Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

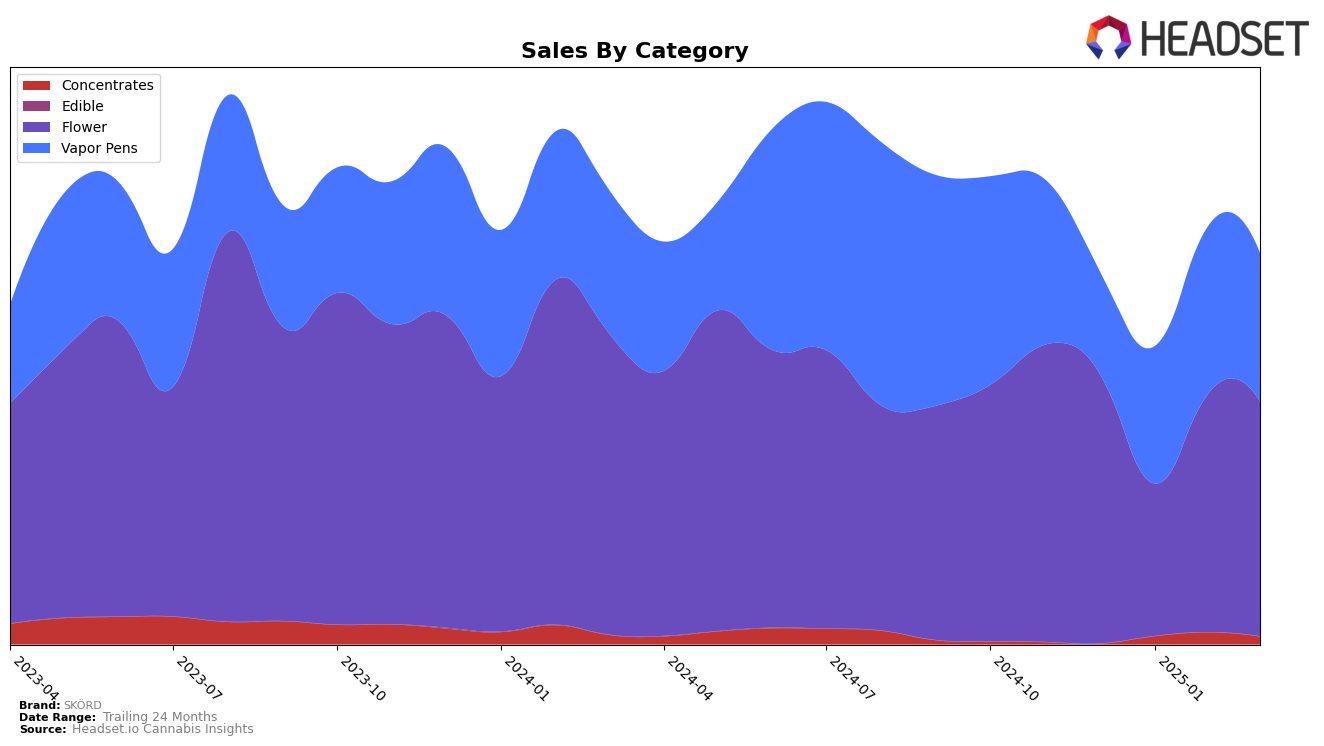

SKÖRD has demonstrated a mixed performance across different product categories in Washington. In the Flower category, SKÖRD saw a notable fluctuation in rankings, starting at 17th in December 2024, dropping to 39th in January 2025, and then climbing back to 18th in February before settling at 22nd in March. This volatility suggests a dynamic market presence, where SKÖRD managed to regain ground after an initial dip. However, in the Concentrates category, SKÖRD was absent from the top 30 rankings throughout the observed months, indicating a potential area for improvement or a strategic shift in focus away from this category.

In the Vapor Pens category, SKÖRD showed a positive upward trend, beginning at 45th place in December 2024 and improving to 23rd by February 2025, before slightly dropping to 30th in March. This suggests a strengthening position in the Vapor Pens market, possibly driven by increased consumer interest or effective product offerings. Despite the drop in March, the overall movement suggests a growing competitiveness in this segment. The absence from the top 30 in Concentrates, however, could imply either a lack of emphasis on this category or challenges in gaining traction within it. The performance across these categories highlights SKÖRD's varying levels of success and potential areas for strategic focus in the Washington market.

Competitive Landscape

In the competitive landscape of the Washington flower market, SKÖRD has experienced notable fluctuations in its ranking and sales performance. Starting from December 2024, SKÖRD was ranked 17th but saw a significant drop to 39th in January 2025, before recovering to 18th in February and then slipping slightly to 22nd in March. This volatility contrasts with brands like Smokey Point Productions (SPP) and Agro Couture, which also experienced declines but maintained a steadier presence within the top 20, albeit at lower ranks by March. Meanwhile, Torus showed a consistent upward trend, moving from 31st in December to 23rd by March, indicating a potential threat to SKÖRD's market share. The sales figures reflect these trends, with SKÖRD's sales peaking in February, aligning with its improved rank, but then declining in March. This suggests that while SKÖRD can rebound quickly, maintaining a stable position in the competitive Washington flower market remains a challenge against brands like Passion Flower Cannabis, which, despite a slight drop in March, showed a strong performance in January.

Notable Products

In March 2025, the top-performing product for SKÖRD was Lemon Shortbread (3.5g) in the Flower category, securing the number one rank with notable sales of 1256 units. Following closely, Divine Kush Breath (3.5g) also in the Flower category, climbed to the second position from its previous fifth position in January 2025. The Cake Donut Ceramic Full Spectrum PHO Cartridge (1g) in the Vapor Pens category held the third position, marking its first appearance in the top rankings. Sinmint Sundae (3.5g) ranked fourth, maintaining a strong presence in the Flower category. Lastly, Dark Rainbow Ceramic Reserve PHO Cartridge (1g) slipped to fifth place from its third position in February 2025, indicating a slight decline in popularity.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.