Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

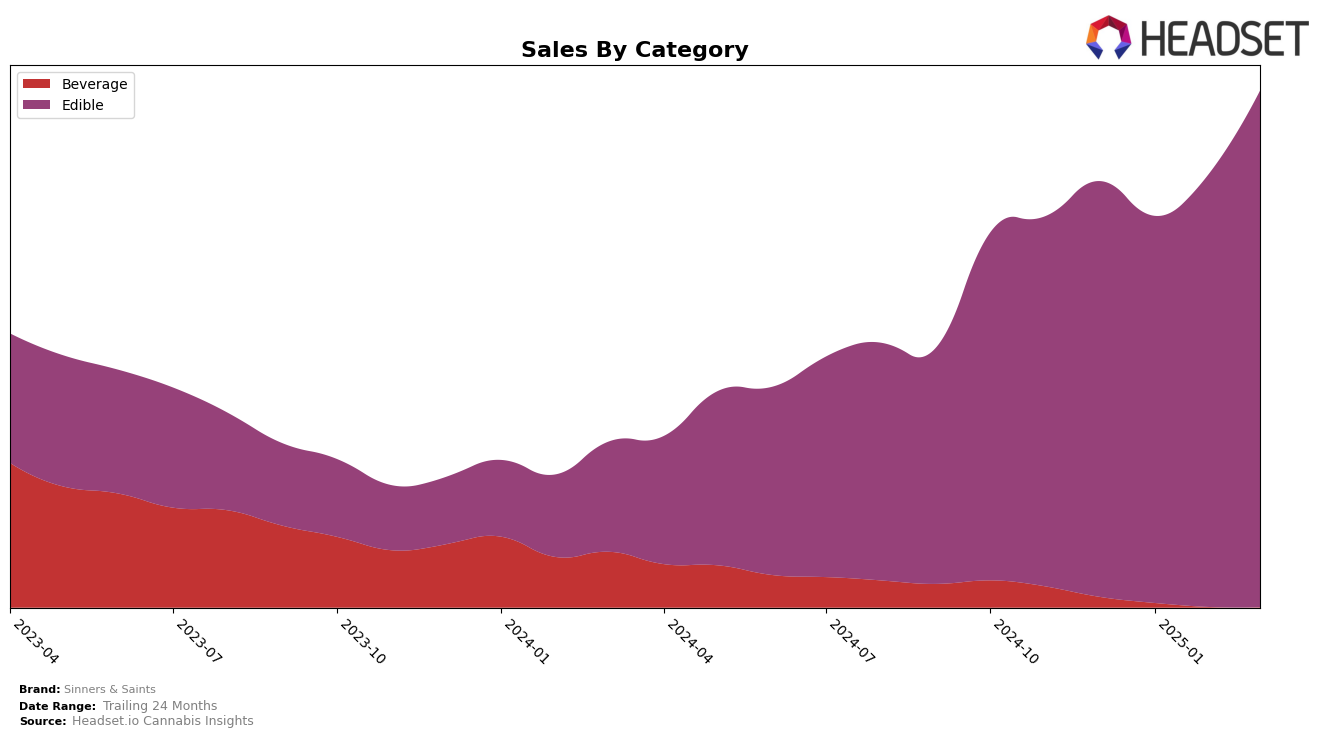

Sinners & Saints has shown a promising upward trajectory in the Edible category within Washington. Starting from an 18th rank in December 2024, the brand has steadily climbed to the 15th position by March 2025. This consistent improvement is indicative of strong consumer interest and effective brand strategies. Notably, the sales figures for March 2025 reflect a significant increase compared to previous months, suggesting successful marketing efforts or product innovations that have resonated well with consumers.

Despite the positive momentum in Washington, Sinners & Saints' absence from the top 30 rankings in other states or provinces could signal challenges in expanding their market presence beyond their established territory. This lack of visibility in additional regions might be a strategic focus for the brand moving forward, as capturing diverse markets is crucial for sustained growth. The brand's ability to replicate its success in Washington across other states could determine its long-term competitive edge in the cannabis industry.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Sinners & Saints has shown a notable upward trend in rankings from December 2024 to March 2025. Initially positioned at 18th place in December 2024, Sinners & Saints climbed to 15th by March 2025, reflecting a strategic improvement in market presence. This rise is particularly significant given the competitive pressure from brands like The 4.20Bar, which maintained a consistent rank around 13th and 14th during the same period, and Drops, which improved from 16th to 13th. While Constellation Cannabis experienced a slight decline, moving from 14th to 17th, Sinners & Saints capitalized on this shift to enhance its market position. The brand's sales trajectory also mirrors this positive trend, with a notable increase in March 2025, suggesting effective marketing strategies and product offerings that resonate well with consumers in the Washington edible market.

Notable Products

In March 2025, the top-performing product for Sinners & Saints was the CBN/CBD/THC 2:2:1 Blue Raspberry Gummies 10-Pack, which climbed to the first position with a notable sales figure of 2356 units. The CBN/CBD/THC 2:2:1 Sour Berry Pomegranate Gummies 10-Pack secured the second spot, showing a consistent performance with a slight drop from its previous first-place ranking in January. The CBD/CBC/CBG/THC 1:1:1:1 Mango Passionfruit Gummies 10-Pack ranked third, maintaining a strong presence after fluctuating between first and fourth in the preceding months. The CBD/CBC/CBG/THC 1:1:1:1 Strawberry Kiwi Gummies 10-Pack dropped to fourth place, marking a consistent decline since December 2024. The CBD/CBN/THC 2:2:1 Pink Lemonade Gummies 10-Pack remained steady in fifth place, showing gradual sales growth each month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.