Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

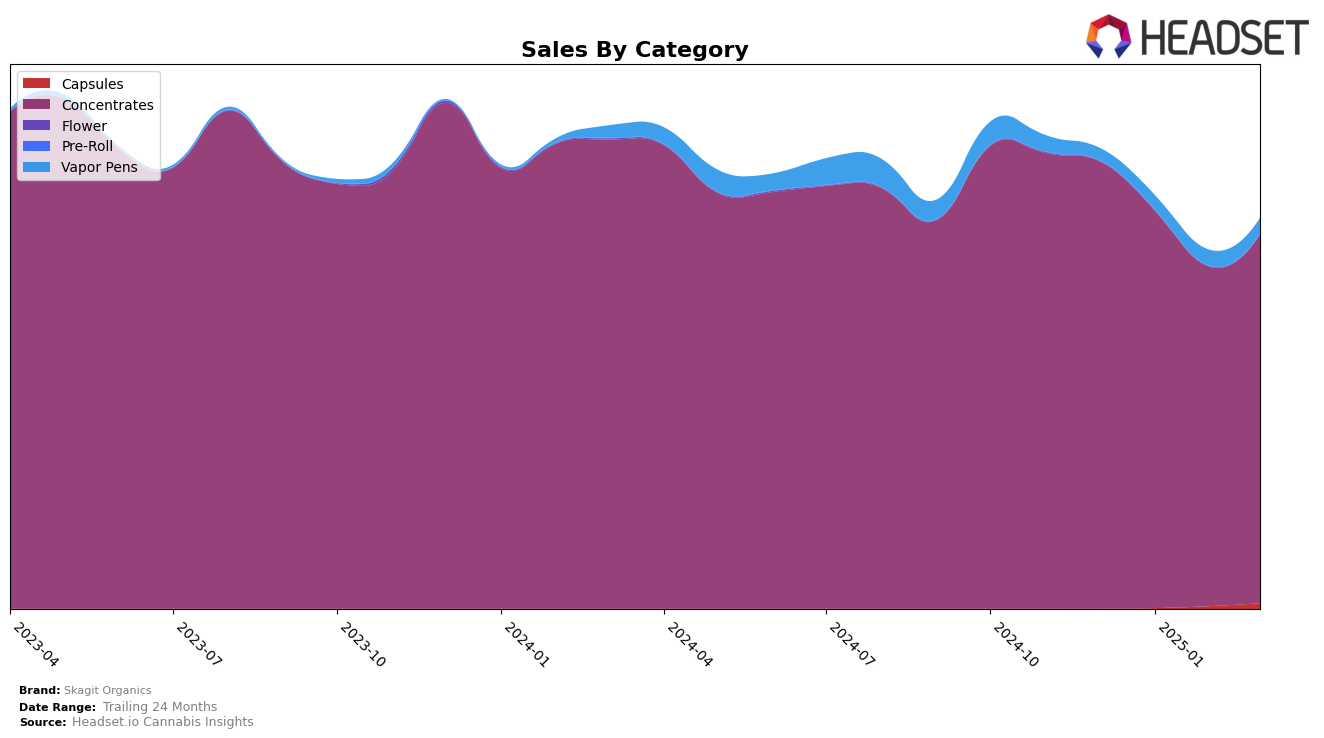

Skagit Organics has demonstrated a consistent presence in the Concentrates category within Washington, though there has been a noticeable decline in their ranking over the past few months. Starting at 12th place in December 2024, the brand slipped to 17th by March 2025. This downward trend in rankings aligns with a decrease in sales figures, suggesting potential challenges in maintaining market share amidst growing competition or shifting consumer preferences. Despite these challenges, Skagit Organics remains within the top 20, indicating a resilient market presence in the state.

Interestingly, the brand did not appear in the top 30 rankings in any other states or categories during this period, which could be interpreted as both a limitation and an opportunity. The absence from other markets might suggest a strong regional focus or potential barriers to expansion. However, this also highlights an untapped potential for growth beyond Washington, particularly if Skagit Organics can leverage its existing strengths in the Concentrates category to penetrate new markets. The brand's trajectory in Washington could serve as a valuable case study for strategic adjustments aimed at broader market engagement.

Competitive Landscape

In the Washington concentrates market, Skagit Organics experienced a notable decline in rank from December 2024 to March 2025, moving from 12th to 17th place. This downward trend in rank is mirrored by a decrease in sales over the same period. Competitors such as Crystal Clear and VENOM Extractions (WA) have shown more resilience, with Crystal Clear improving its rank from 18th to 16th and VENOM Extractions climbing from 21st to 15th. Meanwhile, Slab Mechanix and Pressed 4 Less have fluctuated in their rankings, with Slab Mechanix dropping out of the top 20 in February 2025 and Pressed 4 Less maintaining a relatively stable position. These shifts suggest a competitive landscape where Skagit Organics may need to strategize to regain its footing and address the factors contributing to its declining performance.

Notable Products

In March 2025, the top-performing product for Skagit Organics was Super Silver Haze RSO Syringe (1g) in the Concentrates category, maintaining its leading position from February despite a slight decrease in sales to 571 units. The Original- Blackberry Kush RSO (1g) emerged as a strong contender, securing the second rank, while 9lb Hammer RSO (1g) slipped from second to third place. Original - Blue Dream RSO (1g) held steady at fourth place, showing a positive trend with increased sales from February. Original - Sour Alien RSO (1g) remained in fifth place, indicating consistent performance since its debut in February. Overall, the rankings reflect a dynamic shift in consumer preferences with notable stability at the top.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.