Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

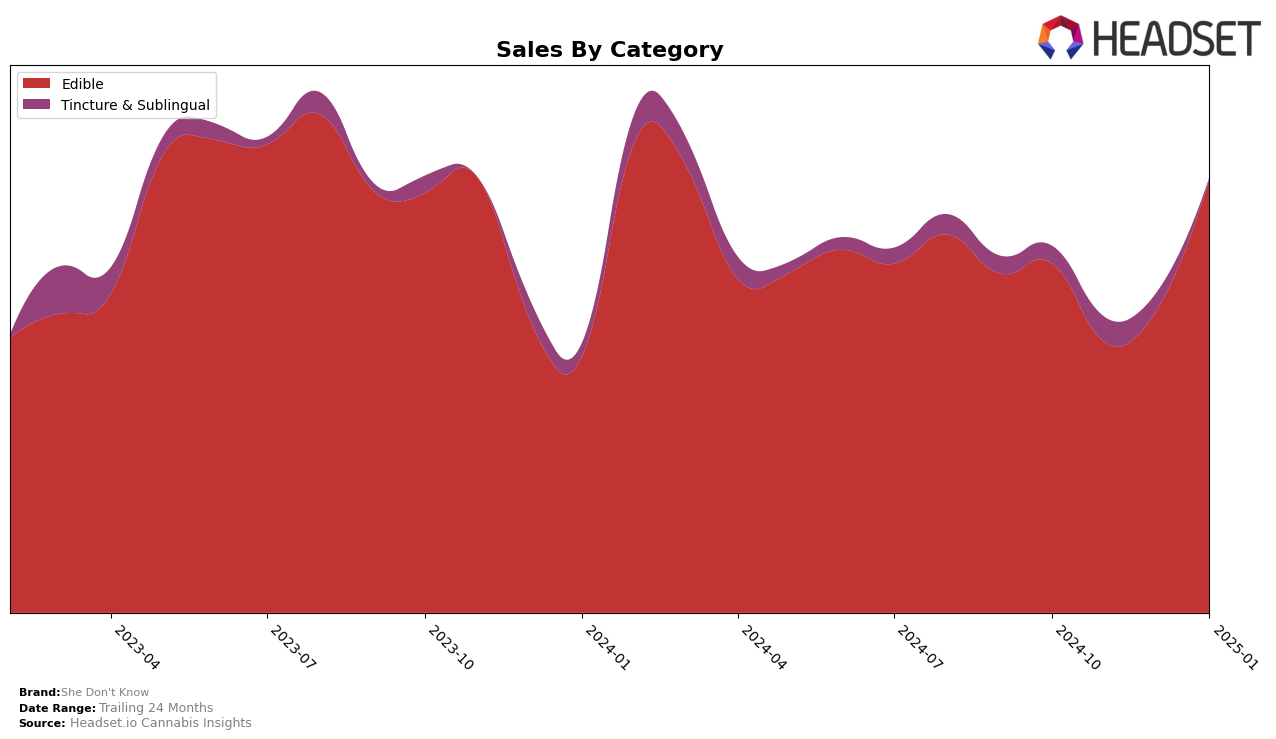

She Don't Know has shown notable performance in the Edible category within the state of Oregon. Over the span from October 2024 to January 2025, the brand experienced fluctuations in its rankings, starting at 26th and then dipping to 30th in November. However, it managed to climb back to 28th in December and reached 22nd by January. This upward trend is indicative of a positive reception and growing consumer interest in their products within the state. The significant jump in January suggests a strong market presence, possibly driven by holiday sales or new product launches.

Despite the competitive nature of the Edible category, She Don't Know's ability to regain and improve its position highlights its resilience and adaptability in the market. The fact that they remained within the top 30 throughout these months is a testament to their consistent performance, unlike other brands that may have fallen off the radar. This consistent presence in the rankings suggests stable demand and effective brand strategies. However, without being in the top 30 in other states or categories, there is room for growth and potential for expansion beyond Oregon. This could be an area to watch as the brand continues to develop its market strategy.

Competitive Landscape

In the competitive landscape of the Oregon edible cannabis market, She Don't Know has shown a notable upward trajectory in rank over the past few months, moving from 30th place in November 2024 to 22nd by January 2025. This improvement in rank is significant, especially when compared to brands like Chalice Farms, which consistently hovered around the 20th rank, and beaucoup, which experienced a decline from 13th to 21st place over the same period. Despite Dr. Feel Good maintaining a relatively stable position until a slight drop in January, She Don't Know's sales have shown a positive trend, particularly in January 2025, where they saw a substantial increase, indicating a potential shift in consumer preference. Meanwhile, Canna Crispy remained relatively stable, suggesting that She Don't Know's recent strategies might be effectively capturing market share from both established and fluctuating competitors.

Notable Products

In January 2025, She Don't Know's top-performing product was the Strawberry Fruit Crunchers Gummy (100mg) in the Edible category, maintaining its number one rank with a notable sales figure of 1199 units. The Watermelon Gummy (100mg) climbed back to the second position after slipping to fifth in December 2024, showing a significant recovery in sales. The Raspberry Fruit Crunchers Gummy (100mg) dropped to the third position from its consistent second-place ranking in the previous months. A new entry, the Tart Apple RSO Gummy (100mg), secured the fourth position, indicating its strong market entry. The POG RSO Gummy (100mg) remained steady at the fifth spot, consistent with its December 2024 ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.