Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

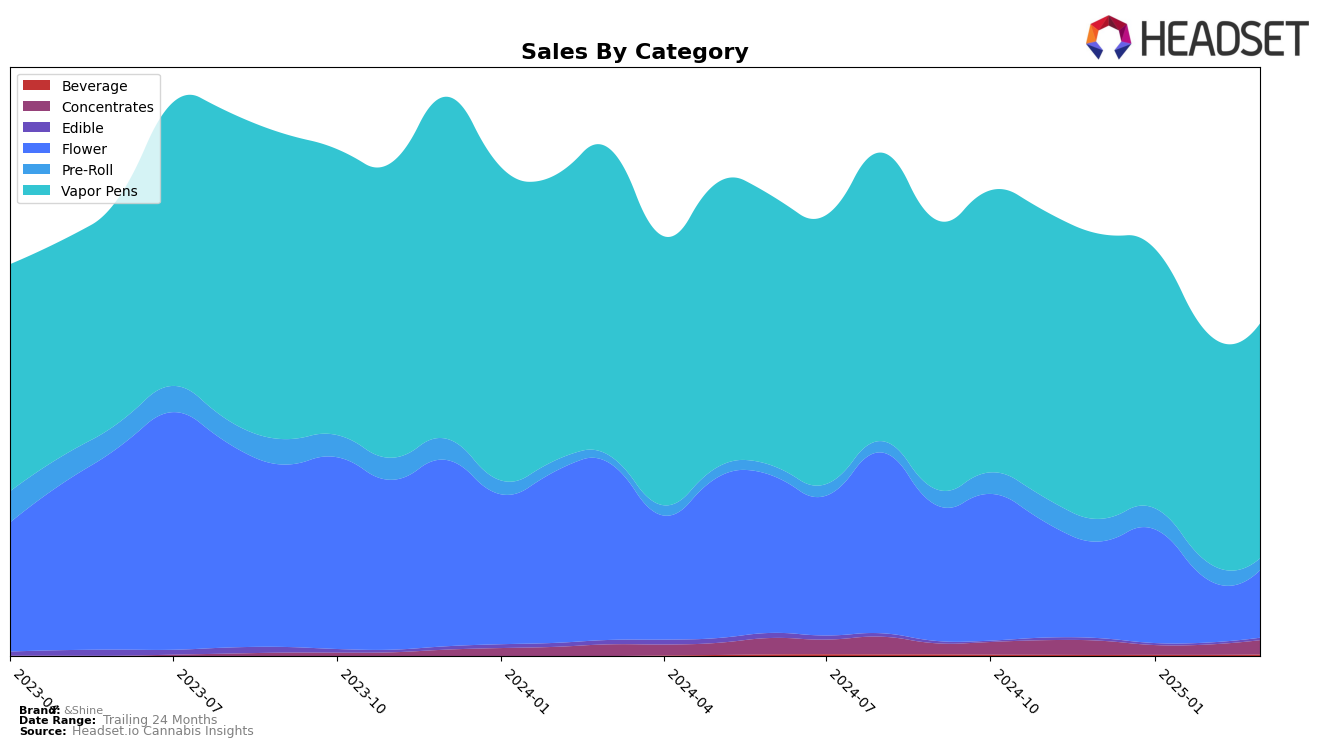

&Shine has displayed a varied performance across different categories and states, with notable achievements and some areas for improvement. In the Illinois market, &Shine has consistently maintained the top position in the Vapor Pens category from December 2024 to March 2025, showcasing its strong presence and consumer preference in this segment. However, in the Flower category, the brand's ranking has fluctuated, with a notable improvement from 18th in December 2024 to 9th by March 2025, suggesting a positive trend in consumer acceptance. In contrast, the &Shine brand did not make it into the top 30 for Vapor Pens in Massachusetts in December 2024, but managed to climb to the 22nd position by January 2025, indicating a growing foothold in this market.

In Maryland, &Shine has shown consistency in the Vapor Pens category, maintaining the 2nd position from December 2024 through March 2025, which reflects stable consumer demand. However, the brand's absence in the top rankings for Flower in the latter months of 2025 could be a point of concern. Meanwhile, in New Jersey, the brand has experienced a decline in the Flower category, dropping from 16th in December 2024 to 28th by March 2025, indicating potential challenges in maintaining market share. Conversely, in Nevada, &Shine's Vapor Pens have consistently held the 3rd position, while its Flower category saw a ranking drop-off by March 2025, which might suggest a shift in consumer preferences or competitive pressures.

Competitive Landscape

In the highly competitive Vapor Pens category in Illinois, &Shine has consistently maintained its position as the top-ranked brand from December 2024 through March 2025. This consistent ranking highlights &Shine's strong market presence and customer loyalty. Despite fluctuations in sales, with a notable dip in February 2025, &Shine's sales figures remain robust, consistently outperforming its closest competitor, Select, which has held the second position throughout the same period. Joos, another competitor, has shown some movement in rankings, alternating between third and fourth positions, indicating a dynamic market environment. The ability of &Shine to maintain its lead amidst these shifts underscores its strategic market positioning and effective customer engagement strategies.

Notable Products

In March 2025, the top-performing product from &Shine was Pineapple Express Distillate Cartridge (1g) in the Vapor Pens category, maintaining its leading position from February with impressive sales of 11,150 units. Northern Lights CDT Distillate Cartridge (1g) rose to the second position, reflecting a notable increase from its third-place ranking in February. Blue Dream Oil Cartridge (1g) ranked third, experiencing a slight drop from its second-place position the previous month. Blue Raspberry Distillate Cartridge (0.5g) entered the rankings in fourth place, while Blueberry Distillate Cartridge (1g) secured the fifth position. The rankings highlight a dynamic shift, with Pineapple Express consistently leading and Northern Lights showing significant improvement in sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.