Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

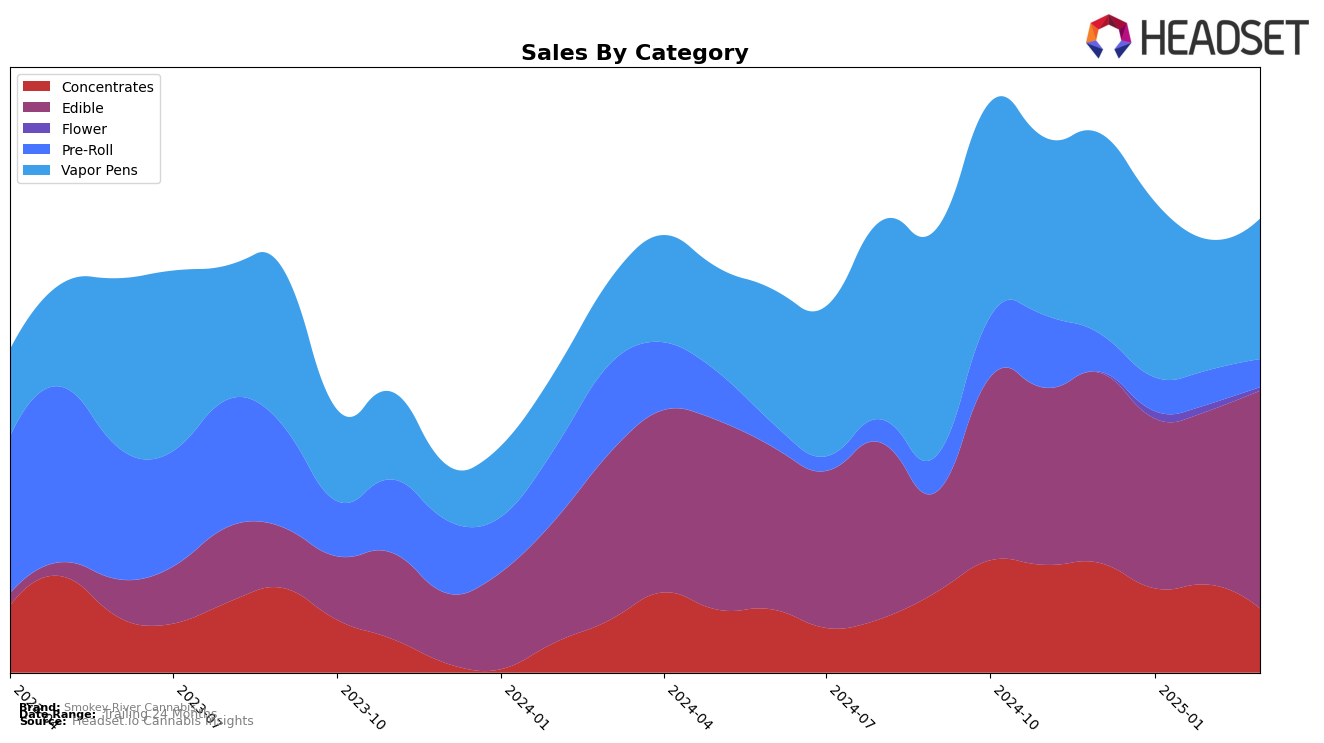

Smokey River Cannabis has shown varied performance across different product categories in Missouri. In the concentrates category, the brand experienced a slight decline in ranking from 14th in December 2024 to 19th by March 2025, with sales reflecting a downward trend. On the other hand, their edibles category performed better, climbing from 18th to 16th place over the same period, with a notable increase in sales in March 2025. This upward movement in edibles suggests a strengthening market presence for Smokey River Cannabis in this category, contrasting with the challenges faced in concentrates.

The performance in the pre-roll category was less favorable, as Smokey River Cannabis did not make it into the top 30 rankings during the observed months, indicating potential areas for improvement. Meanwhile, in the vapor pens category, the brand's ranking fluctuated, starting at 26th in December 2024 and settling at 36th by March 2025. Despite these movements, the sales figures for vapor pens showed some resilience, suggesting that while the brand faces competition, there is a consistent customer base. These dynamics across categories highlight the brand's varying strengths and challenges within the Missouri market.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Missouri, Smokey River Cannabis has shown a promising upward trend in rankings from December 2024 to March 2025. Starting at 18th place in December, Smokey River Cannabis improved its position to 16th by March, indicating a positive trajectory in market presence. This improvement is particularly notable when compared to brands like Dixie Elixirs, which maintained a relatively stable but lower rank, and ROBHOTS, which fluctuated but ended March in a lower position. Despite Good Taste starting strong in the top 10, their rank dropped significantly by March, suggesting potential market volatility. The sales growth for Smokey River Cannabis, especially in March, indicates a robust market strategy that could be capitalizing on shifts in consumer preferences, setting it apart from competitors who experienced either stagnation or decline in sales during the same period.

Notable Products

In March 2025, the top-performing product from Smokey River Cannabis was Dewberry Super High Dose Gummies 10-Pack (1000mg), which rose to the number one rank with sales reaching 2216 units, up from its consistent second place in previous months. Insta Cake Pre-Roll 2-Pack (1g) fell from first to second place, showing a slight decline in sales compared to February. Apple Pie High Dose Gummies 10-Pack (1000mg) re-entered the rankings at third place, indicating a resurgence in popularity. Meanwhile, Strawberry Lemonade High Dose Gummies 10-Pack (1000mg) maintained a steady presence, ranking fourth with a slight increase in sales from February. Apple Fritter Pre-Roll (1g) rounded out the top five, experiencing a drop from its third-place position in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.