Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

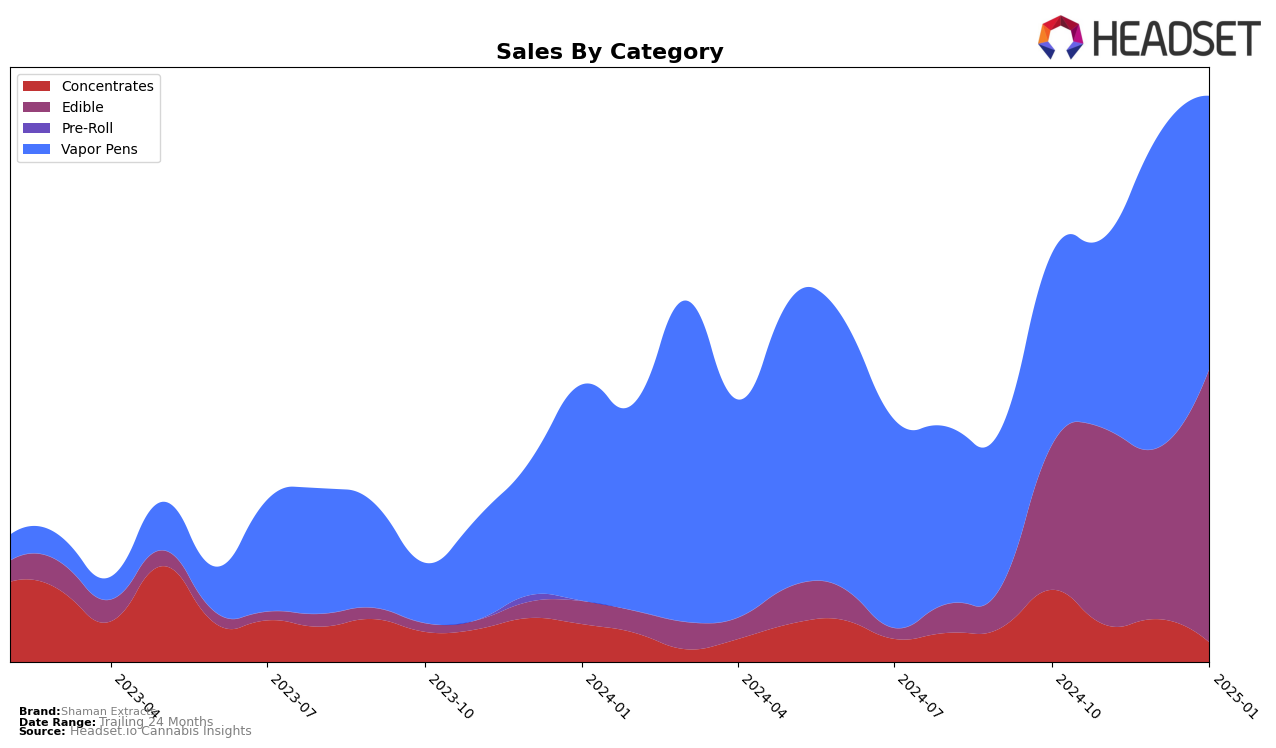

Shaman Extracts has demonstrated varied performance across different categories in the state of California. In the concentrates category, the brand has faced challenges, as evidenced by its ranking slipping from 48th in October 2024 to 99th by January 2025, indicating a declining trend in market presence. This downward movement could suggest increasing competition or a shift in consumer preferences within this category. Conversely, their performance in the edible category shows a positive trajectory, with an improvement in rank from 29th to 20th over the same period, which might reflect successful product offerings or marketing strategies that resonate well with consumers.

In the vapor pens category, Shaman Extracts has maintained a relatively stable position, with a slight improvement from 66th in October 2024 to 50th in January 2025. This stability suggests a consistent demand for their vapor pen products, although there is still room for growth to break into the top tier of brands. The fact that Shaman Extracts did not make it into the top 30 in the concentrates category during this period highlights a potential area for strategic focus. Overall, the brand's performance across these categories in California reveals both opportunities for growth and areas needing attention.

Competitive Landscape

In the competitive landscape of the California edible market, Shaman Extracts has shown a notable upward trajectory in its rankings over the past few months. Starting from a rank of 29 in October 2024, Shaman Extracts climbed to the 20th position by January 2025, demonstrating a significant improvement in market presence. This upward movement is particularly impressive when compared to competitors like Punch Extracts / Punch Edibles, which remained relatively stable, fluctuating slightly but ending at rank 21. Meanwhile, Zen Cannabis maintained a consistent position around rank 22, and Happy Fruit and Petra held stronger positions, consistently ranking in the top 20. Despite Shaman Extracts' lower starting point, its sales growth trajectory has been robust, culminating in a significant sales boost in January 2025, which likely contributed to its improved rank. This trend suggests that Shaman Extracts is effectively capturing market share and could continue to rise if these dynamics persist.

Notable Products

In January 2025, the top-performing product from Shaman Extracts was Passion Fruit Guava Live Resin Gummies (100mg), which rose to the number one rank with notable sales of 5897 units. The Hybrid Chili Mango Live Resin Gummies 10-Pack (100mg) followed closely, maintaining a strong position at rank two, despite being ranked first in December 2024. Sour Green Apple Gummies 10-Pack (100mg) made a significant appearance, securing the third position in January after not being ranked in previous months. Juicy Pineapple Live Resin Gummies 10-Pack (100mg) saw a decline, dropping from first in October and November 2024 to fourth in January 2025. Meanwhile, THC/CBN 2:1 Lemon Cherry Live Resin Gummies 10-Pack (100mg THC, 50mg CBN) rounded out the top five, showing a consistent presence in the rankings over the months.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.