Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

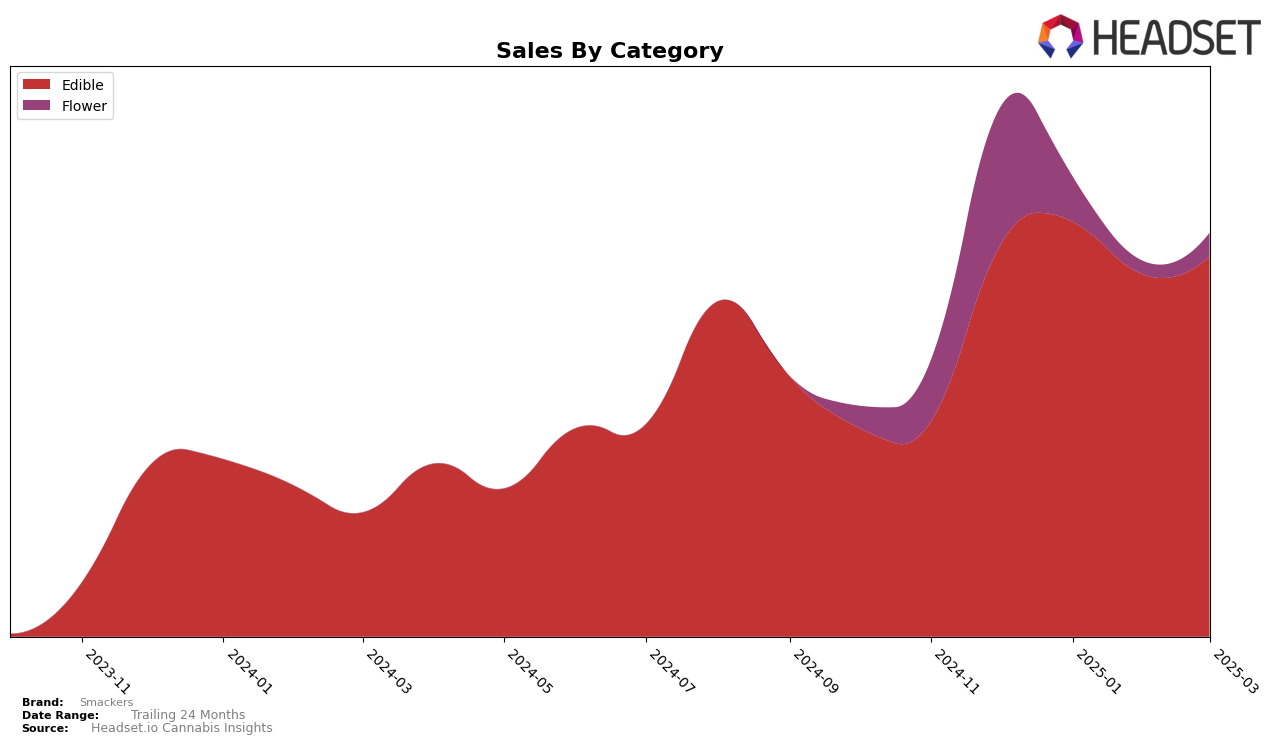

In the state of Missouri, Smackers has shown a relatively stable performance within the Edible category. Despite slight fluctuations, the brand maintained a position within the top 30, ranking 23rd in December 2024 and slightly declining to 25th by March 2025. This consistent presence is indicative of a solid consumer base, although the brand did experience a dip in sales from January to February 2025. The ability to remain in the top ranks while facing sales volatility suggests a strong brand loyalty that buffers against market fluctuations.

Analyzing Smackers' performance across other states or provinces could provide a more comprehensive picture of its market position, but such data isn't available in this snapshot. The absence of rankings in other states or categories might suggest that Smackers hasn't yet achieved a top 30 position elsewhere, which could be a point of concern or an opportunity for growth. This highlights the importance of strategic expansion and targeted marketing efforts to bolster their presence beyond Missouri. Understanding regional consumer preferences and adjusting product offerings accordingly could be key to improving their standings in new markets.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Missouri, Smackers has experienced some fluctuations in its ranking from December 2024 to March 2025. Starting at rank 23 in December 2024, Smackers improved slightly to rank 22 in January 2025, but then saw a decline to rank 24 in February and further to rank 25 in March. This downward trend in rank coincides with a decrease in sales from January to February, although there was a slight recovery in March. In comparison, Plume Cannabis (MO) has shown a more consistent upward trajectory, moving from rank 27 in December to 23 in March, with sales steadily increasing over the same period. Meanwhile, Flav has also improved its position, climbing from rank 32 to 26, indicating a growing market presence. The competition from these brands suggests that Smackers may need to innovate or adjust its marketing strategies to regain its competitive edge in the Missouri edible market.

Notable Products

In March 2025, the top-performing product from Smackers was the Strawberry Lemonade Rosin Gummies 10-Pack (100mg) in the Edible category, maintaining its first-place ranking from December 2024 and January 2025, with notable sales of 1885 units. The Strawberry Lemonade Rosin Gummies 10-Pack (250mg) held steady in the second position, showing consistent performance across the months. Indica Cherry Gummies 10-Pack (250mg) improved its ranking to third place in March from fifth in February, indicating a recovery in sales. Hybrid Sour Apple Gummies 10-Pack (100mg) dropped to fourth place after briefly reaching the top rank in February. Tangerine Gummies 10-Pack (100mg) entered the rankings in March, securing the fifth position with 672 units sold, following its debut in February at third place.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.