Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

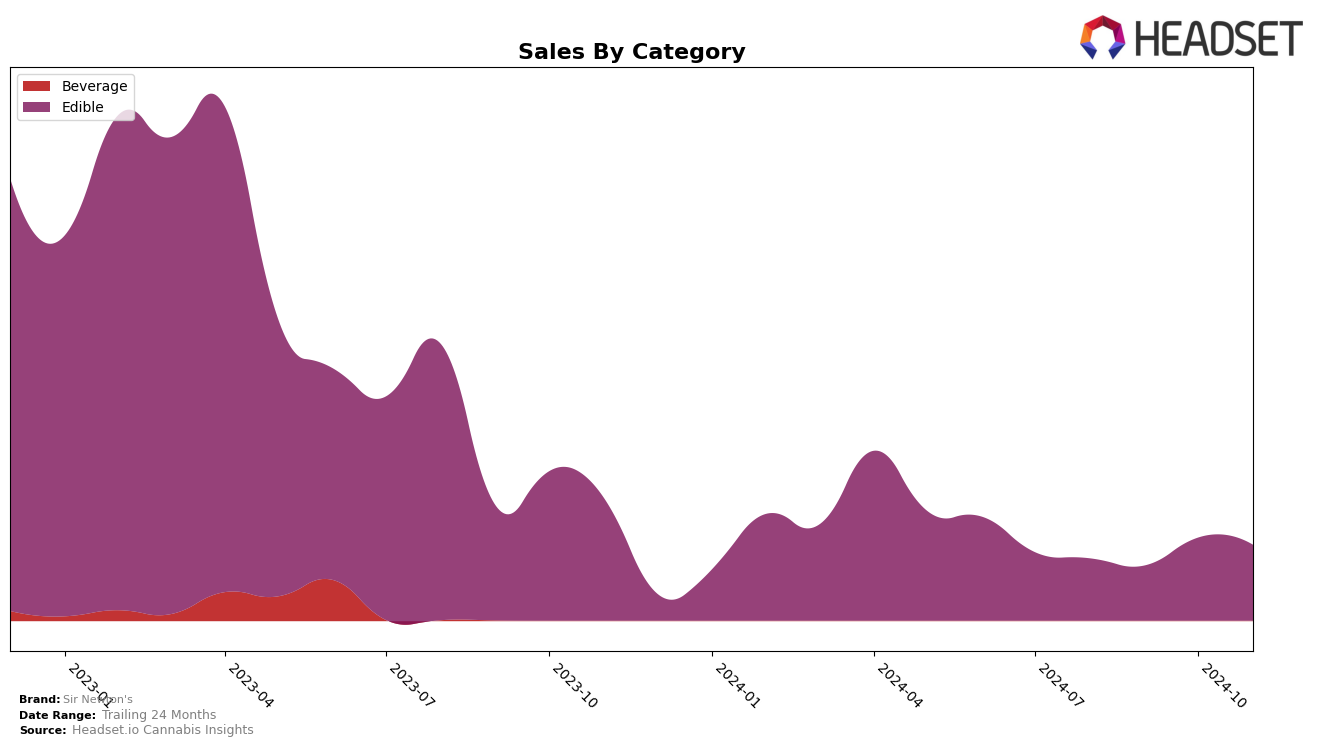

Sir Newton's has demonstrated notable fluctuations in its performance across various categories and states. In the Edible category in Arizona, the brand has seen some interesting movements over the past few months. While they were not in the top 30 in August and September 2024, they achieved a rank of 29 in both October and November 2024. This indicates a positive trend in their market presence within the state, suggesting increased consumer interest and potentially effective marketing strategies or product offerings that resonated with the local market.

However, the absence of Sir Newton's from the top 30 rankings in August and September highlights challenges they may have faced earlier in the year. This could suggest increased competition or shifts in consumer preferences that initially impacted their standings. Despite these hurdles, the brand's recovery in the following months is a promising sign of resilience and adaptability. Observing these patterns could provide insights into the brand's strategic adjustments and the dynamic nature of the cannabis market in Arizona.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Arizona, Sir Newton's has shown a notable improvement in its rank from August to November 2024, climbing from 34th to 29th place. This upward trend is significant, especially when compared to competitors like iLava, which maintained a relatively stable position around the mid-20s, and Grow Sciences, which consistently held a top 25 rank until a slight dip in November. Despite Chew & Chill (C & C) experiencing fluctuations and dropping to 37th in October, Sir Newton's managed to surpass them by November, indicating a positive shift in consumer preference or strategic positioning. Meanwhile, Tipsy Turtle remained consistently ranked in the low 30s, suggesting stable but not aggressive competition. Sir Newton's sales trajectory, with a notable increase in October, suggests effective marketing or product innovation that could be capitalized on to further enhance market position.

Notable Products

In November 2024, the top-performing product for Sir Newton's was Guava Gummies 10-Pack (900mg), which rose to the first position with sales of 351 units, maintaining its strong upward trajectory from the second rank in October. Mixed Berry Gummy 10-Pack (900mg) slipped to the second position, although it had been consistently ranked first from August through October. Mixed Flavors Gummy 10-Pack (300mg) remained stable in the third position, showing a slight decline in sales from the previous month. Peach Mango Gummy 10-Pack (300mg) continued to hold the fourth position, mirroring its performance from the past months. CBD/THC 1:1 Peach Mango Gummy (150mg CBD, 150mg THC) stayed in fifth place, consistent with its ranking in the preceding months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.