Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

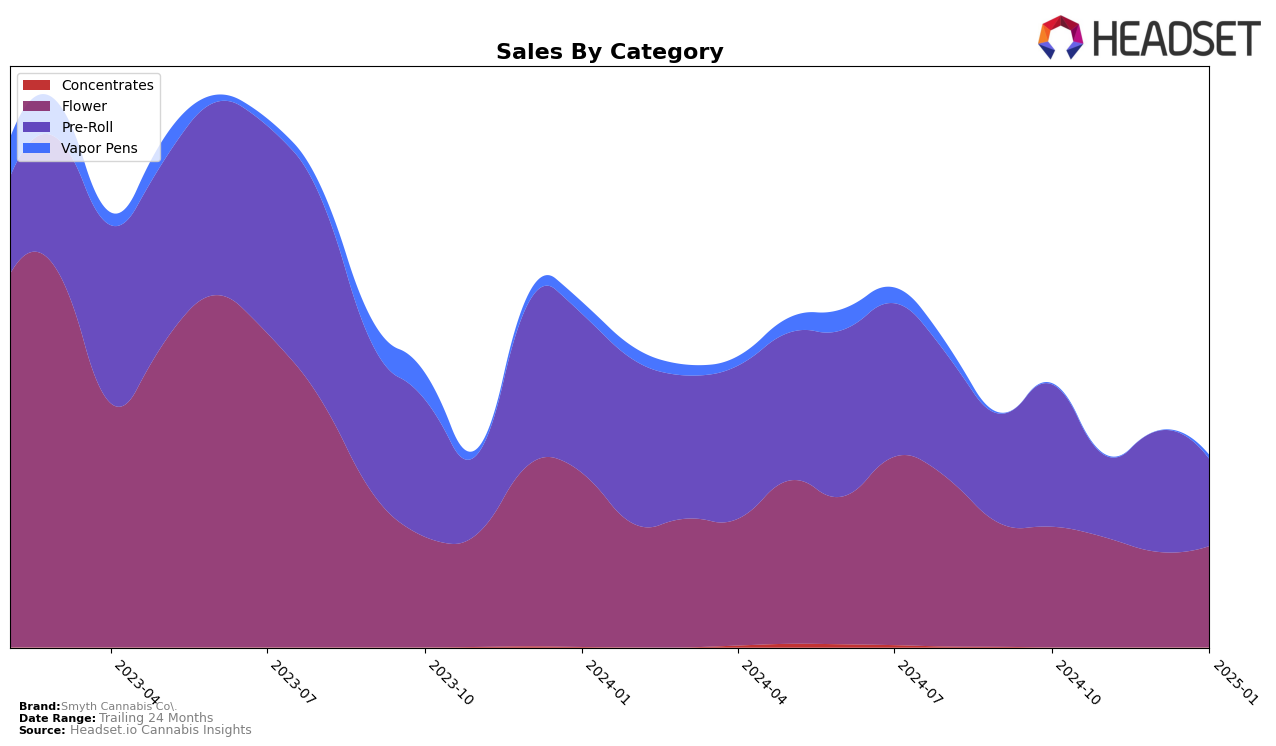

Smyth Cannabis Co. has shown varied performance across different product categories in Massachusetts. In the Flower category, the brand did not make it into the top 30 rankings from October 2024 through January 2025, indicating a challenge in solidifying its position among leading competitors. Despite this, there was a slight improvement in January 2025, moving up from December's rank of 48 to 41. This suggests a potential recovery or strategic adjustment that may be worth watching in the coming months. Although specific sales figures are not disclosed here, the directional movement in rankings provides insight into the brand's fluctuating presence in the Massachusetts Flower market.

In contrast, the Pre-Roll category tells a different story for Smyth Cannabis Co. In Massachusetts, the brand maintained a presence within the top 30, though with some volatility. Starting strong at rank 19 in October 2024, it experienced a dip to 31 in November but rebounded to 22 in December. By January 2025, the brand settled at rank 27, suggesting some stability and potential growth opportunities in this segment. The sales trends in this category indicate a dynamic market position, with the brand managing to stay relevant despite the competitive landscape. This performance in Pre-Rolls could be a focal point for future strategic efforts to enhance market share.

Competitive Landscape

In the Massachusetts flower category, Smyth Cannabis Co. has experienced notable fluctuations in its market position over the past few months. Starting at rank 39 in October 2024, Smyth Cannabis Co. saw a dip to rank 48 by December 2024 but rebounded to rank 41 in January 2025. This recovery in rank is a positive sign, especially considering the competitive landscape. For instance, Grassroots maintained a relatively stable position, hovering around rank 38, while Savvy showed a more consistent performance, ranking 39 in both October 2024 and January 2025. Meanwhile, Khalifa Kush demonstrated a significant upward trend, improving from rank 58 in October 2024 to 42 by January 2025, indicating a potential threat to Smyth Cannabis Co.'s market share. Despite these challenges, Smyth Cannabis Co.'s sales saw a slight increase in January 2025, suggesting resilience and potential for further growth in this competitive market.

Notable Products

In January 2025, Quattro Kush Pre-Roll (1g) emerged as the top-performing product for Smyth Cannabis Co., reclaiming its number one position from October and surpassing its previous sales figures with 4511 units sold. Minx Pre-Roll (1g) made a notable comeback, securing the second rank after not being ranked in November and December, with sales reaching 3434 units. Pinky's Advice Pre-Roll (0.8g) climbed to the third position from its fifth rank in November, showing a significant increase in sales. Root Beer Slushie Pre-Roll (1g) dropped to fourth place, experiencing a consistent decline in sales since October. Slurricane Pre-Roll (1g) rounded out the top five, maintaining a steady presence despite a decrease in rank and sales from October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.