Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

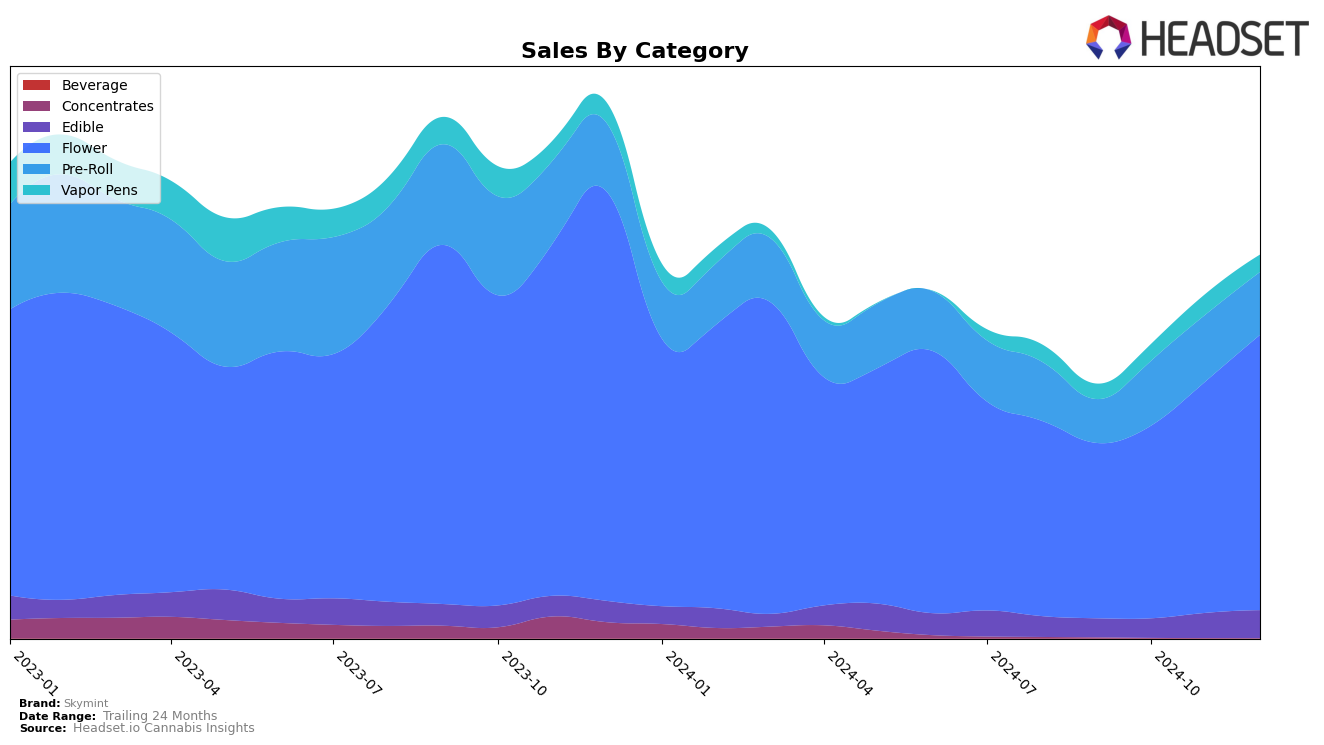

In the state of Michigan, Skymint has shown notable progress in the Flower category, where it climbed from the 31st position in September 2024 to the 17th position by December 2024. This upward trajectory reflects a strong performance and increasing consumer preference for Skymint's Flower products. Another significant improvement is seen in the Pre-Roll category, where Skymint moved from 44th place in September to 22nd place by December, indicating a growing market presence. However, in the Vapor Pens category, they did not manage to break into the top 30, hovering around the 70th position by December, suggesting potential areas for growth and market penetration.

Skymint's performance in the Edible category in Michigan also shows a steady improvement, with a rise from the 49th position in September to the 43rd position by December 2024. This gradual climb suggests a consistent increase in consumer interest and sales, although they still remain outside the top 30. Despite not making the top 30 in Edibles and Vapor Pens, the consistent sales growth across these categories indicates a positive trend. The brand's ability to enhance its rankings in Flower and Pre-Roll categories suggests a strategic focus that could potentially be leveraged to improve standings in other categories as well.

Competitive Landscape

In the competitive landscape of the Michigan Flower category, Skymint has shown a notable upward trajectory in rankings over the last few months of 2024. Starting from a rank of 31 in September, Skymint improved to 17 by December, indicating a positive trend in market presence. This upward movement is contrasted by Dog House, which experienced a decline from rank 8 in September to 16 in December. Meanwhile, Redemption demonstrated a strong performance, climbing from 32 in September to 15 in December, suggesting a competitive pressure on Skymint. NOBO and Carbon also showed fluctuating ranks, with Carbon peaking at 13 in November before dropping to 19 in December. Skymint's consistent rise in rank alongside increasing sales figures suggests a strengthening brand position, though the competition remains fierce with other brands like Redemption also gaining traction.

Notable Products

In December 2024, the top-performing product for Skymint was Wedding Cake Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking consistently from September through December, with a notable sales figure of 13,645. Wedding Cake (3.5g) in the Flower category experienced a significant rise, moving from fourth place in November to second place in December. Wonka Bars #13 Pre-Roll (1g) also saw an improvement in its position, climbing from fifth in November to third in December. The Flower category's Wonka Bars #13 (3.5g) debuted at fourth place in December. Platinum OG Kush (3.5g) entered the rankings in December at fifth place, showing the dynamic shifts in product popularity within Skymint's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.