Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

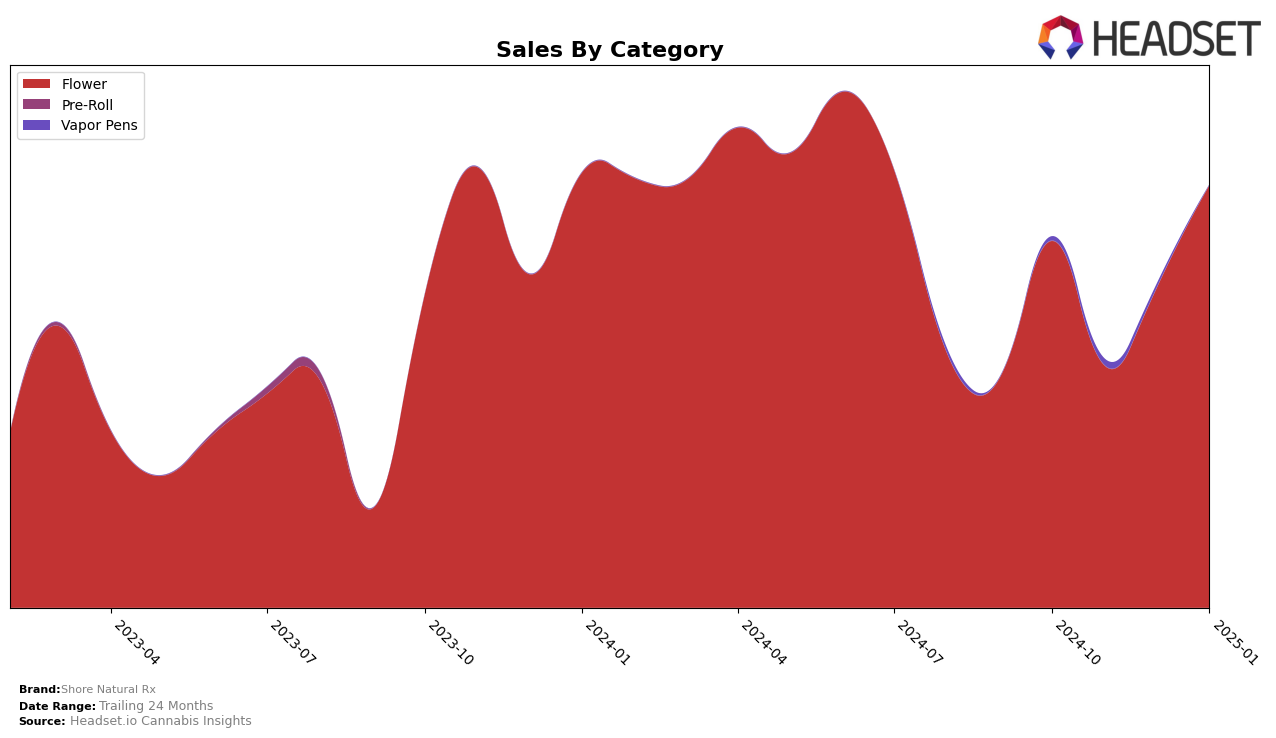

In the state of Maryland, Shore Natural Rx has shown a fluctuating performance in the Flower category over the last few months. The brand was not in the top 30 rankings in October, November, or December of 2024, which indicates a struggle to maintain a strong market presence during these months. However, there was a notable improvement in January 2025 when Shore Natural Rx climbed to the 28th position. This upward movement suggests a positive shift in market dynamics or consumer preference that could be worth exploring further.

Analyzing sales trends, Shore Natural Rx experienced a significant increase in sales from November 2024 to January 2025, with January sales reaching $283,546. This upward trend in sales aligns with their improved ranking in January, hinting at a correlation between sales performance and market position. Despite the challenges faced in the latter months of 2024, the brand's recent performance in January could indicate a potential turnaround or successful strategic adjustments. Observing how Shore Natural Rx continues to navigate the competitive landscape in Maryland will be crucial for understanding their long-term viability in the Flower category.

Competitive Landscape

In the competitive landscape of the Maryland flower category, Shore Natural Rx has shown a dynamic shift in its ranking and sales performance over recent months. While Shore Natural Rx experienced a dip in rank from 31st in October 2024 to 35th in November 2024, it rebounded to 28th by January 2025, indicating a positive trend. This recovery is notable when compared to competitors such as Small A$$ Bud, which consistently improved its rank from 33rd to 26th over the same period, and Find., which fluctuated but maintained a presence in the top 30. Shore Natural Rx's sales trajectory also reflects this competitive pressure, with a significant increase from November to January, aligning closely with Belushi's Farm, which saw a similar sales boost. Despite these challenges, Shore Natural Rx's ability to climb back in rank suggests resilience and potential for growth in the Maryland market.

Notable Products

In January 2025, Shore Natural Rx's top-performing product was Blue Diesel (3.5g) from the Flower category, which achieved the number one rank with a notable sales figure of 1968 units. Hammerhead (3.5g), also in the Flower category, secured the second position, dropping from its first-place spot in December 2024 despite strong sales. Cluster Funk (3.5g) made its debut in the rankings at third place, indicating a growing popularity. Lucid Blue (7g) and Blue Diesel Shake (7g) rounded out the top five, ranking fourth and fifth respectively, both making their first appearance in the top rankings. This shift in rankings suggests a dynamic change in consumer preferences towards a broader variety of products within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.