024, before making a significant recovery in February and March 2024. This recovery is particularly impressive when considering the performance of its competitors. For instance, Binske experienced a steady decline in rank and sales over the same period, indicating Seed & Smith's relative market strength despite its earlier setbacks. Conversely, Rare Dankness made a remarkable leap in February, surpassing Seed & Smith in rank and sales by March. Meanwhile, Newt Brothers Artisanal maintained a more stable position but still saw a slight decline, indicating a competitive but volatile market. Edun, similar to Seed & Smith, showed recovery in March but remained lower in sales and rank, highlighting Seed & Smith's potential for growth and market resilience amidst fluctuating trends.

Notable Products

In March 2024, Seed & Smith's top-selling product was the Original Green Bud Sugar Wax (1g) from the Concentrates category, securing the first rank with notable sales of 817 units. Following closely, the Orange Cookies Chem Sugar Wax (1g) and Pinot Nova Sugar Wax (1g) claimed the second and third spots, respectively, showcasing the popularity of concentrates within their product lineup. The Space Force (3.5g) from the Flower category, which was the top seller in January, dropped to the fourth position in March, indicating a shift in consumer preference towards concentrates. Lastly, the MAC1 Live Resin (1g) rounded out the top five, further emphasizing the growing trend towards high-quality concentrate products. This shift in rankings from previous months highlights a dynamic market and changing consumer tastes within the cannabis industry.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.