Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

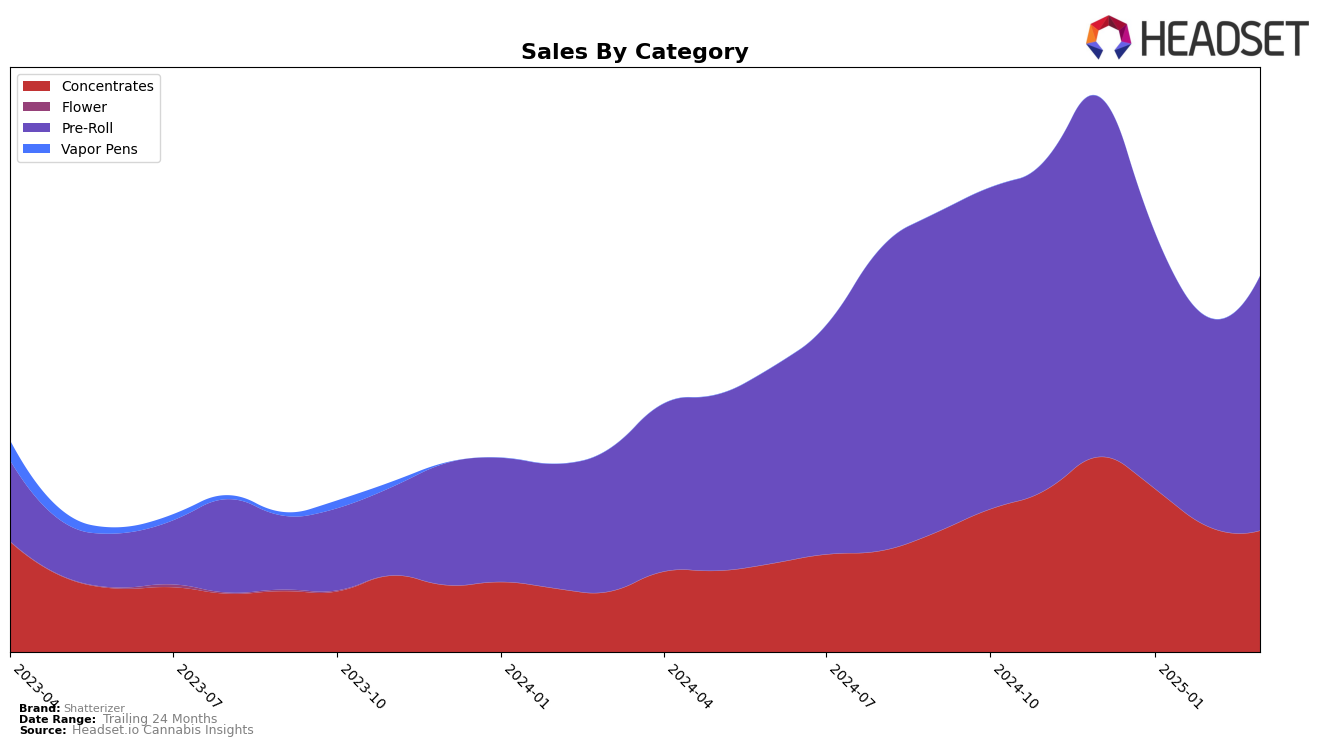

Shatterizer's performance across different categories and regions presents a mixed bag of outcomes. In Alberta, the brand's absence from the top 30 in the Pre-Roll category for the first quarter of 2025 suggests a challenging market presence, as they ranked 95th in December 2024. This indicates a need for strategic adjustments to climb the ranks. Conversely, in Ontario, Shatterizer maintained a strong foothold in the Concentrates category, consistently ranking 6th from December 2024 through February 2025, before slightly dipping to 7th in March 2025. This stability reflects a robust market engagement, although the slight drop in March warrants attention to ensure continued competitiveness.

In the Ontario Pre-Roll category, Shatterizer's journey has been somewhat volatile. Starting in December 2024 with a rank of 24th, the brand slipped to 31st by February 2025, only to recover slightly to 30th in March 2025. This fluctuation suggests an ongoing battle to maintain a consistent market position amidst stiff competition. The sales figures mirror this trend, with a noticeable dip from December to February, followed by a rebound in March. This recovery could signal the effectiveness of recent strategic initiatives, but the brand's position outside the top 20 highlights the need for continued focus and innovation to capture a larger share of the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Ontario pre-roll market, Shatterizer has experienced a dynamic shift in its ranking and sales performance over the past few months. Starting from December 2024, Shatterizer was ranked 24th but saw a decline to 31st by February 2025, before slightly improving to 30th in March 2025. This fluctuation in rank is mirrored by its sales, which decreased from December to February but showed a positive trend in March. In contrast, Tribal demonstrated a more stable performance, with a notable jump to 22nd place in February, indicating a potential threat to Shatterizer's market position. Meanwhile, 1964 Supply Co and Happy & Stoned have shown consistent improvements in their rankings, suggesting increasing consumer preference. Shatterizer's competitors, such as OHJA, have also maintained steady sales, highlighting the need for Shatterizer to innovate and strategize to regain its competitive edge in the Ontario pre-roll category.

Notable Products

In March 2025, Shatterizer's top-performing product was the 8 Ball Kush Shatter Double Infused Pre-Roll (1g), maintaining its number one rank consistently from December 2024 onwards, with sales reaching 9,667 units. The Rockstar Shatter Diamonds & Kief Infused Pre-Roll (1g) held steady at the second position across the same period. Slurricane Double Infused Pre-Roll (1g) remained at third place, showing stable performance without any rank changes. The 8 Ball Kush Shatter (1g) also maintained its fourth position throughout these months. A new entry, the Pink Gas Shatter Infused Pre-Roll 3-Pack (1.5g), emerged in March 2025, securing the fifth rank, indicating a positive reception in its debut month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.