Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

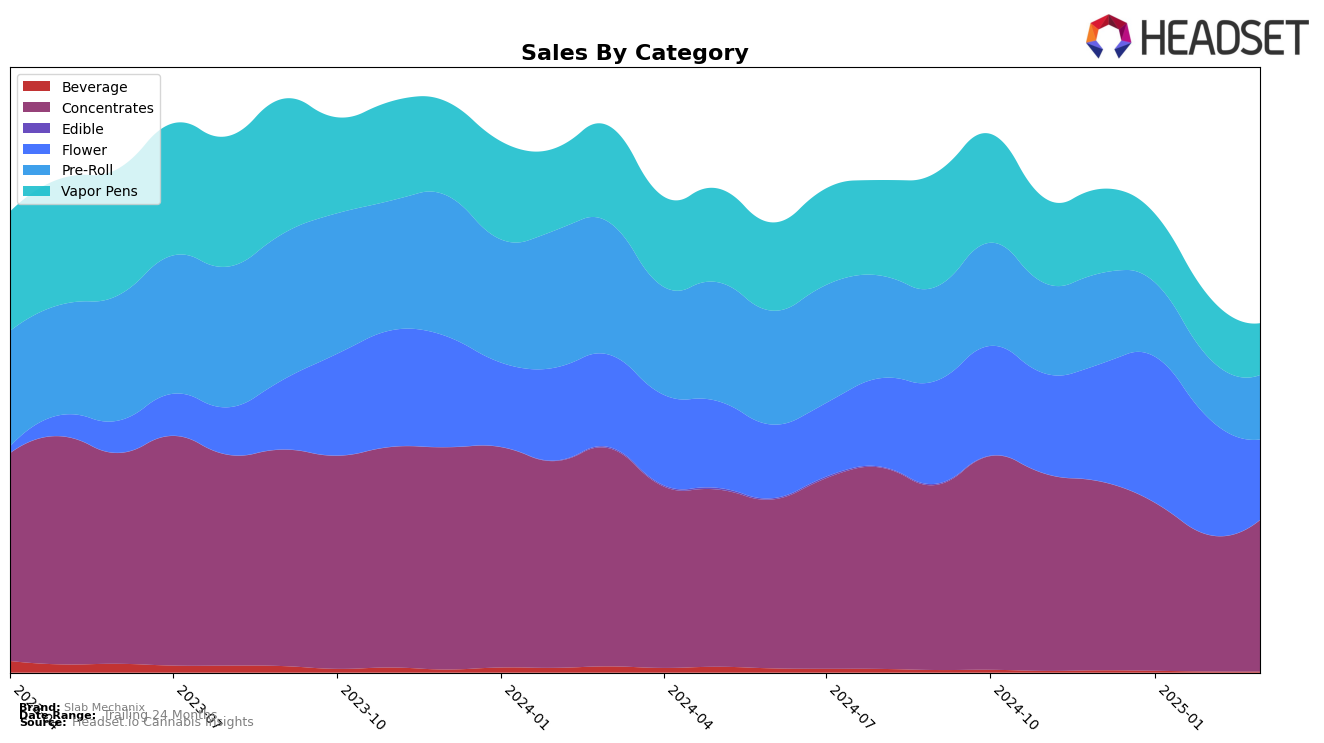

Slab Mechanix has shown varied performance across different product categories in Washington. In the Concentrates category, the brand experienced a slight decline in rankings from 14th in December 2024 to 19th by March 2025. This movement indicates a challenge in maintaining its position among top competitors, despite a modest recovery in sales from February to March. Meanwhile, in the Flower category, Slab Mechanix managed to improve its rank from 100th to 81st between December 2024 and January 2025, although it fell out of the top 30 by March, suggesting a struggle to sustain growth in this segment.

In the Pre-Roll segment, Slab Mechanix's ranking fluctuated slightly, moving from 68th in December to 76th in March. This trend reflects a consistent, albeit minor, decline in market position. The Vapor Pens category saw a similar downward trajectory, with the brand dropping from 75th to 94th over the same period. The absence of a top 30 ranking in both Flower and Vapor Pens categories by March 2025 highlights areas where Slab Mechanix may need to bolster its market strategy to regain visibility and competitiveness. These movements across categories and the state suggest a mixed performance, with potential areas for strategic focus to enhance market presence.

Competitive Landscape

In the Washington concentrates market, Slab Mechanix has experienced some fluctuations in its ranking and sales performance over the past few months. Starting in December 2024, Slab Mechanix was ranked 14th, but by February 2025, it had slipped out of the top 20, only to recover slightly to 19th place in March 2025. This downward trend in rank is mirrored by a decline in sales, which saw a notable drop from December 2024 to February 2025, before a modest recovery in March 2025. In comparison, Skagit Organics maintained a more stable presence, although it also experienced a decline in rank from 12th to 17th over the same period. Meanwhile, Hitz Cannabis and Pressed 4 Less have shown more consistent performance, with Hitz Cannabis ranking between 15th and 20th, and Pressed 4 Less maintaining a rank between 14th and 18th. Notably, Pacific & Pine made a significant leap from 26th in December 2024 to 20th in February 2025, indicating a potential emerging competitor. These dynamics suggest that while Slab Mechanix faces challenges in maintaining its market position, there are opportunities for strategic adjustments to regain its competitive edge in the Washington concentrates category.

Notable Products

In March 2025, the top-performing product for Slab Mechanix was Alaskan Thunderfuck Infused Pre-Roll 1g, which claimed the number one rank with sales of 577 units. Tahoe OG Pre-Roll 1g followed closely at second place, maintaining its consistent position from January 2025. Blackberry Kush Wax 1g debuted in the rankings at third place, marking its first appearance with notable sales. Dutch Treat Pre-Roll 1g slipped slightly to fourth place from its previous fifth position in February. Northern Lights Wax 1g rounded out the top five, dropping from its February second-place ranking.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.