Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

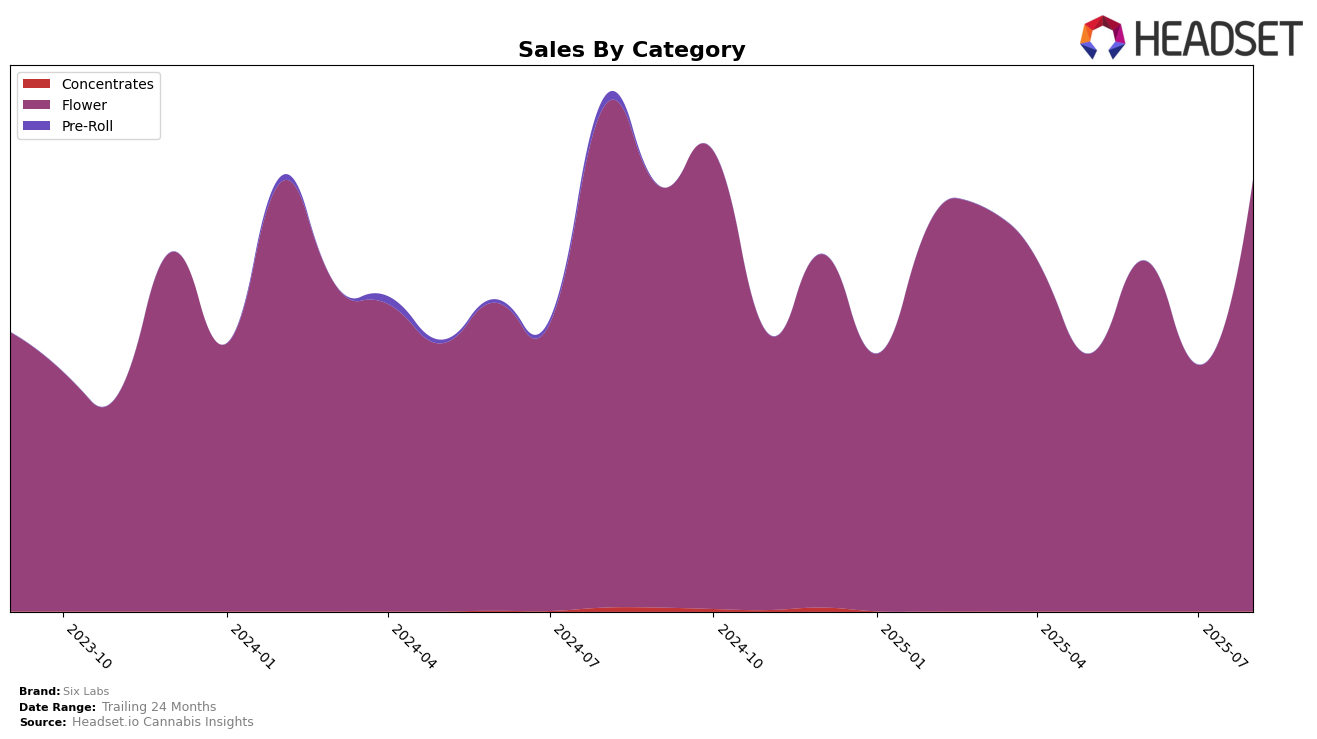

In Michigan, Six Labs has shown a dynamic performance in the Flower category over the past few months. Starting in May 2025, Six Labs was ranked 30th, but by June, they improved significantly to 19th place. However, in July, they fell out of the top 30, only to make a strong comeback in August, reaching 14th position. This fluctuation indicates a volatile yet promising presence in the Michigan market, suggesting that Six Labs is gaining traction but still faces competitive challenges. The August sales figures reflect a notable increase, hinting at a strategic move or market response that could be worth exploring further.

While the data for other states or provinces is not provided here, the performance of Six Labs in Michigan's Flower category could serve as a useful benchmark for evaluating their overall market strategy and adaptability. The absence of Six Labs from the top 30 in July might be seen as a setback, yet their ability to rebound quickly suggests resilience and potential room for growth. Observing how Six Labs navigates such fluctuations could provide insights into their broader market strategies and operational adjustments, which are crucial for sustaining long-term success in the competitive cannabis industry.

Competitive Landscape

In the competitive landscape of the Michigan flower market, Six Labs has demonstrated notable fluctuations in rank and sales over the summer of 2025. Starting from a rank of 30 in May, Six Labs surged to 19 in June, dipped to 33 in July, and then climbed impressively to 14 in August. This upward trajectory in August coincides with a significant increase in sales, suggesting a successful strategy or product launch. In comparison, Grown Rogue also showed improvement, moving from rank 25 in May to 16 in August, while Dog House maintained a more stable position, hovering around the 12-15 rank range. Meanwhile, MJ Verdant experienced a remarkable rise from 33 in May to 12 in August, indicating strong competitive pressure. These dynamics highlight a volatile market where Six Labs must continue to innovate to maintain and improve its standing against agile competitors like MJ Verdant and consistent performers like Dog House.

Notable Products

In August 2025, Sherb Cream Pie (1g) emerged as the top-performing product for Six Labs, achieving the number one rank with sales of 10,198 units. The Soap (1g) followed closely, securing the second position. Log Cabin OG (Bulk) climbed to the third spot, improving from its fourth-place ranking in July, with sales increasing significantly to 7,214 units. Platinum Life Hack (Bulk) dropped from second to fourth place, despite maintaining strong sales figures. Mac N' Gary (3.5g) completed the top five, marking its debut in the rankings for August.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.