Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

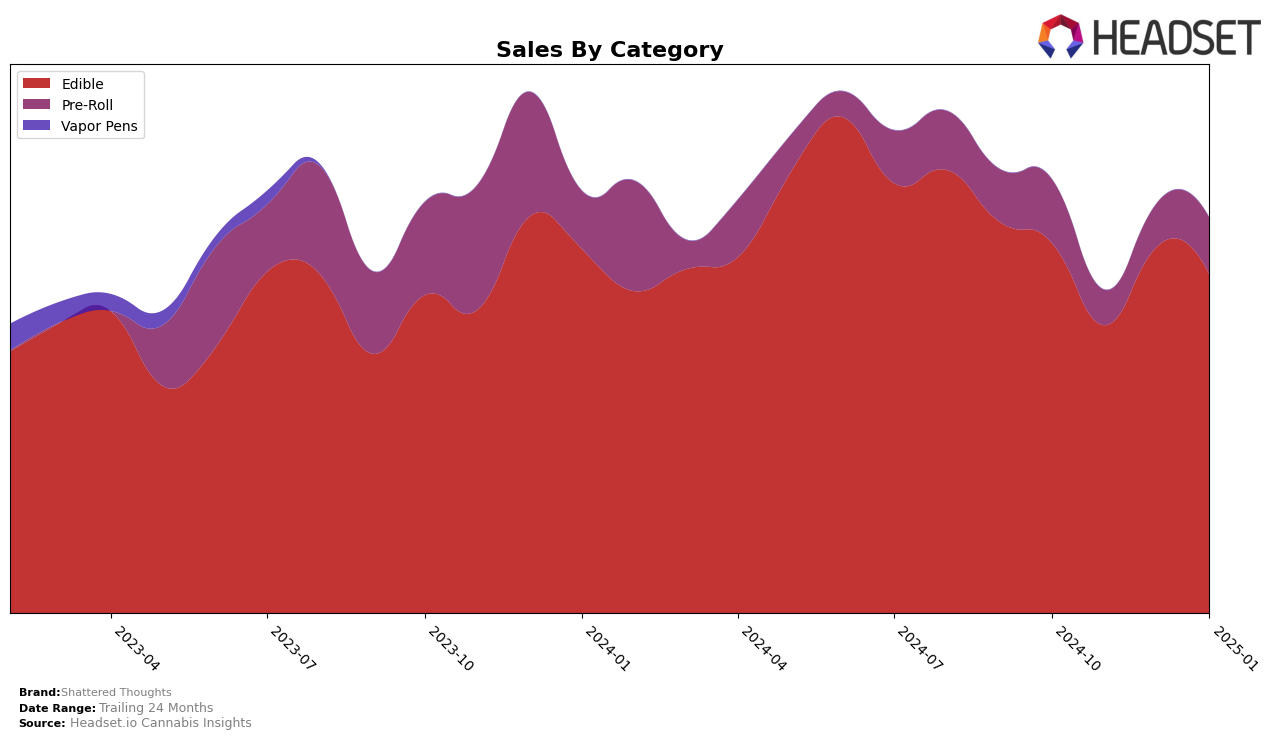

Shattered Thoughts has shown a dynamic performance across various categories and states, with notable movements in rankings. In the Edible category within Michigan, the brand has experienced some fluctuations over the last few months. Starting from a rank of 23 in October 2024, Shattered Thoughts dropped to 29 in November but managed to climb back to 25 in December and further improve to 23 in January 2025. This indicates a resilience and potential recovery in consumer interest or market strategy. The sales figures support this trend, with a dip in November but a noticeable rebound in December, maintaining a relatively stable position into January.

However, the performance in the Pre-Roll category in Michigan paints a different picture. Shattered Thoughts did not secure a position in the top 30 brands for this category over the observed months, only appearing with a rank of 99 in January 2025. This absence from the top rankings could suggest challenges in market penetration or competition within this category. It highlights an area where the brand might need to strategize differently to capture more market share or improve visibility. The contrasting performances across these categories underscore the varied success Shattered Thoughts experiences in different segments of the cannabis market.

Competitive Landscape

In the competitive landscape of Michigan's edible cannabis market, Shattered Thoughts experienced fluctuating rankings from October 2024 to January 2025, indicating a dynamic competitive environment. Despite a dip in November 2024, where it fell to 29th place, Shattered Thoughts rebounded to 23rd by January 2025, suggesting resilience and potential strategic adjustments. Comparatively, Mischief showed a similar pattern, dropping to 27th in November but recovering to 22nd by January, slightly outperforming Shattered Thoughts. Meanwhile, Magic Edibles maintained a stronger position, though it slipped from 14th to 21st over the same period, indicating a downward trend. Mitten Extracts consistently ranked close to Shattered Thoughts, with a slight edge in November and December. These insights suggest that while Shattered Thoughts faces stiff competition, there is room for growth and improvement, particularly by analyzing the strategies of brands like Mischief and Magic Edibles.

Notable Products

In January 2025, the top-performing product from Shattered Thoughts was Cranberry Vegan Friendly Gummies 10-Pack (200mg), which rose to the number one rank with sales of 10,951 units. Ruby Limeapple Gummies 10-Pack (200mg) maintained its second position with 9,341 units sold, showing a consistent performance from December 2024. Peaches And Cream Gummies 10-Pack (200mg) dropped to third place, despite a strong showing in December when it was ranked first. Cherry Berry Gummies 10-Pack (200mg) experienced a decline from its top position in October and November 2024 to fourth place in January 2025. Dragonfruit Gummies 10-Pack (200mg) held steady at fifth place, mirroring its November 2024 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.