Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

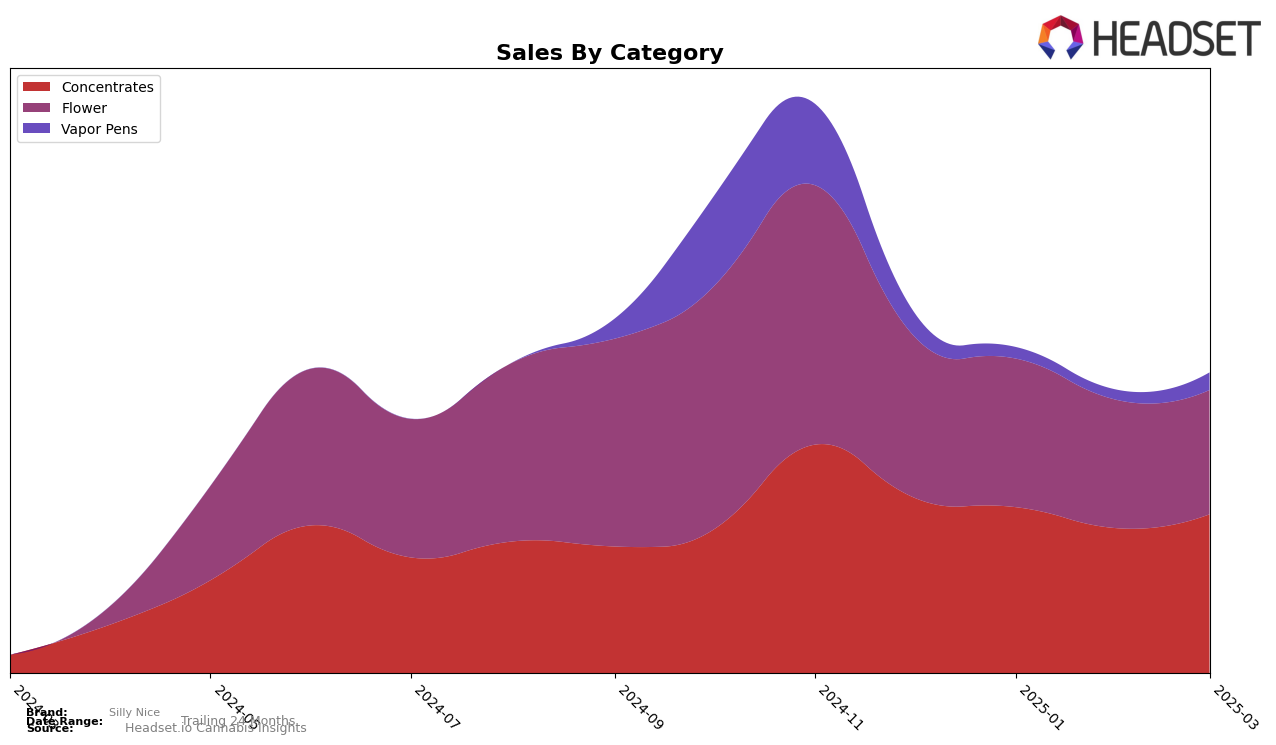

In the New York market, Silly Nice has shown a consistent presence in the Concentrates category, maintaining a steady ranking of 10 from January to March 2025 after starting at 9 in December 2024. This suggests a relatively stable performance, although there was a slight decline in sales from December 2024 to February 2025, with a minor recovery in March. However, in the Flower category, Silly Nice experienced a downward trend, dropping from 63 in December 2024 to 85 by March 2025, indicating potential challenges in maintaining competitiveness within this segment. Notably, their absence from the top 30 in the Vapor Pens category after December 2024 highlights an area where the brand is struggling to capture market share.

The performance of Silly Nice in New York across different product categories reveals both strengths and areas for improvement. While their consistent ranking in Concentrates suggests a solid foothold, the declining trend in the Flower category raises questions about their strategy and adaptability in this segment. The lack of presence in the top 30 for Vapor Pens after December 2024 could be a significant concern if this category is growing in popularity among consumers. This mixed performance across categories suggests that while Silly Nice has a stable position in some areas, there are opportunities for growth and optimization in others, particularly in expanding their reach and influence in the Vapor Pens market.

Competitive Landscape

In the competitive landscape of the concentrates category in New York, Silly Nice has maintained a consistent rank at 10th place from January to March 2025, despite a slight dip in sales from December 2024 to February 2025, before a recovery in March. This stability in ranking suggests a resilient market position amidst fluctuating sales figures. Notably, House of Sacci and American Hash Makers have shown some volatility, with House of Sacci moving from 13th to 11th place by March, indicating a potential upward trend that could pose a challenge to Silly Nice if it continues. Meanwhile, Blotter and New York Honey (NY Honey) have consistently ranked higher, with Blotter maintaining a strong presence in the top 8, suggesting that while Silly Nice holds its ground, there is significant competition from brands with higher sales volumes. This competitive environment underscores the importance for Silly Nice to innovate and potentially expand its market share to improve its ranking and sales performance.

Notable Products

In March 2025, Silly Nice THCA Diamond Powder (0.5g) maintained its position as the top-selling product, with sales reaching 1051 units, showing an increase from previous months. Papaya Wine Infused Frosted Flower (3.5g) held steady in second place, continuing its consistent performance from December 2024. Silly Nice Sifted Bubble Hash (1g) ranked third, showing stability after briefly dropping to fourth in January. Silly Nice Frosted Hash Ball (1g) reclaimed its fourth position, having slipped to fifth in February. Frosted Flower Infused (3.5g) remained in fifth place, experiencing a decline in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.