Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

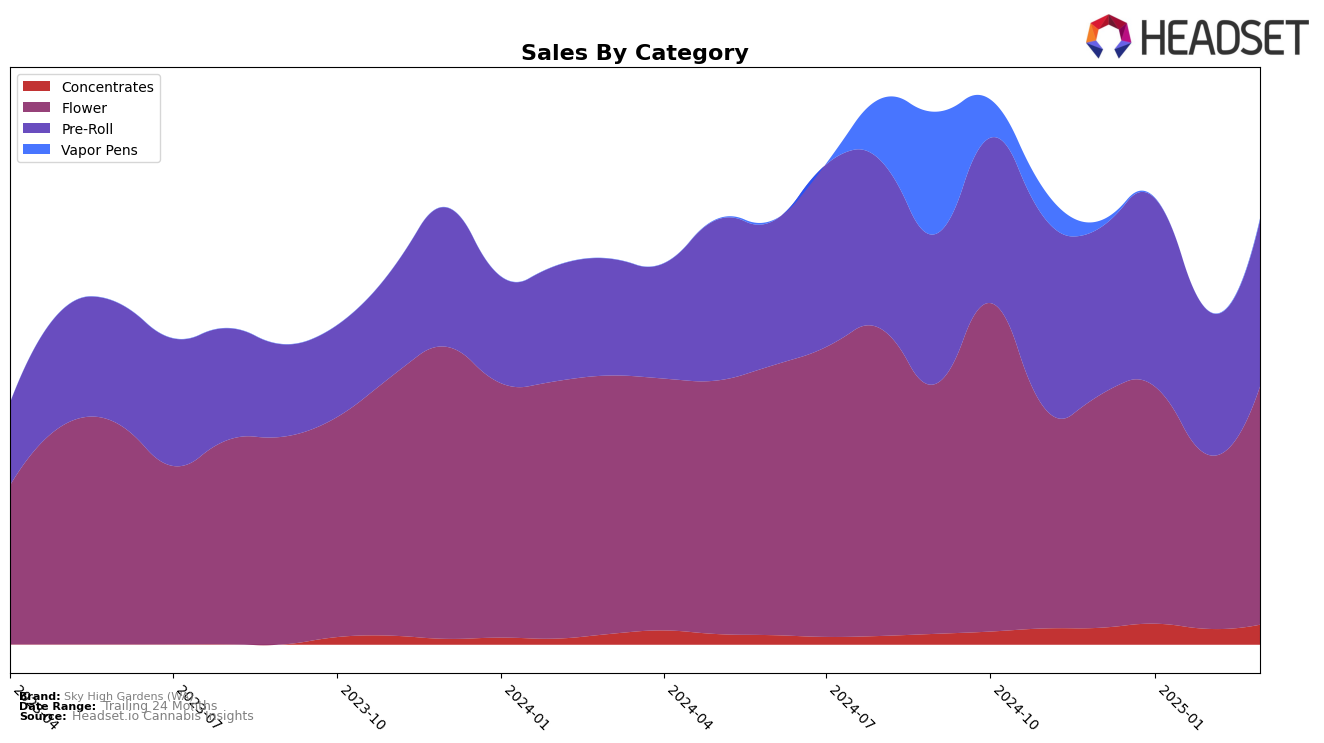

Sky High Gardens (WA) has shown dynamic performance across various product categories in the state of Washington. In the Concentrates category, the brand has seen a fluctuating journey, moving from a rank of 97 in December 2024 to 80 by March 2025. This suggests an upward trend, although it remains outside the top 30, indicating room for growth. Meanwhile, the Flower category has demonstrated more stability and strength, with Sky High Gardens maintaining a consistent presence within the top 40, peaking at rank 30 in March 2025. This suggests a solid foothold in the Flower segment, reflecting consumer preference and brand strength in this category.

In the Pre-Roll category, Sky High Gardens has experienced some volatility, moving from a rank of 26 in December 2024 to 19 in January 2025, before returning to 26 by March 2025. This indicates a competitive landscape where the brand is managing to maintain a presence but may need to strategize further to climb higher. Notably, the brand's absence from the top 30 in the Concentrates category highlights a potential area for strategic improvement. Overall, while Sky High Gardens shows promising trends in certain categories, there remain opportunities for growth and enhancement in others to solidify its standing across the board in Washington.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Sky High Gardens (WA) has shown a dynamic performance with notable fluctuations in its ranking and sales. From December 2024 to March 2025, Sky High Gardens (WA) experienced a rise in rank from 38th to 30th, indicating a positive trend in market positioning. Despite a dip in February 2025, where it dropped back to 38th, the brand rebounded strongly in March. This improvement in rank is mirrored by a recovery in sales, which increased from $162,780 in February to $223,299 in March. In comparison, Mt Baker Homegrown showed a consistent upward trend, surpassing Sky High Gardens (WA) by March with a rank of 29th and slightly higher sales. Meanwhile, Bodega Buds maintained a stronger position throughout this period, consistently ranking in the mid-20s, which suggests a stable consumer base and robust sales figures. The competitive pressure from brands like Snickle Fritz and Bacon Buds, both of which also showed varying degrees of rank improvement, highlights the dynamic and competitive nature of the Washington Flower market.

Notable Products

In March 2025, the top-performing product for Sky High Gardens (WA) was Pineapple Chunk (3.5g) in the Flower category, reclaiming its top spot with sales reaching 1440 units. The Pineapple Chunk Pre-Roll 2-Pack (1.2g) followed closely in second place, maintaining its steady performance from the previous months. Sundae Ecstasy Pre-Roll 2-Pack (1.2g) rose to third place, showing a significant increase in sales compared to February 2025. Cosmic Chem Pre-Roll 2-Pack (1.2g) dropped from first place in February to fourth in March, while Sundae Ecstasy Pre-Roll 5-Pack (3g) rounded out the top five, having slipped from its top position earlier in the year. This month saw a notable reshuffling of rankings, with Pineapple Chunk (3.5g) making a remarkable comeback to lead the sales chart.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.