Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

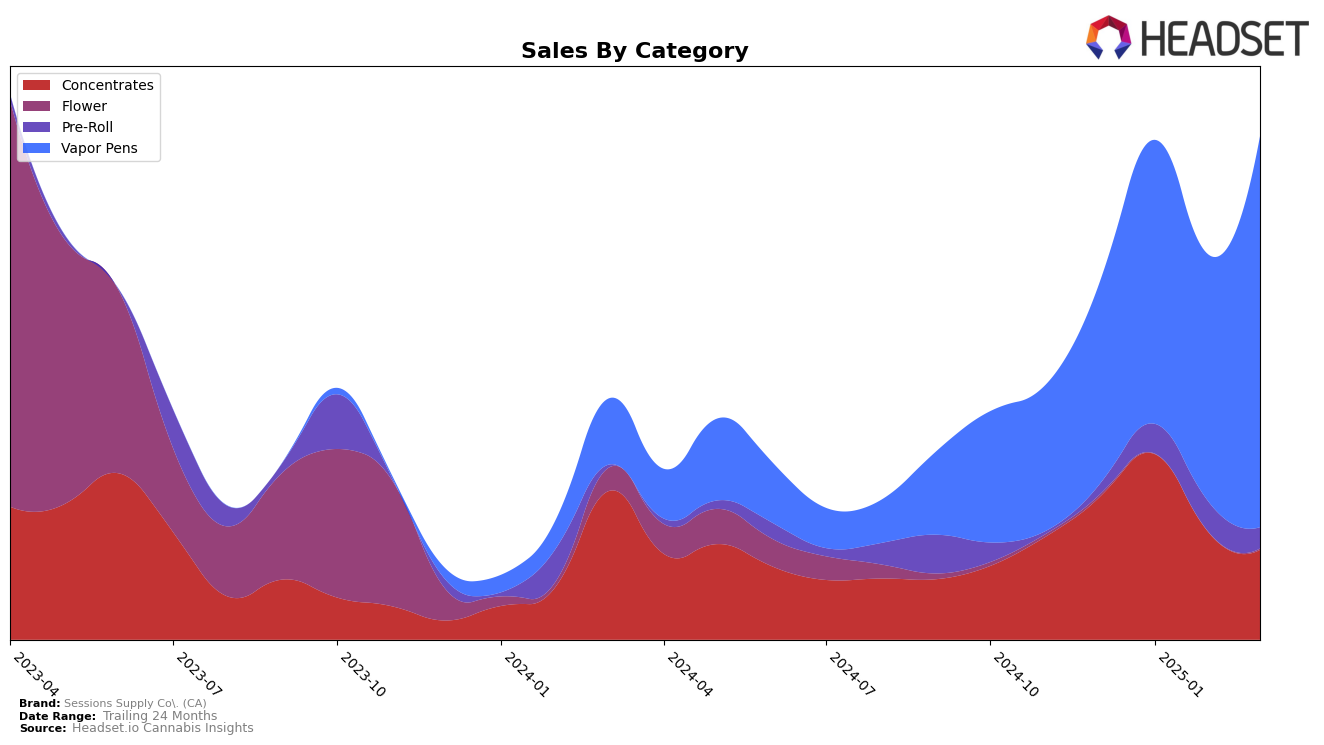

Sessions Supply Co. (CA) has shown varied performance across different categories and regions, reflecting both opportunities and challenges. In Arizona, the brand's presence in the Vapor Pens category has seen a slight improvement, moving from 70th to 68th place between December 2024 and January 2025. However, the absence of rankings in February and March 2025 indicates that Sessions Supply Co. did not maintain a top 30 position, which could be a cause for concern regarding their market penetration in Arizona's competitive landscape. This trend suggests a need for strategic adjustments to regain visibility and market share in the upcoming months.

In Oregon, Sessions Supply Co. has experienced fluctuations in the Concentrates category, with a notable drop from 19th place in January 2025 to 32nd by March 2025. This decline may point to increasing competition or shifting consumer preferences. Conversely, the brand has demonstrated a positive trajectory in the Vapor Pens category in Oregon, climbing from 41st in December 2024 to 29th by March 2025, with a significant increase in sales during this period. This upward movement suggests that the brand's offerings in Vapor Pens are resonating well with consumers, potentially setting the stage for further growth if they can capitalize on this momentum.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Sessions Supply Co. (CA) has shown a notable upward trend in rankings from December 2024 to March 2025. Starting at rank 41 in December, Sessions Supply Co. (CA) improved to rank 29 by March, indicating a significant rise in market presence. This upward movement is particularly impressive when compared to competitors like Orchid Essentials and Altered Alchemy, which have experienced fluctuating ranks within the 28-32 range during the same period. Despite Punch Bowl maintaining a stronger position in the early months, their decline to rank 27 in March suggests potential vulnerabilities that Sessions Supply Co. (CA) could capitalize on. Additionally, Loot Bar has shown inconsistency, hovering around the 24-29 rank range. Sessions Supply Co. (CA)'s consistent sales growth from $93,685 in December to $202,878 in March underscores its strengthening foothold in the Oregon vapor pen market, setting the stage for further competitive advancements.

Notable Products

In March 2025, the top-performing product for Sessions Supply Co. (CA) was Strawberry Gary Cured Resin (1g) in the Concentrates category, achieving the number one rank with sales of 2071 units. Following closely was the Ice Cream Paint Job Cured Resin Disposable (1g) from the Vapor Pens category, which climbed to the second position from fifth in January 2025, with a notable increase in sales to 1460 units. Pineapple Parfait Cured Resin Cartridge (1g) also performed well, maintaining a strong presence by ranking third, despite a slight drop from its second position in February. Tropical Fruit Cured Resin (1g) in the Concentrates category secured the fourth rank, indicating a solid entry into the top ranks. Gushers Cured Resin Cartridge (1g) rounded out the top five, experiencing a decline from fourth in February, suggesting a competitive market for Vapor Pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.